SAGE MOUNTAIN 945 East Paces Ferry Rd NE, Suite 2660, Atlanta, GA 30326

Sage Mountain Research

Market Update – Q1 2024

“Risk-on” assets rose during the first quarter while interest rates rose

In the first quarter, confidence increasingly rose thatthe US economy would remain strong while inflationconcerns persisted, pushing out expectations for thefirst Federal Reserve rate cut to later in 2024 or eveninto 2025. The economy not only avoided recession,it has been stronger than expected. Meanwhile,progress on inflation is generating debate. Bullsbelieve the lagged impact of slower rent growth andsupply chain improvements will be enough to getinflation back to the Fed’s 2% target. Bears fearhigher commodities and wages will make the “lastmile” of the inflation fight the hardest. We believethe Fed will still cut, but at a slower pace. Investorspreviously priced in five to six cuts in 2024, butexpectations now center on two to three.

The AI boom is still onging, as AI bellwetherNVIDIA climbed 82% in the first quarter. Other bigcontributors to equity market gains were Microsoft,Meta, and Amazon. Although growth outpacedvalue in Q1, cyclical sectors such as energy, financials,and industrials contributed to strong absoluteperformance for value stocks.

We would be remiss not to mention the performance ofBitcoin as another sign of investor excitement. Theapproval of the exchange-traded funds propelled ahuge rally, as Bitcoin hit a new all-time high, rising morethan 60% in the first quarter.

Disappointed hopes that the Fed would quickly cutinterest rates hurt the performace of bonds with longermaturities and more duration. On the other hand, thespread investors require to own riskier debt continuedto shrink. Investment grade corporate bonds, high yieldbonds, and securitizd credit all benefitted from theeconomy’s continued strength.

We believe it is an encouraging sign that “good news isgood news” again in equity markets which rallieddespite higher interest rates and the delay in the Fed’santicipated cutting cycle. Economic fundamentalsremained strong, with unemployment low andconsumer spending holding up well. After a year ofanemic earnings growth in 2023, analysts areforecasting 10% growth in S&P 500 earnings in 2024 andnearly 14% in 2025. Geopolitical concerns are also in themix, but, while important, typically do not impact theinvestment landscape much over the medium or longterm.

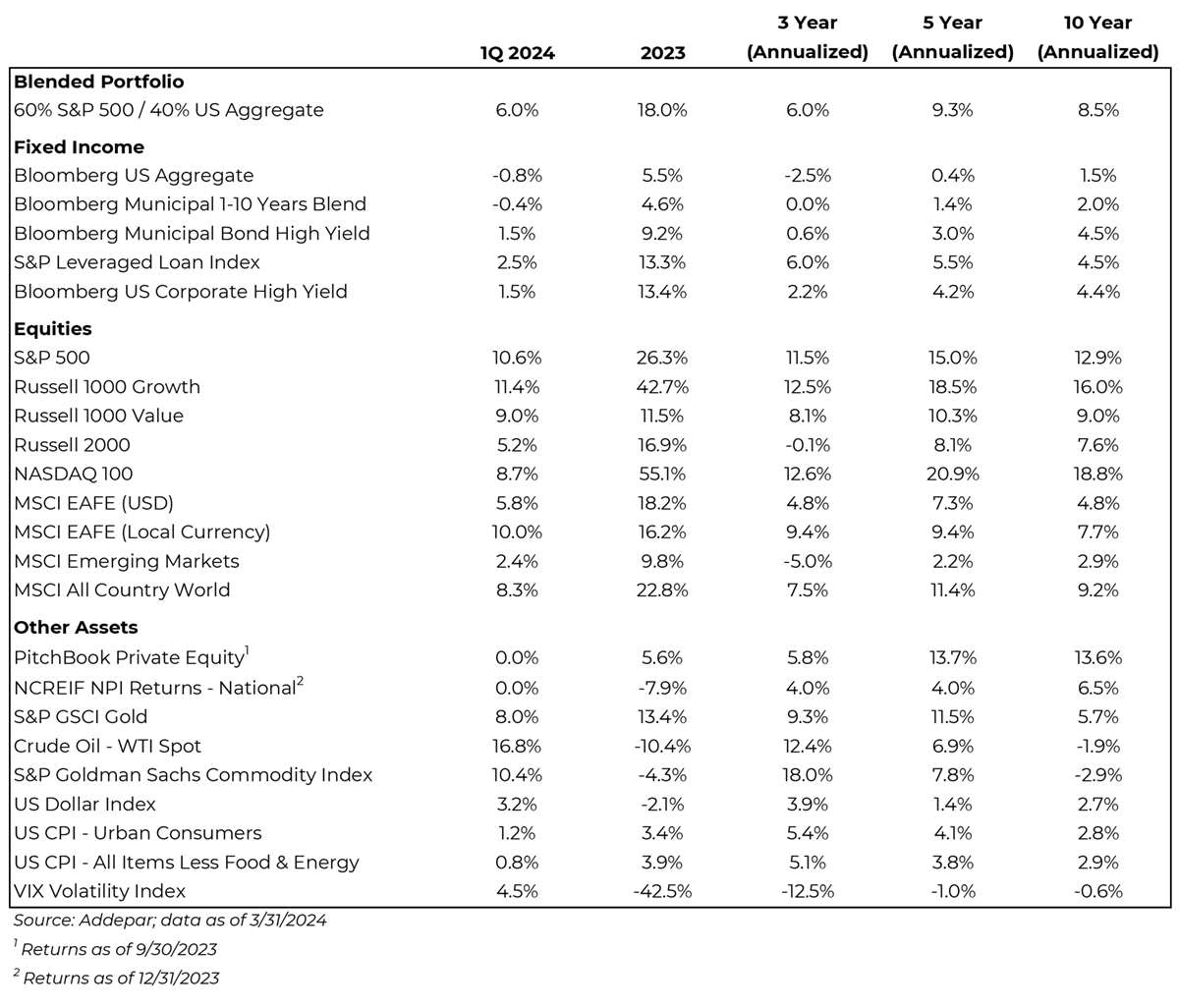

Market Snapshot

Investment grade fixed income was down in Q1 as markets digested shifting expectations for Fed rate cuts, while high yield outperformed as credit spreads remained tight.

