SAGE MOUNTAIN 945 East Paces Ferry Rd NE, Suite 2660, Atlanta, GA 30326

Sage Mountain Research

2025 Market Update & 2026 Outlook

2025 Recap & Themes for 2026

KEY THEMES

Despite a turbulent political environment, equities delivered a third consecutive year of strong returns

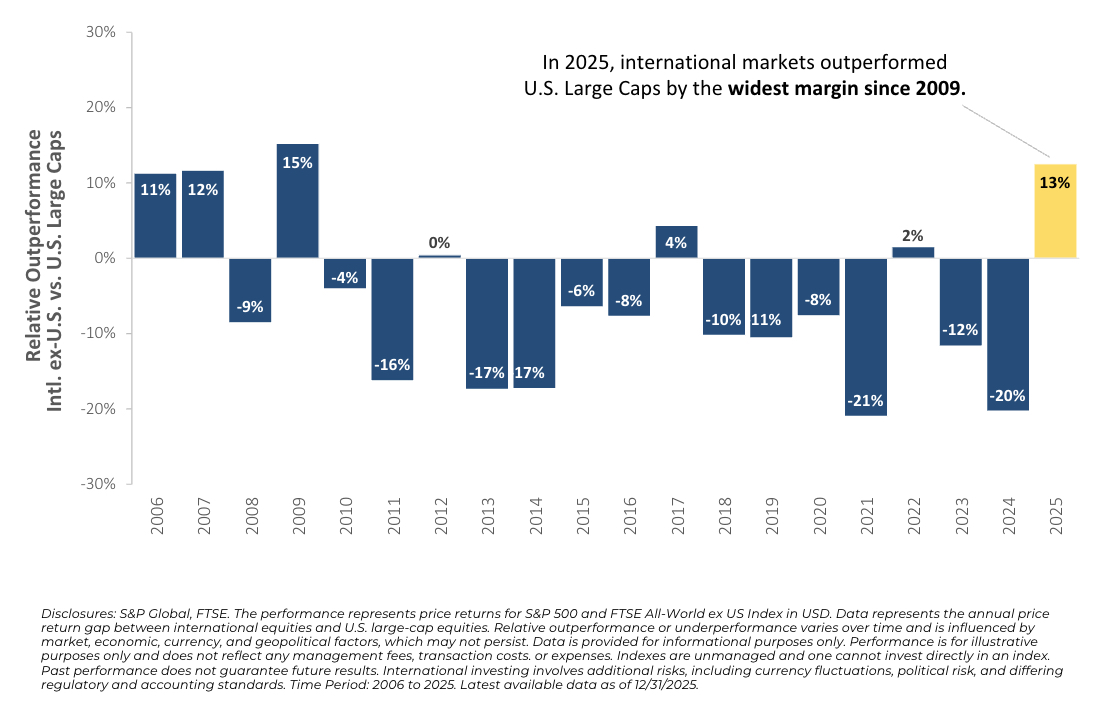

International stocks significantly outperformed the US with a boost from a weaker USD…

…which forecasters expect will continue to weaken, but at a slower pace than in 2025

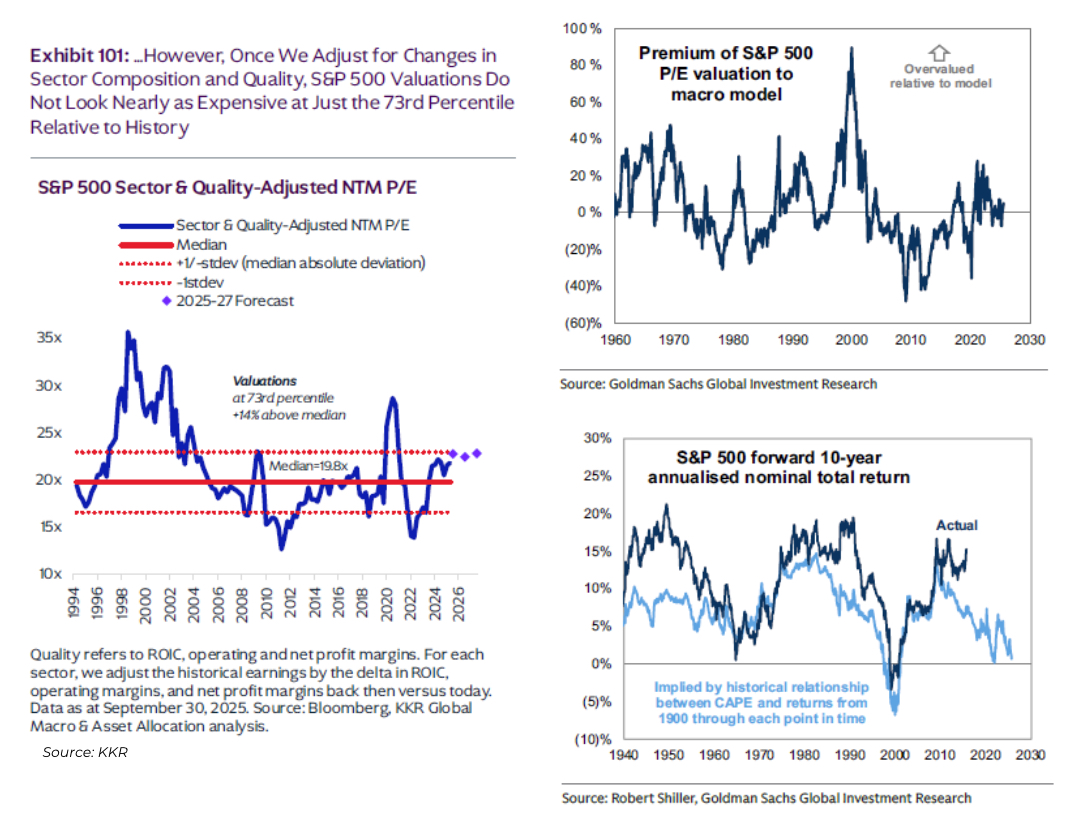

Valuations are high on the surface, especially in the US, but are more normal when accounting for high expected earnings growth

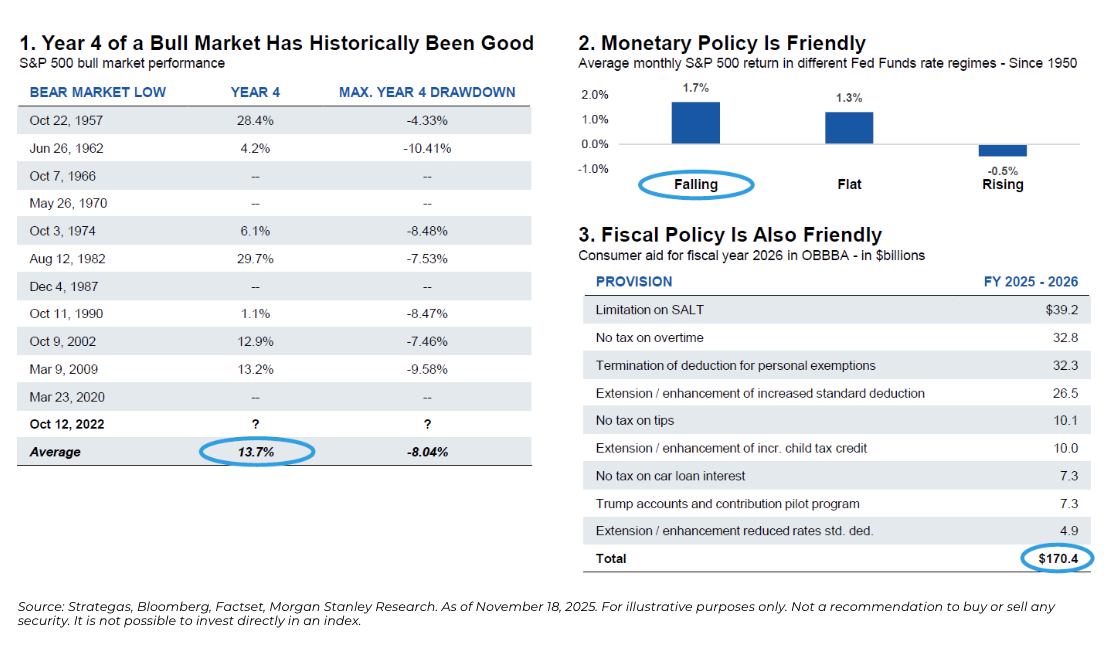

Tailwinds include a fiscal boost from the OBBBA, the lagged impact of Fed rates cuts, moderating inflation, low oil prices, and a pick-up in M&A activity