Equities continued their trends from 2023 as US markets led Internationalm Growth outpaced Value, and Emerging Markets lagged.

Oil prices climbed in the first quarter on the back of a tight market outlook. The US Dollar bounced back, rising 3.2% in the first quarter. Volatility saw a small spike in the first quarter coming off a sharp decline in the VIX Index last year.

A 60% equity / 40% bond portfolio rose in Q1, posting a 6.0% driven by positive equity returns.

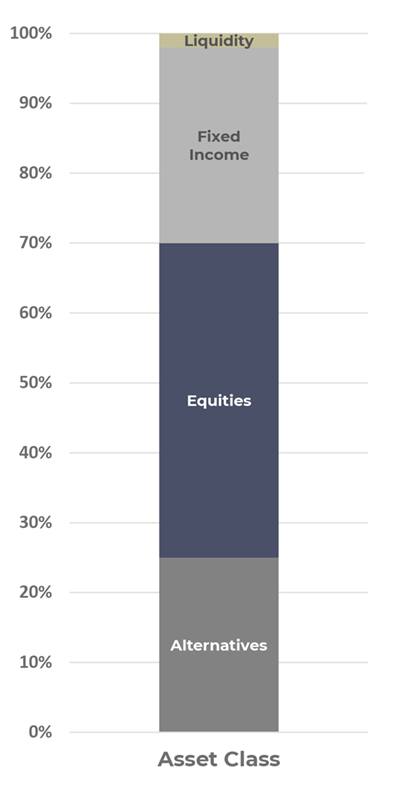

Illustrative current positioning and asset class views

Cash

Cash

- Tactically holding cash remains an attractive option. With yields on money market funds near 5.00% or higher, we strategically utilize those high yielding cash instruments to earn income while ensuring we meet clients’ liquidity needs. However, it is important to note the potential opportunity cost of being on the sidelines too long.

Fixed Income

- Government Bonds: In the US, the Fed Funds markets have shifted back towards a “higher for longer” outlook. Stubbornly high inflation and rising concerns around the sustainability of US government deficits could be bearish for Treasuries.

- US Investment Grade: The strengthening economy has been supportive of credit markets across both high yield and investment grade. Spreads are tight, and thus we expect returns to be driven by yields rather than further spread tightening. We remain tactically allocated to AAA CLOs as they offer higher yields than investment grade corporate bonds and comparable yields to municipal bonds net of taxes.

- US High Yield & Leveraged Loans: Most analysts expect an erosion in the economy and corporate fundamentals to slightly push out spreads of higher risk credit investments. However, the economy has experienced less distress and more resiliency than expected. That has pushed high yield bond spreads to near post-Financial Crisis lows, so we prefer opportunities in other parts of the fixed income market.

Equities

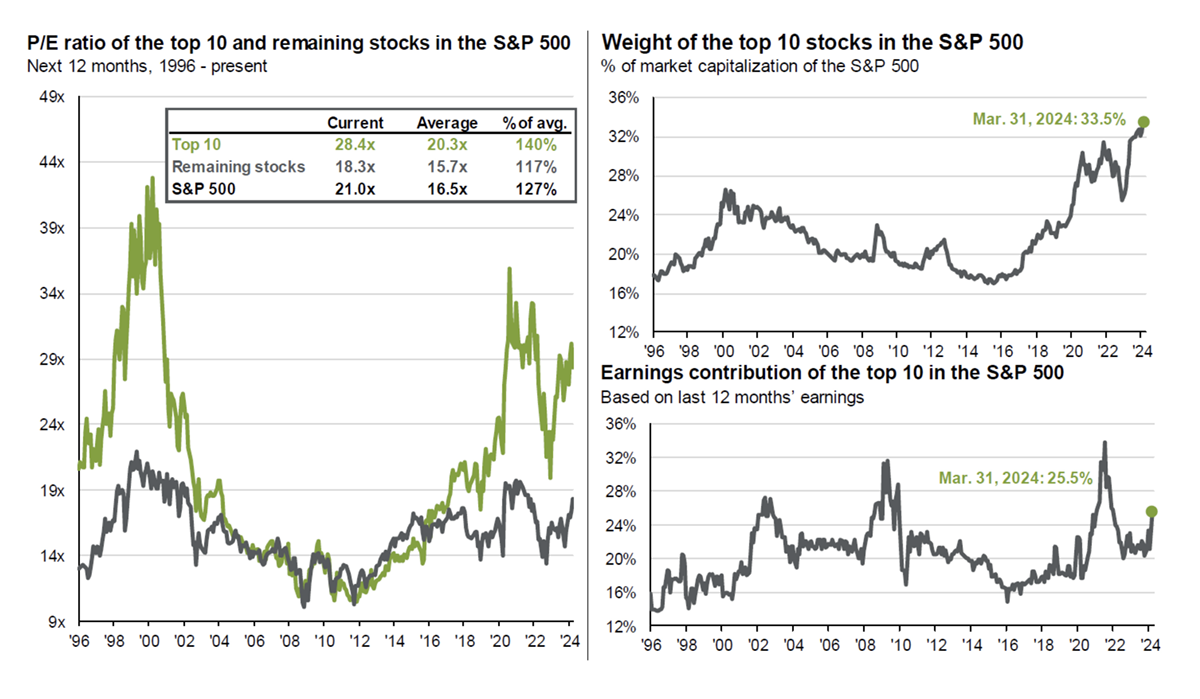

- US: Despite higher interest rates, U.S. equities have remained strong, driven by the mega-cap names and strong earnings. Although we have seen some broadening profit leadership in the market, we remain watchful of the elevated concentration risk, specifically in the “Magnificent seven”. We continue to believe global growth will be led by U.S. markets, and thus retain our view of overweighting these markets versus International.

- International: While valuations for international stocks have remained lower than the U.S., so does their growth outlook. Although U.S. stocks have outperformed global equities over the last 15 years, we are not market timers looking to call the bottom. We recognize there are some potential bright spots outside the U.S., particularly in Japan, Europe, and some select Emerging markets. However, we don’t see a reason to suggest getting more bullish on international stocks at this point.

Alternatives

We have seen a surge into the Private Credit space as higher rates and bank pullbacks inticed investors in early 2023. Unsurprisingly, this area has performed well given the higher rates and increased opportunities but has led to increased crowding and saturation. Additionally, Real Estate debt has been a popular space to be in for similar reasons, and, in our view, offers better risk adjusted returns compared to its equity counterparts. Private Equity and Venture Capital funds have experienced slow downs in capital raising push but see some encouragement for a reversal. We maintain our approach to alternatives to be diversified, both in asset classes and vintage years. Additionally, we maintain a positive outlook on secondaries as there continues to be unique opportunities in a multitude of asset classes.

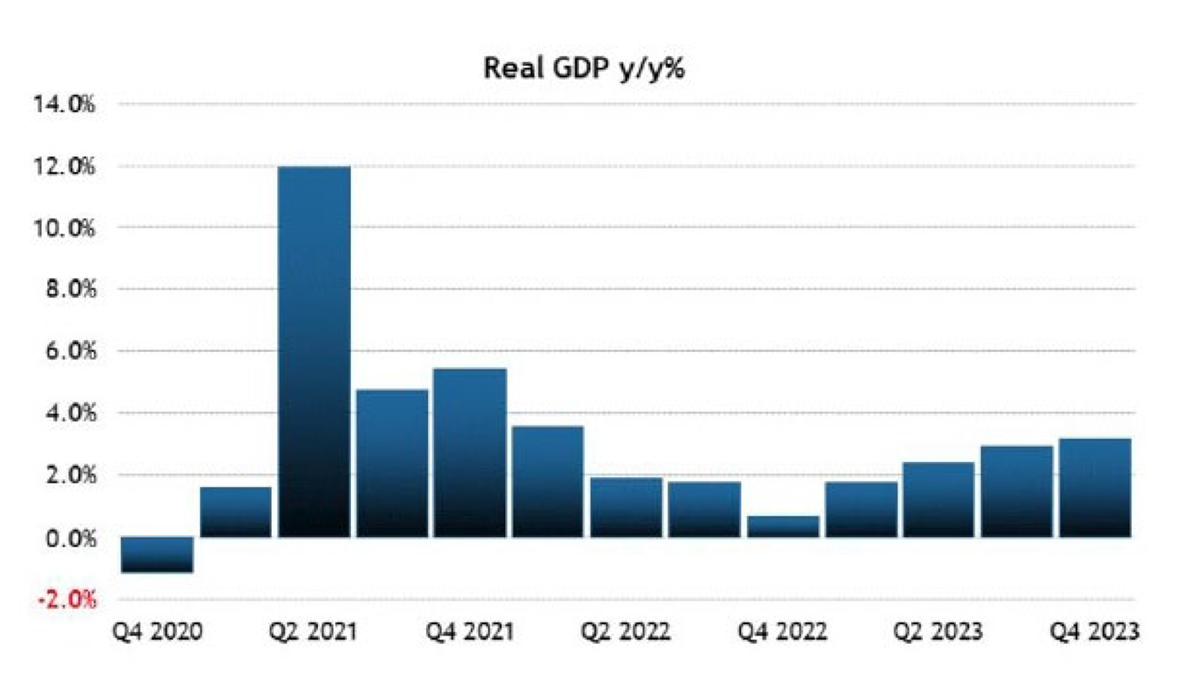

U.S. economic growth has accelerated and is expected to remain strong through 2024

Real GDP increased 2.5% in 2023 vs. 1.9% in 2022. Real time estimates like the Atlanta Fed’s GDPNow forecast 2.8% annualized GDP growth in the first quarter of 2024, and economists anticipate 2.2% for the full year.

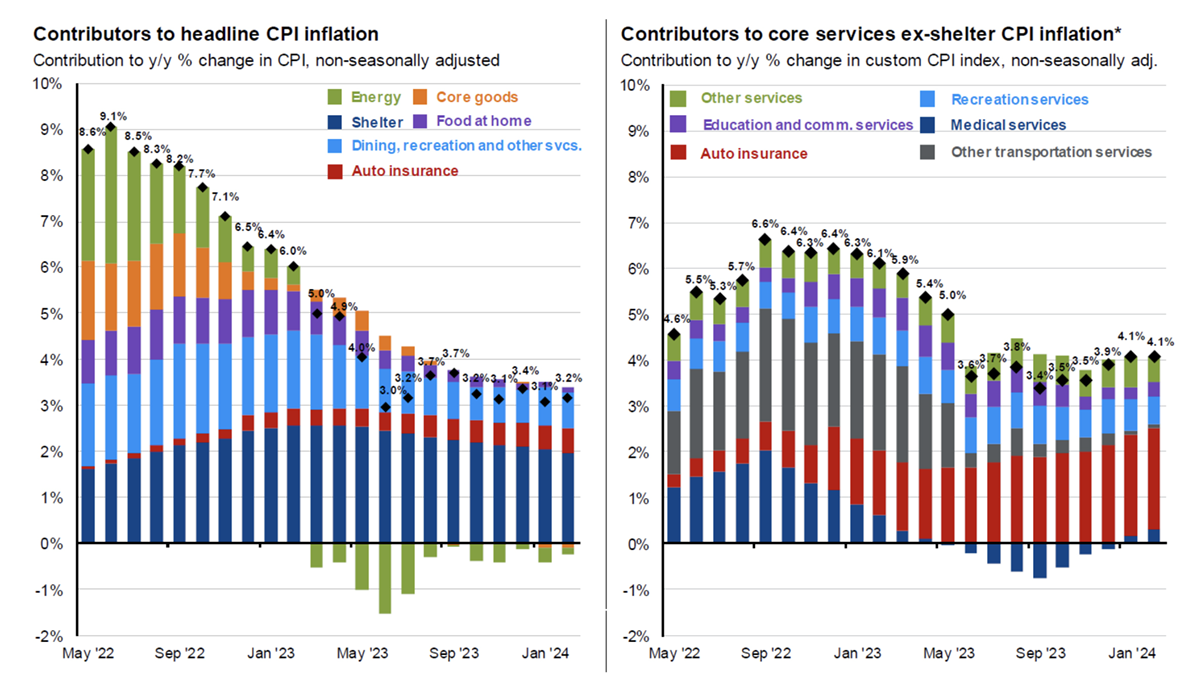

Inflation is holding steady… is this the new norm?