Risks include a weaker labor market, a slowdown in AI-related investment, and concerns about Federal Reserve independence

Expect upside and downside volatility, and focus on quality

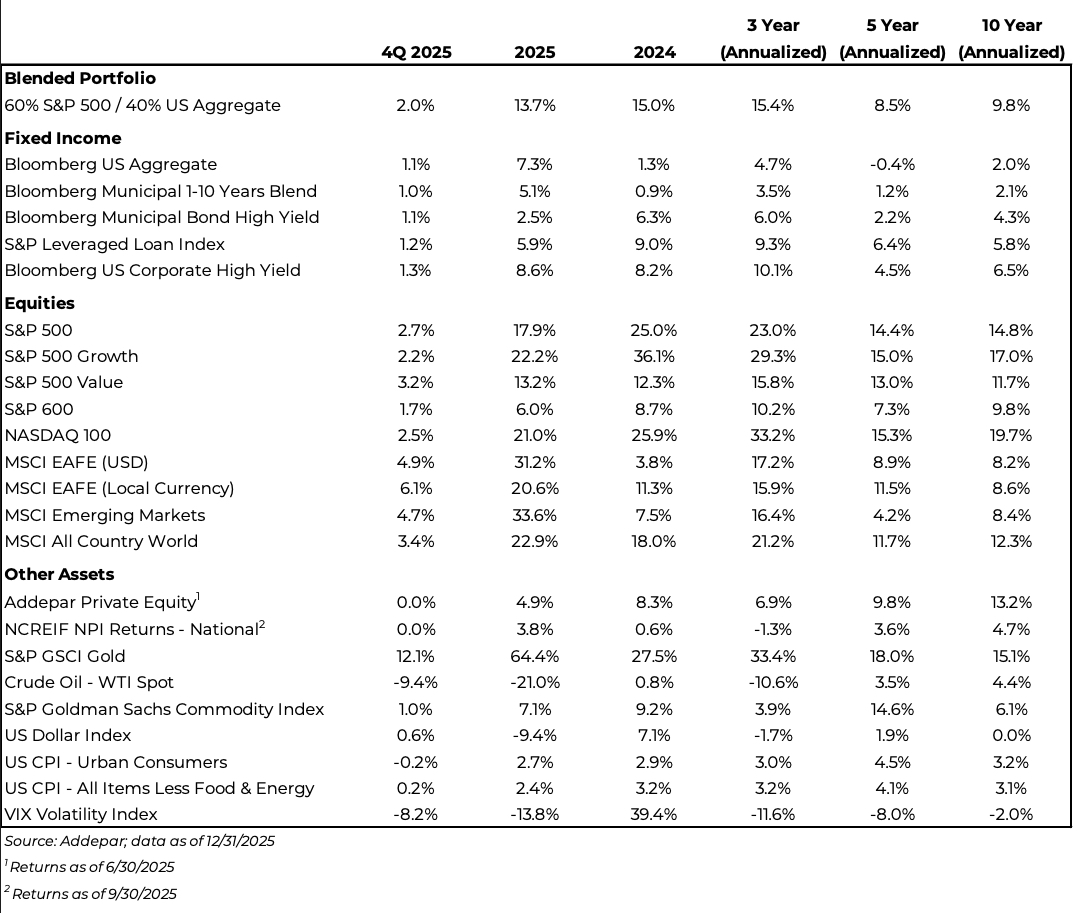

Market Snapshot

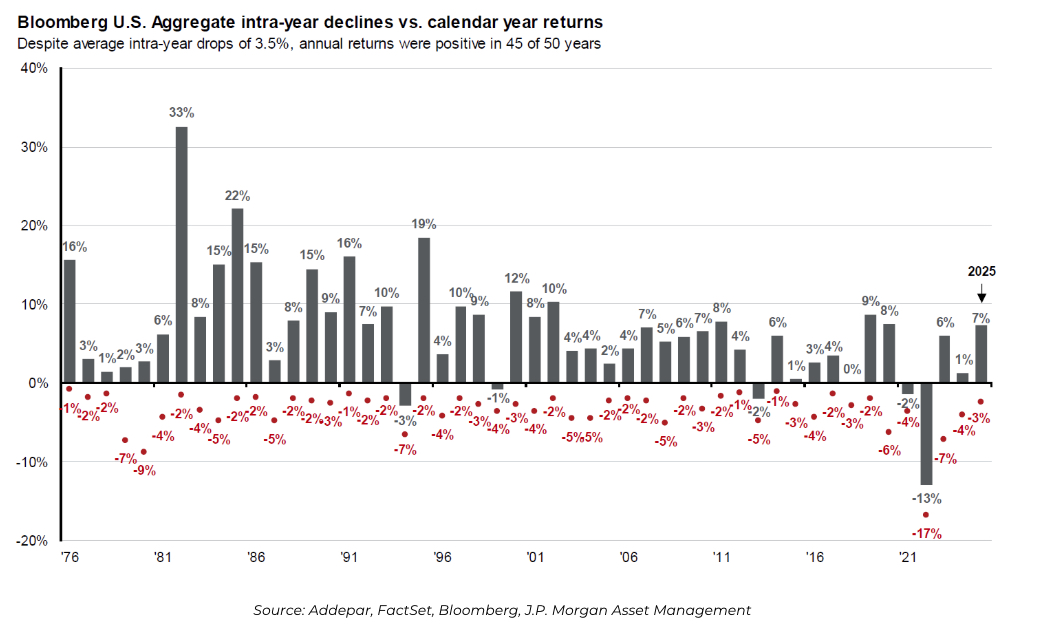

In a continuation from Q3, broad fixed income posted positive returns in Q4 and strong gains for the year on the back of rate cuts, Treasury rallies, and improved outlooks.

US Equities continued to rise in Q4, and all major regions finished well into double-digit gains. The S&P 500’s +17.9% return may look weak in comparison, but it marks a 3rd consecutive year of double-digit returns.