After two years of raging inflation we saw a steady downtrend in the second half of 2023. That progress has halted, at least temporarily, so far this year. While CPI inflation has fallen to 3.2% from a peak of 9.1%, it has held around that level for several months. Core PCE, the Fed’s preferred measure of inflation, increased 2.8% over the past 12 months.

This has sparked renewed concerns that inflation may remain above the Fed’s target of 2% for longer than expected, and the market is now pricing in less than 2 rate cuts in 2024 vs. 6 coming into the year.

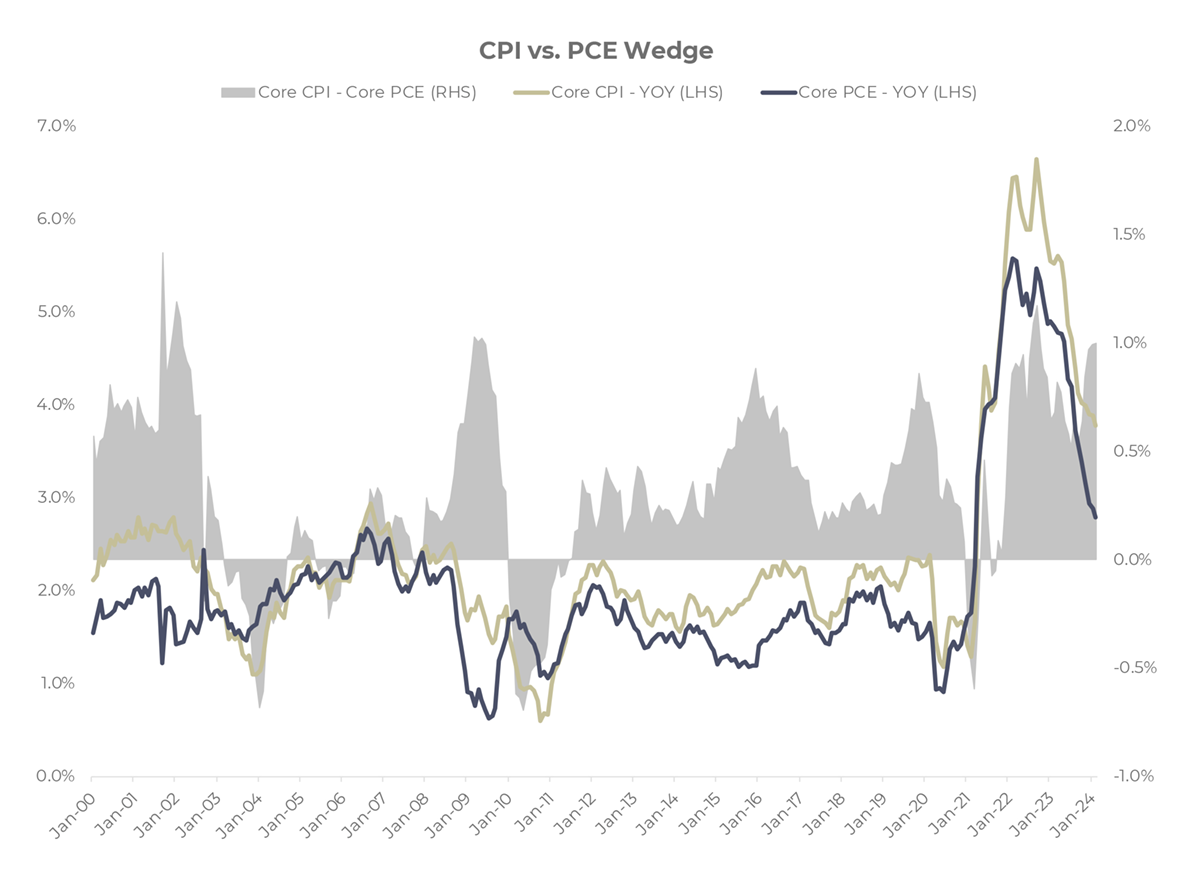

The gap between CPI and PCE inflation is unusually high

The Fed’s 2% inflation target is based on the Personal Consumption Expenditures Price Index (PCE) rather than the more well known Consumer Price Index (CPI). Historically CPI inflation has been about 0.5% higher than PCE, but that gap, or wedge, has increased to 1% over the past 3 months.

There are many differences in how the indexes are constructed which drive that wedge, but the dominant factor today is the 17% weight to shelter in the core PCE vs. 40% in the core CPI.