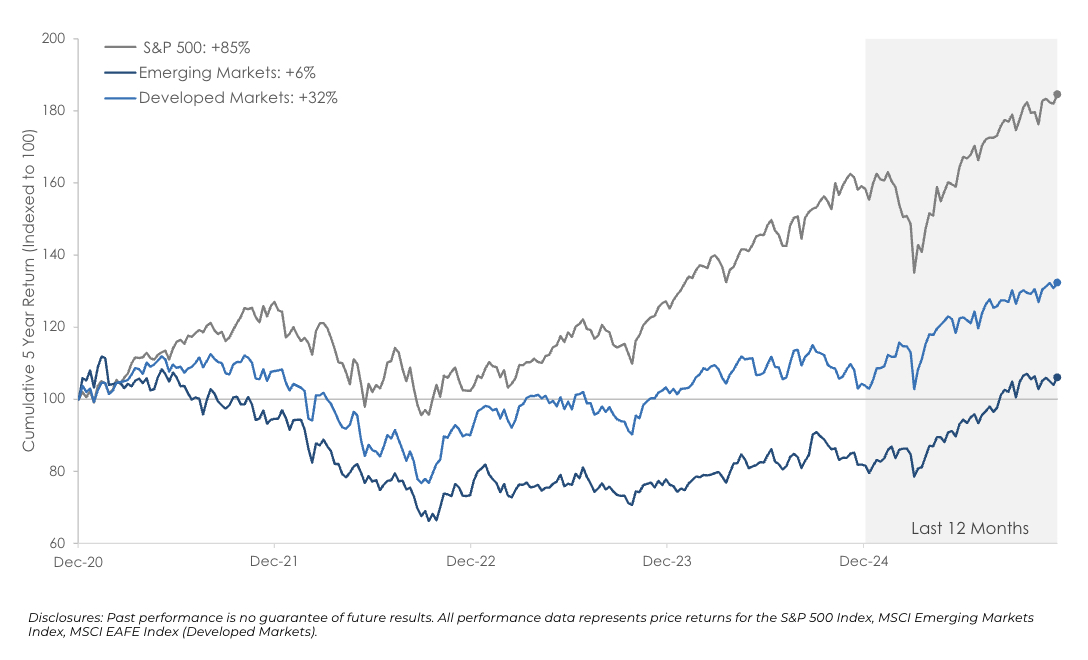

International markets saw continued strength to end the year and massive growth for 2025. With help from a weaker US Dollar, Developed and Emerging Markets led with 30%+ returns.

A 60% equity / 40% bond portfolio rose in Q4, posting a 2.0% return as stock and bond returns were positive.

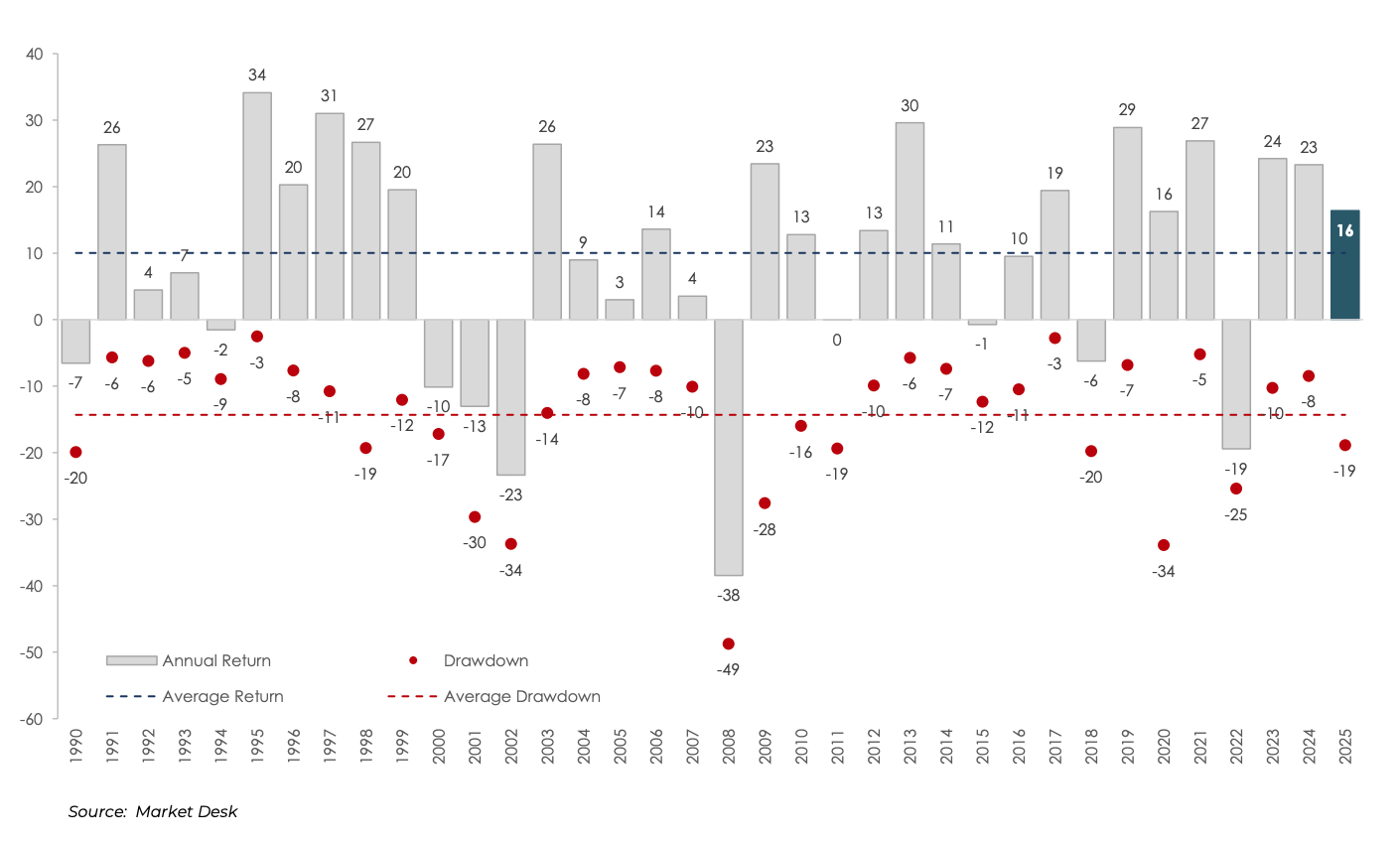

Another strong year for equities despite a large drawdown

2025 RECOMMENDATIONS IN HINDSIGHT

FIXED INCOME

Recommendations included holding steadfast in fixed income duration, maintaining exposure to AAA CLOs, and finding diversified exposures for yield outside of high-yield and traditional bonds.

Maintaining an intermediate-duration target was beneficial within munis. The Bloomberg Municipal 1-10 Year Blend index returned +5.1% while the Bloomberg Municipal Bond 1 Year index returned +3.7%.

The allocation to AAA CLOs was a detractor as the JP Morgan CLO AAA Index returned +5.2% vs. the Bloomberg US Aggregate +7.3%.

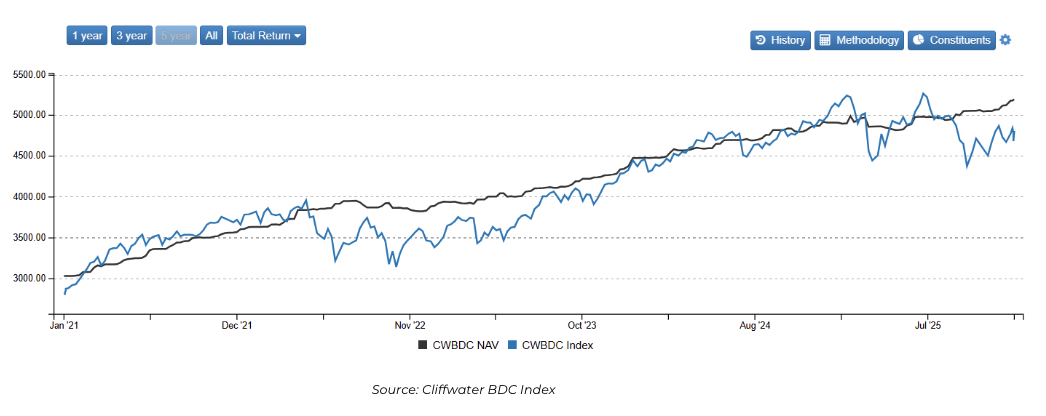

High-yield corporate bonds posted strong gains as spreads remained tight, but our allocation to direct lending performed well, while public BDCs struggled. The Bloomberg US Corporate High Yield index was +8.6% for the full year. The Cliffwater BDC Index returned -4.1% for the year, while the Cliffwater Direct Lending Index returned +7.1% through Q3, the most recent quarter for which data is available.