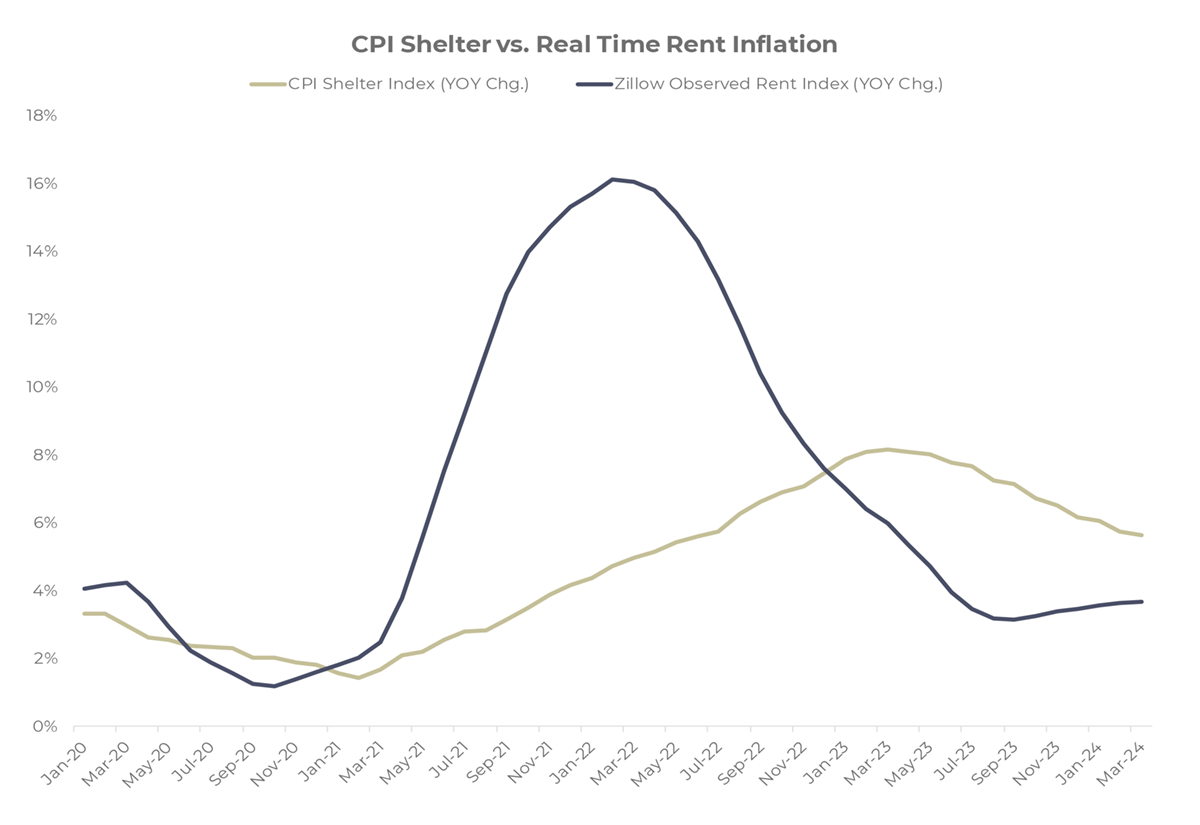

Shelter inflation has been sticky, but should continue to trend lower

Official shelter inflation tends to lag real time measures. This means the increase in inflation was likely understated throughout 2021 and 2022 and is overstated now.

While we don’t know how long it will take for those numbers to converge, it is a reason for optimism that a return to the Fed’s 2% inflation target can be achieved without a recession.

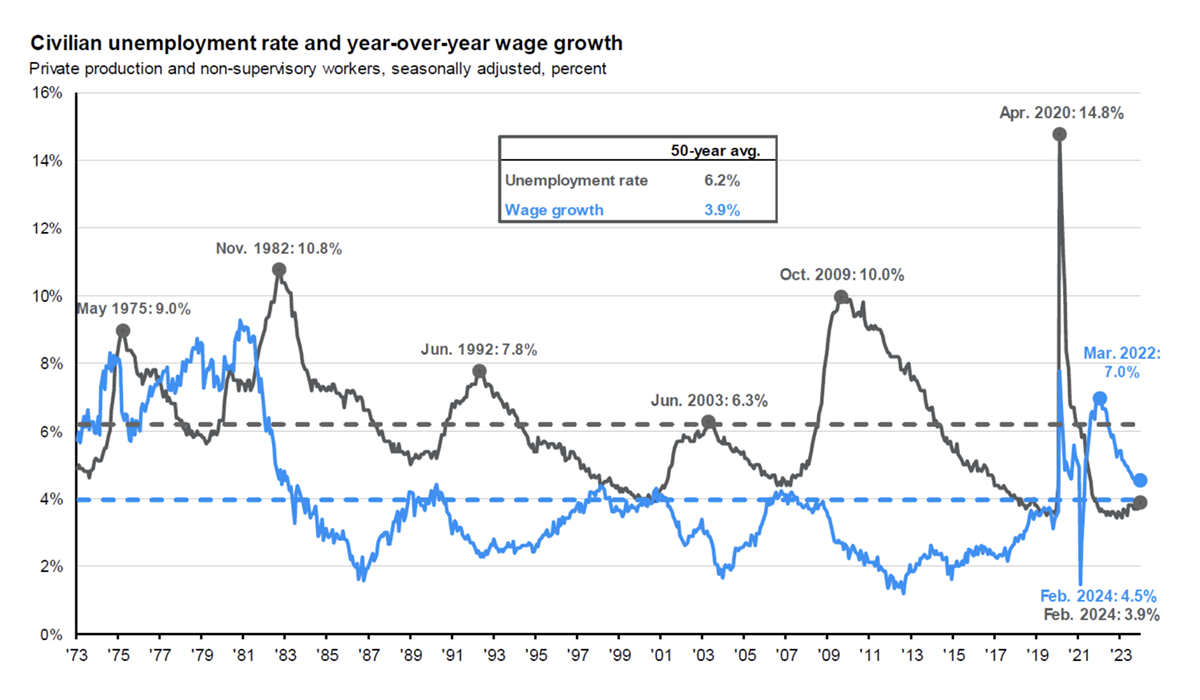

Unemployment and wage growth remain resilient, despite growing concerns

As strong growth remains in the U.S. labor supply, boosted by an increased labor force participation and a surge in immigration, the U.S. economy has experienced impressive job gains without greater inflation. With job openings still elevated, modest economic growth should support steady job gains ahead. While this normally puts downwards pressure on the unemployment rate, the continued inflow of migrants adding to labor supply could keep the unemployment rate within a narrow range of 3.5% to 4.0%.

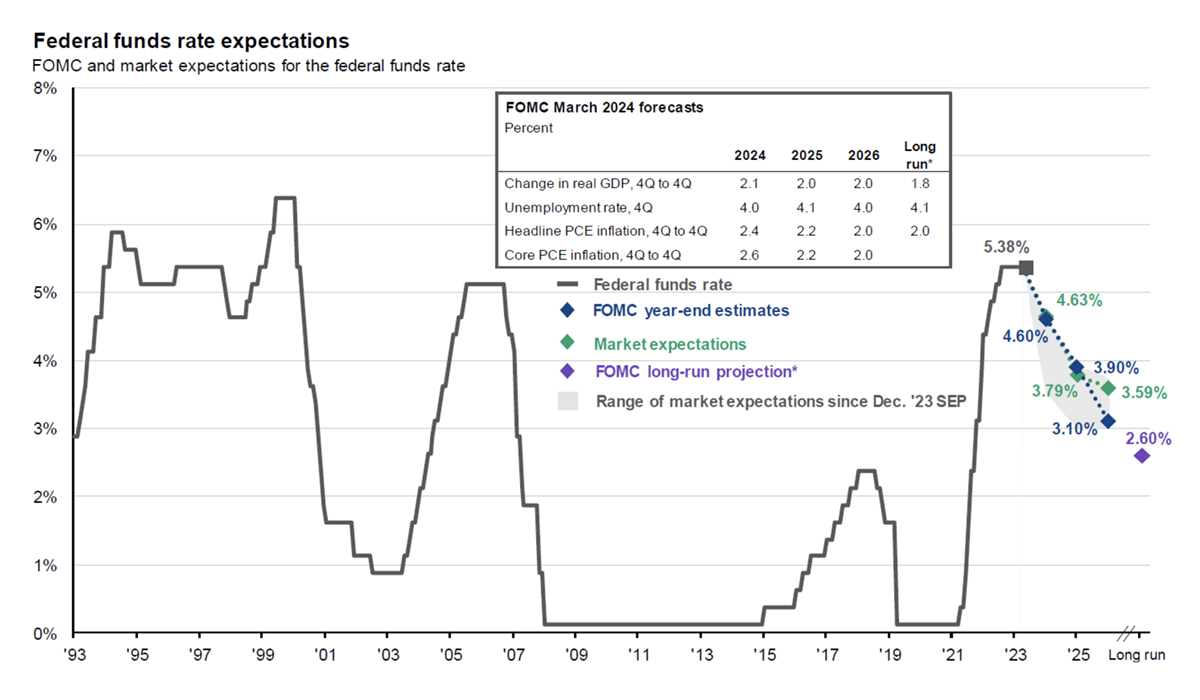

Financial markets are focused on interest rates, as pauses loom and soft-landing woes increase

During the quarter, The Federal Reserve continued its cadence of interest rate pauses in both January and March, citing stronger than anticipated economic data.

As GDP growth, inflation, and labor market statistics remained resilient, the Fed saw no indication of a market slowdown or a need to begin cutting interest rates. As we came into the year with a projected 6 quarter-point cuts in 2024, economists have slashed those projections to 2-3 cuts through 2024, with some hypothesizing there may be none.