EQUITIES

Recommendations included staying invested, maintaining a 4:1 overweight of US vs. international equities, and a quality factor tilt.

Remaining invested paid off as global equities returned +22.9%. Overweighting US was a detractor for 2025 as the S&P 500 returned +17.9 vs. the MSCI EAFE +31.2% on an unhedged basis and +20.6% currency hedged.

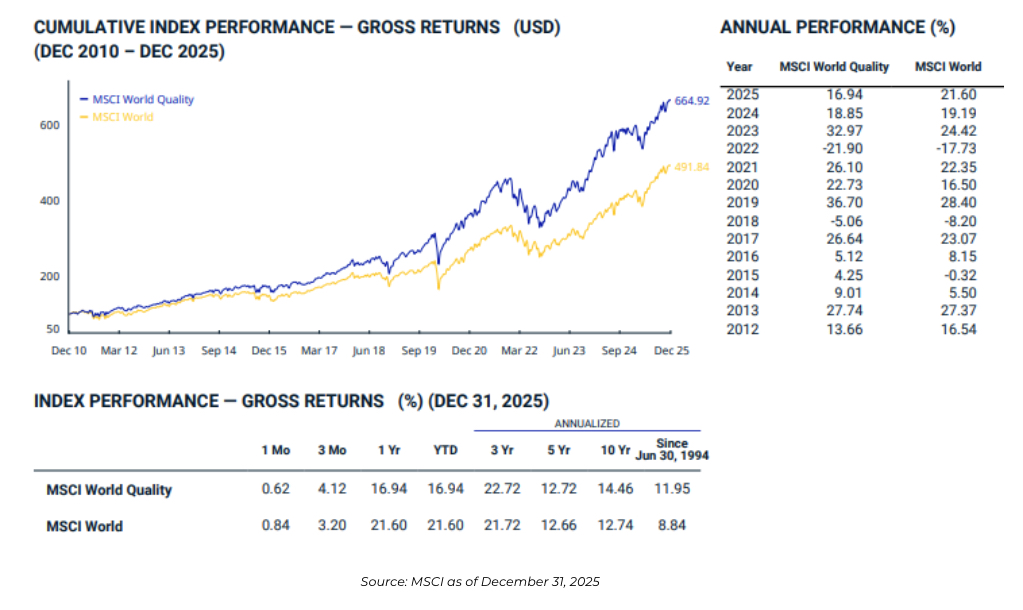

The quality factor tilt was a detractor versus broad equity returns as the JP Morgan US Quality Factor Index returned +11.7% (Trailing S&P 500) and the MSCI World ex USA Sector Neutral Quality Index was +25.1% (Trailing MSCI World ex USA return of 31.9%). Despite lagging for the year, quality did what we anticipated during the market turmoil in April. Year-to-date through the market bottom on April 8th, the S&P was down -15.0% while US Quality was down -11.8%. International quality protected some as well, down -3.3% vs -5.7% for the EAFE Index at the trough. Quality recovered with the market, but slightly behind pace, as it has a much less exposure to the Mag 7 stocks.

ALTERNATIVES

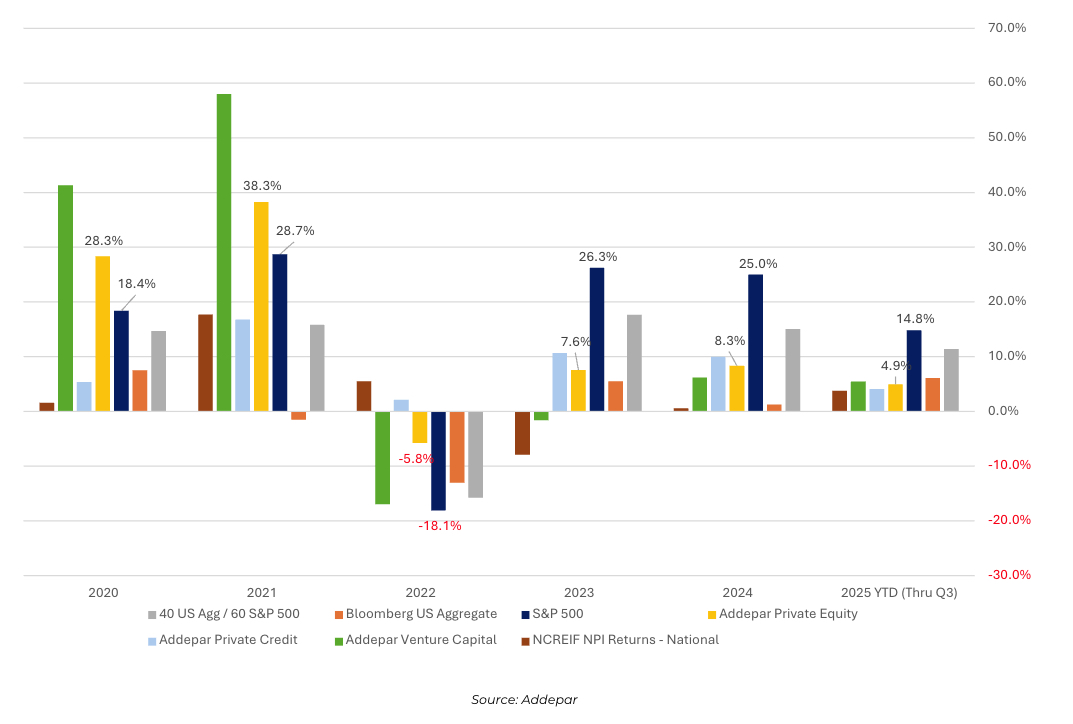

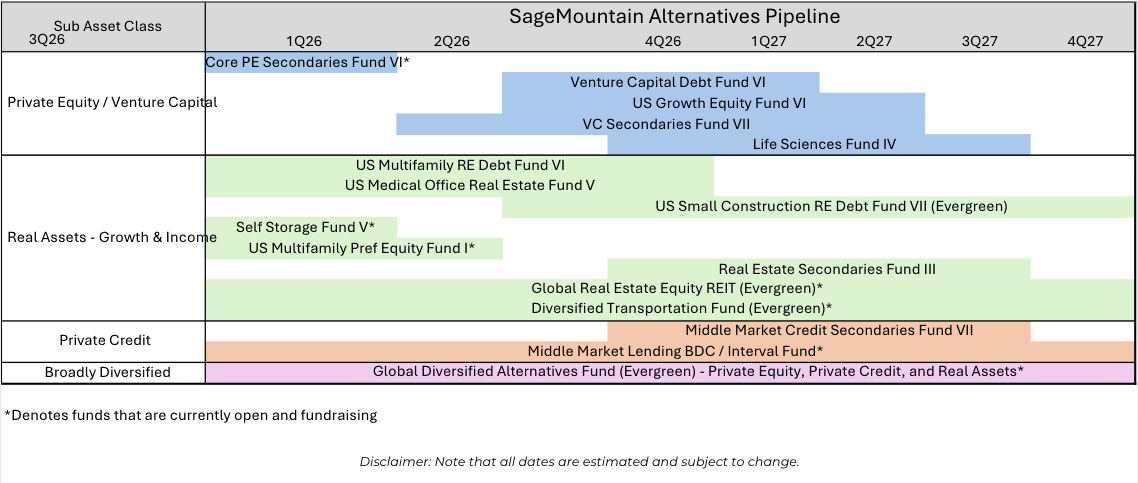

We recommended allocating to alternatives to increase diversification and provide additional potential sources of return. Areas we mentioned included private equity, real estate, and secondaries as well as remaining open to strategies that could benefit as interest rates fall.

As with 2024, alternatives generally lagged relative to equities. However, we believe that the added diversification will benefit portfolios long-term if equity returns moderate and M&A and IPO markets continue to ramp.

We continued to add to our secondaries exposure through a core Private Equity manager we have successfully invested with in prior funds. Additionally, we gained niche exposure to a booming franchise opportunity with strong equity upside, bolstered by debt-like structure for protection. Within real estate, we found compelling opportunities in the equity space of the capital stack and brought two funds on platform: a dedicated self-storage fund and a preferred equity fund focusing on multifamily and retail.

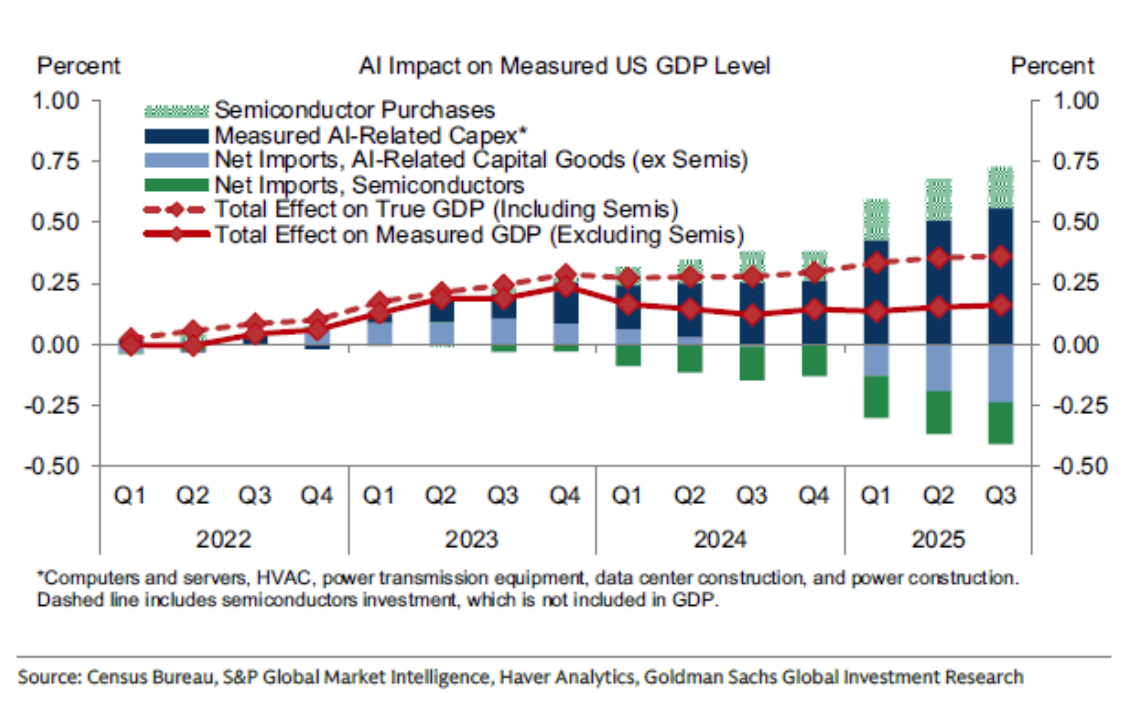

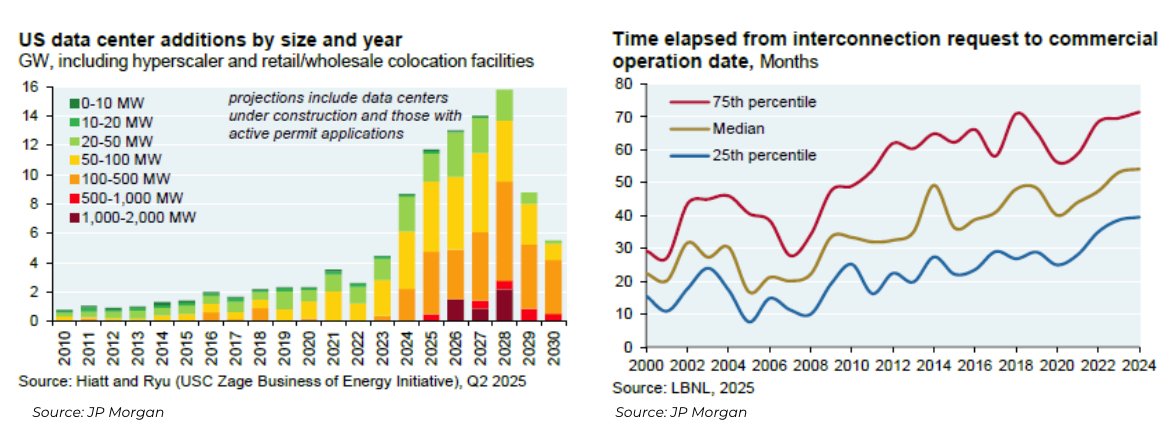

Another notable investment was in a real asset fund that seeks to gain exposure to the data center capex and investment boom through high demand for energy. The fund will seek to secure long-term power agreements with high-credit tenants and provide the power through greenfield natural gas-fired power plants. We view this as a way to take advantage of a lack of energy supply needed for the AI buildout and the massive amounts of investment going into the space, without making a bet on a specific winner in the AI arms race.

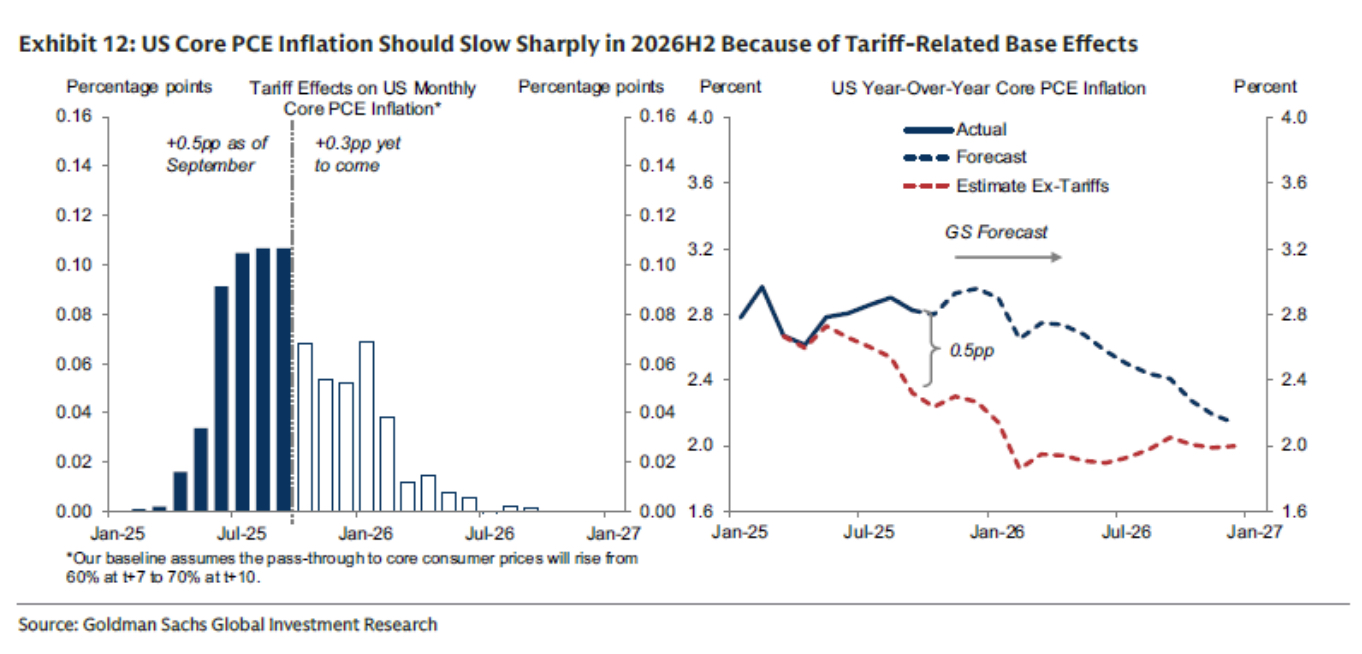

Inflation was above target in the US, but would have been lower without the impact of tariffs