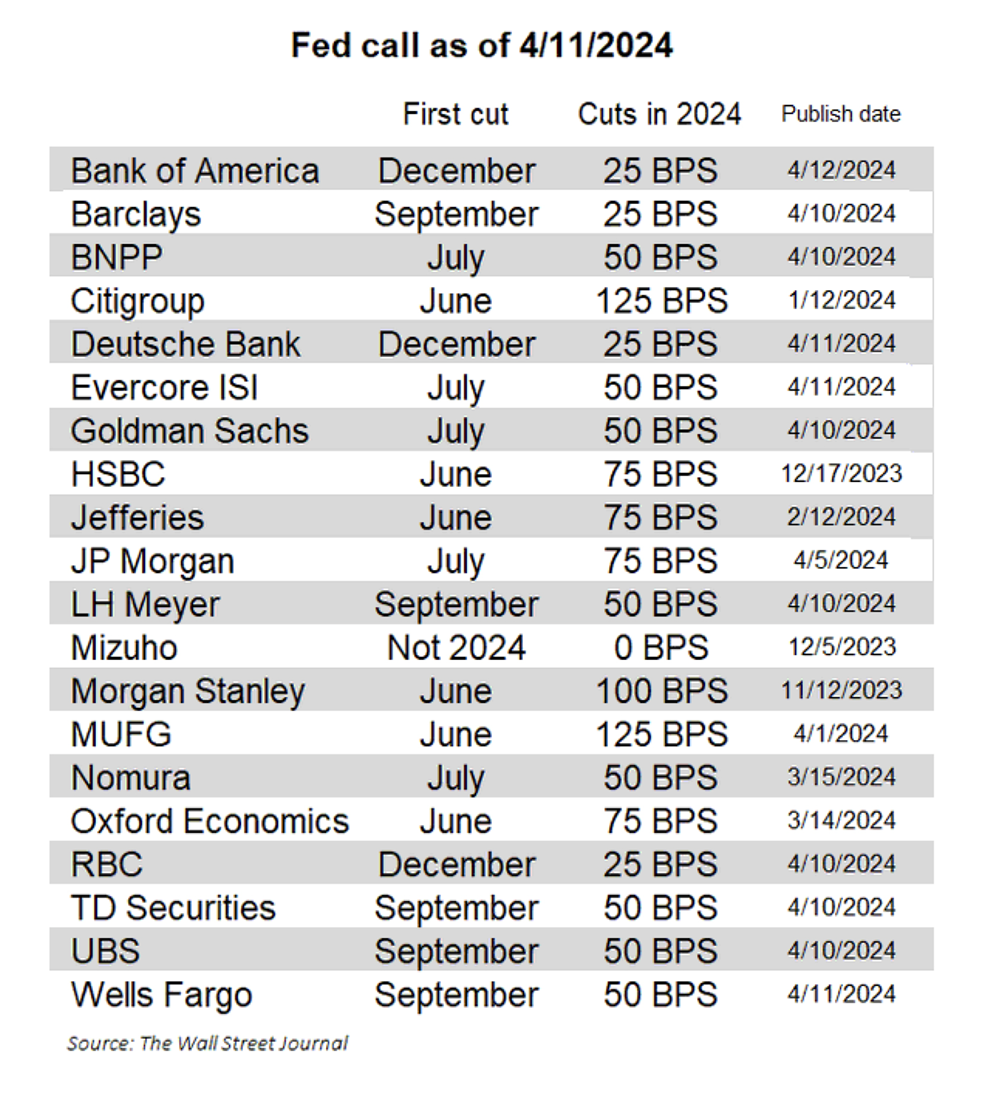

Analysts are now aligned in expecting no rate cuts until June at the earliest

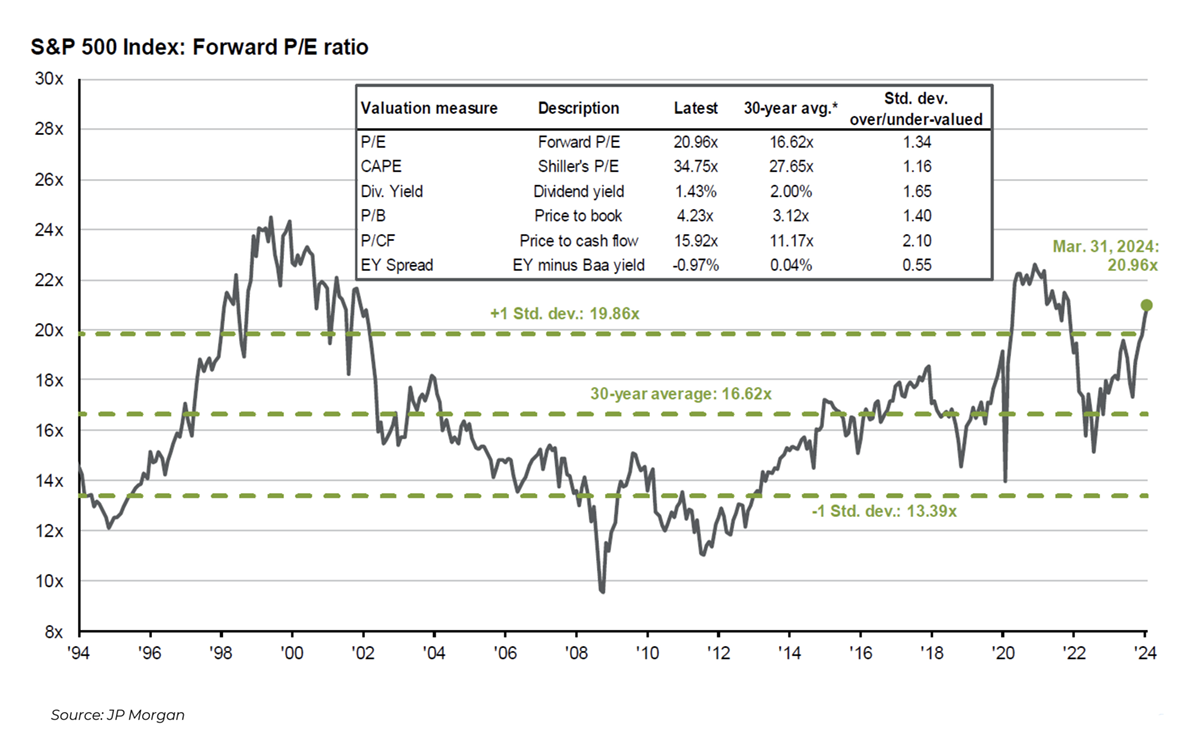

Valuations are on the rise, as stocks continued to climb on the back of economic data

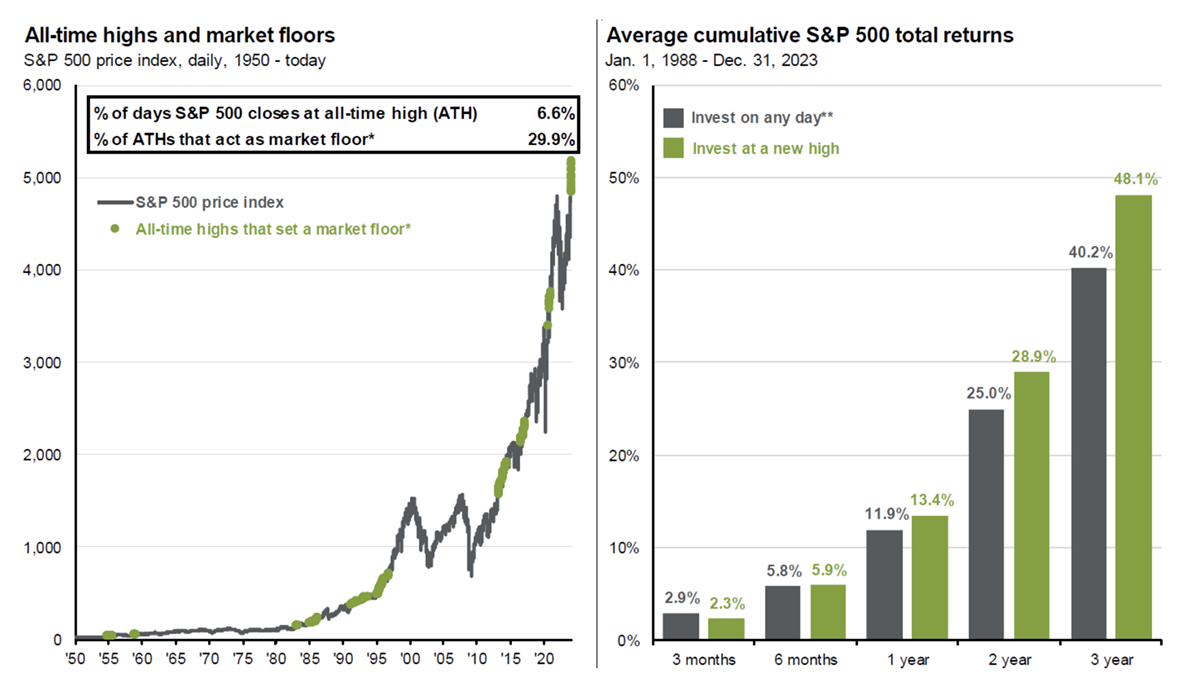

As investors weigh the right time to invest…history shows markets highs lead to more highs