AI spending has boosted US GDP, but the impact has been muted so far

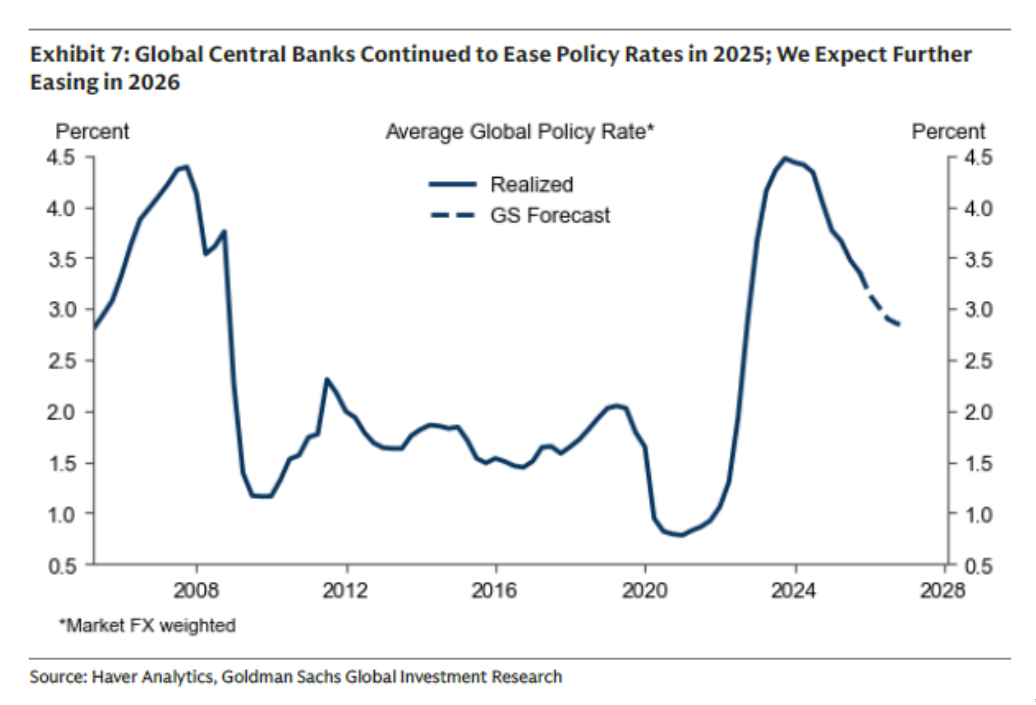

Central banks lowered rates around the world

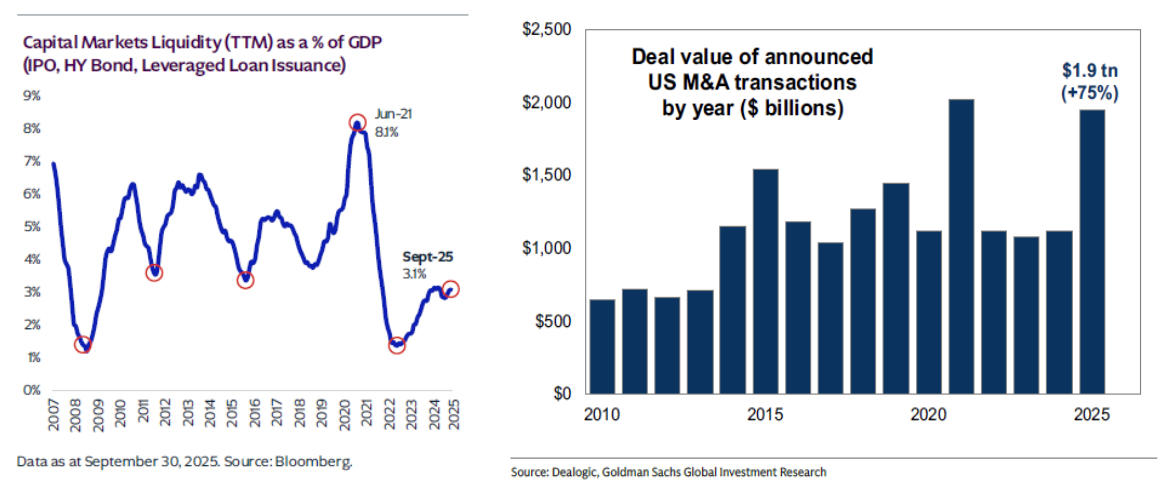

Capital markets activity picked up, albeit from a low starting level

Source: KKR

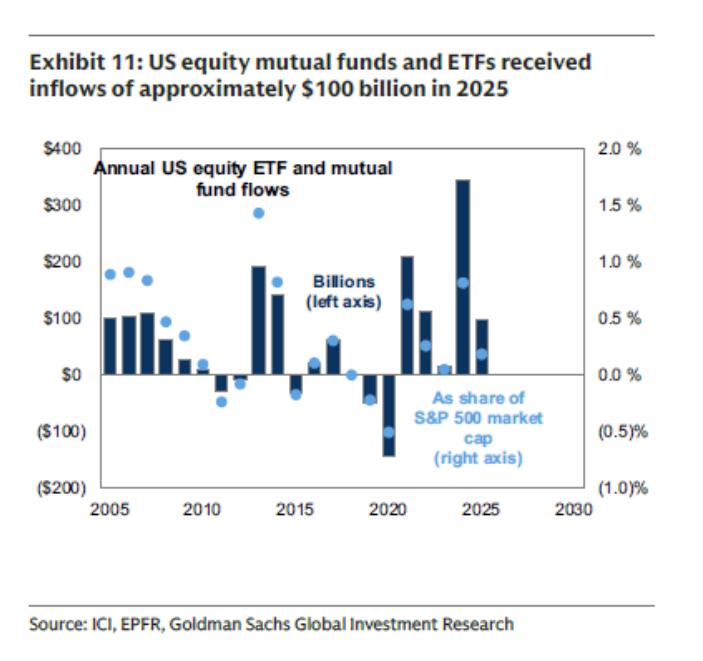

Flows into US equities were relatively small

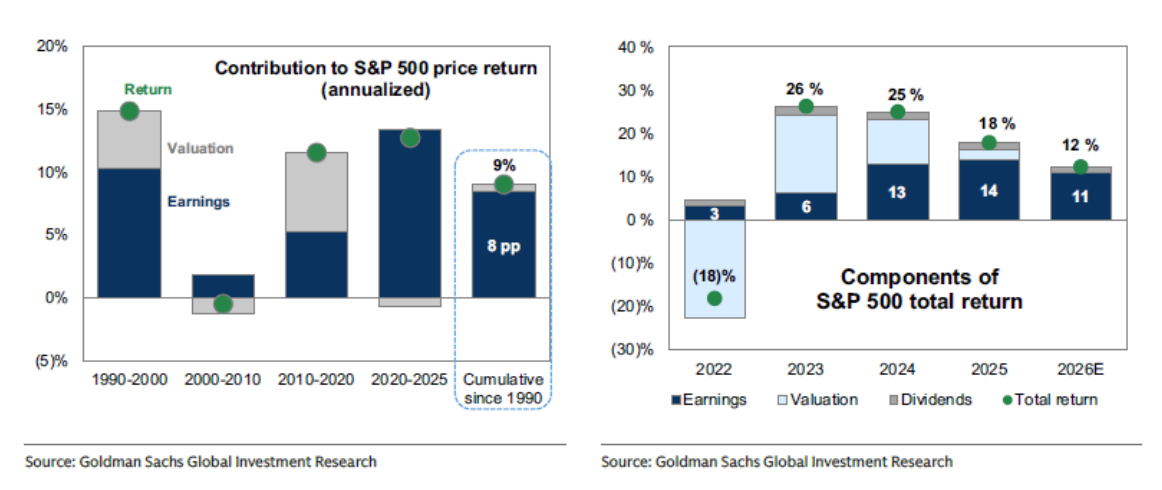

Earnings drove US equity returns in 2025, as they have historically

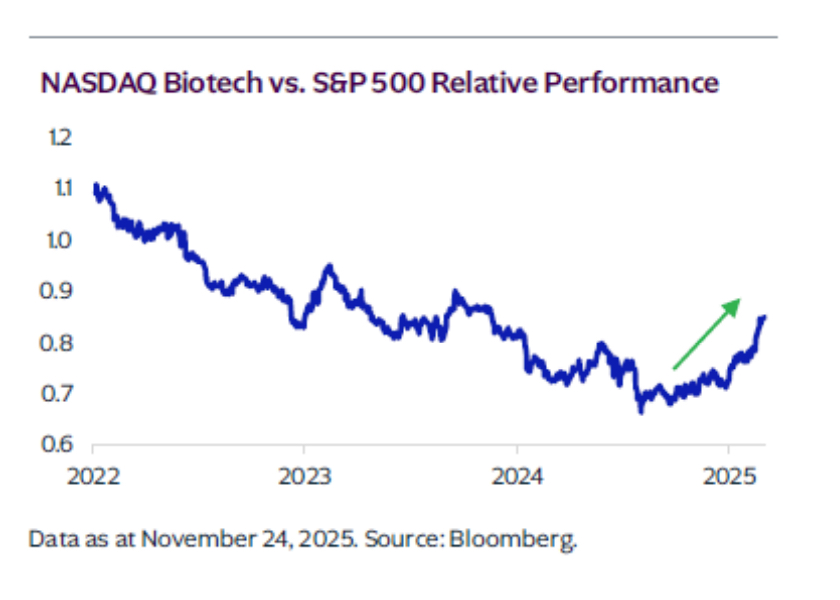

Biotech stocks rallied after lagging for several years

Source: KKR

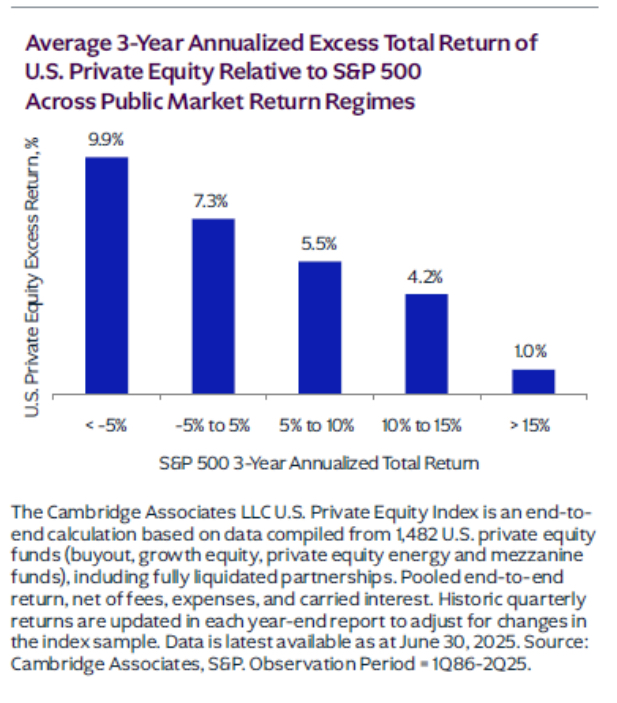

Private equity outperformance tends to be lower when public equity returns are higher