Equities remain concentrated at the top, reinforcing the need for broad market diversification…

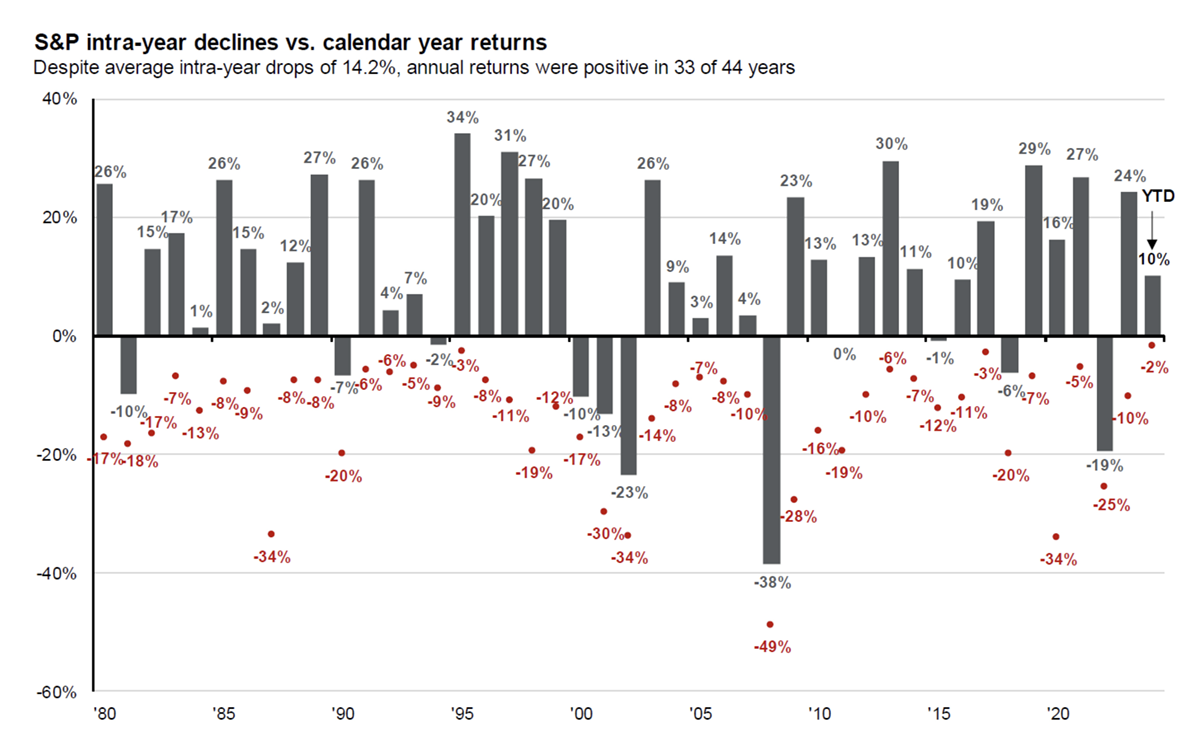

…but investors must be prepared to endure pullbacks even during years with positive equity market returns.

Disclosures

Past performance is not indicative of future results. Sage Mountain Advisors, LLC (“SMA”) is an independent SEC registered investment advisor. Any reference to or use of the terms “registered investment adviser” or “registered,” does not imply that SMA or any person associated with SMA has achieved a certain level of skill or training. This material is provided for informational and educational purposes only.

Any subsequent, direct communication by SMA with a prospective client shall be conducted by a representative that is either registered or qualifies for an exemption or exclusion from registration in the state where the prospective client resides. For more information pertaining to the registration status of SMA, please contact SMA or refer to the Investment Adviser Public Disclosure website (www.adviserinfo.sec.gov). The information contained herein should not be construed as personalized investment, tax, or legal advice. Certain information contained in this presentation has been derived from third party sources. While we believe these sources to be reliable, we make no representations as to the accuracy, timeliness, and completeness of any such information prepared by any unaffiliated third party incorporated herein, and take no responsibility therefore. As such, there is no guarantee that the views and opinions expressed in this presentation will come to pass.

All investments carry a certain degree of risk of loss, and there is no assurance that an investment will provide positive performance over any period of time. The statements contained herein reflect opinions, estimates and projections of SMA as of the date hereof, and are subject to change without notice. SMA reserves the right to modify its current investment strategies and techniques based on changing market dynamics or individual portfolio needs. The opinions expressed herein are those of SMA and are subject to change without notice. Information presented should not be considered as a solicitation or recommendation to buy or sell any security, financial product, or instrument discussed herein. Additionally, this material contains certain forward-looking statements which point to future possibilities. Due to known and unknown risks, other uncertainties and factors, actual results may differ materially from the results portrayed or implied in such forward-looking statements. Furthermore, the illustrative results presented in this presentation in no way reflect the performance of any SMA product or any account of any SMA client, which may vary materially from the results portrayed for various reasons, including but not limited to, investment objectives, financial situations and financial needs of SMA clients; differences in products and investment strategies offered by SMA; and other factors relevant to the management of SMA client accounts.

This presentation and its contents are provided “as is” without warranty of any kind, express or implied, including, but not limited to, implied warranties of merchantability, fitness for a particular purpose, title, non-infringement, security, or accuracy. SMA reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs. It should not be assumed that any of the security transactions, holdings or sectors discussed were or will prove to be profitable, or that the investment recommendations or decisions we make in the future will be profitable or will equal the investment performance of the securities discussed herein. Actual investment advisory fees incurred by clients may vary. A complete description of SMA’s fee schedule can be found in Part 2 of its FORM-ADV which is available at www.sagemountainadvisors.com or by calling (404) 795-4861. Clients are advised that no portion of the services provided by SMA should be interpreted as legal, tax or accounting advice. For legal and tax-related matters, we recommend that you seek the advice of a qualified attorney, accountant or tax professional. SMA-24-0172