Source: KKR

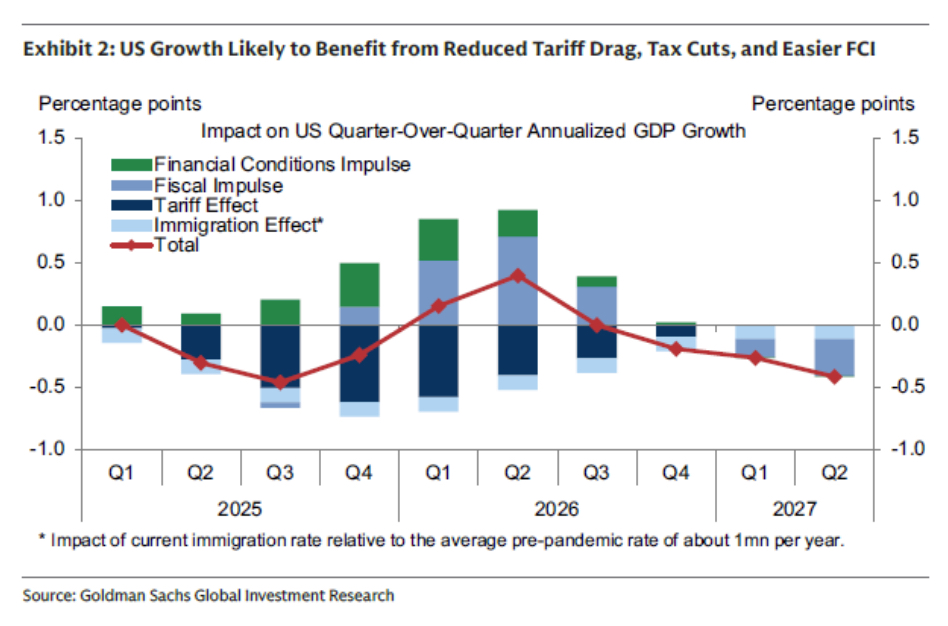

There are several growth tailwinds heading into 2026

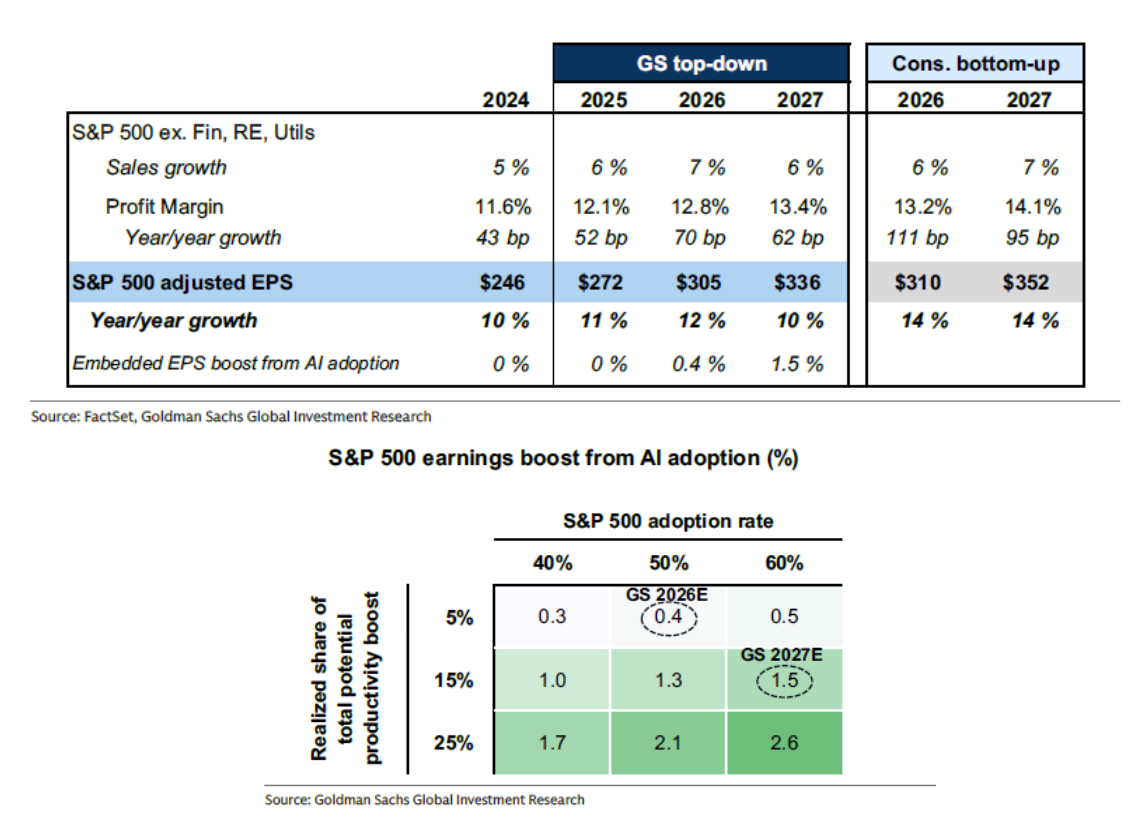

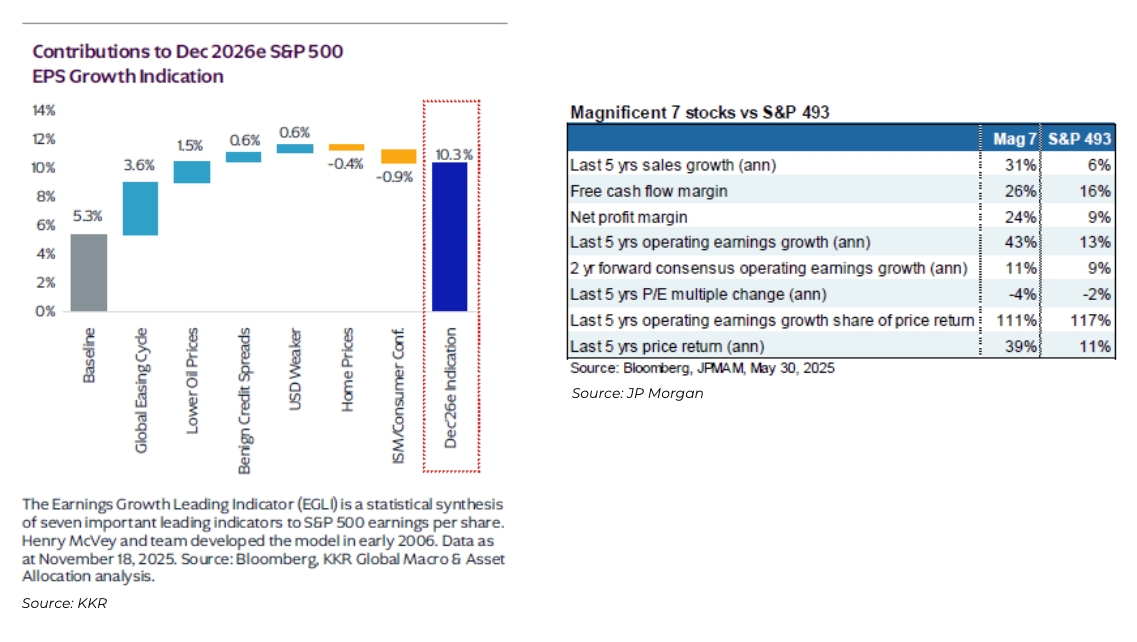

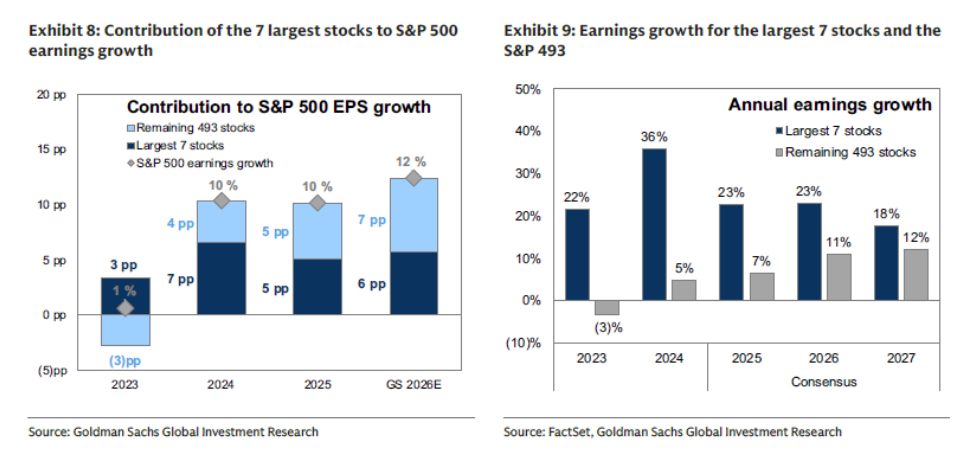

Forecasters expect strong earnings growth, with the potential for a larger boost from AI adoption

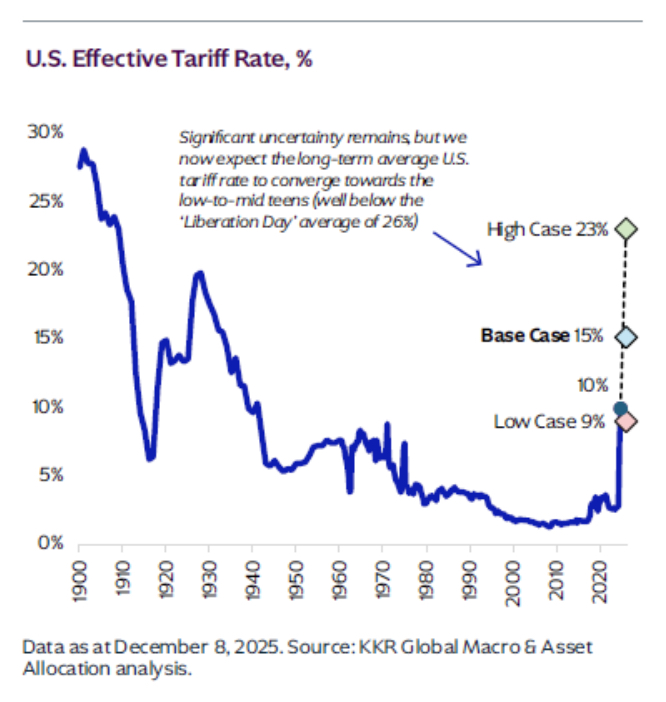

Tariffs are expected to settle below the “Liberation Day” levels…

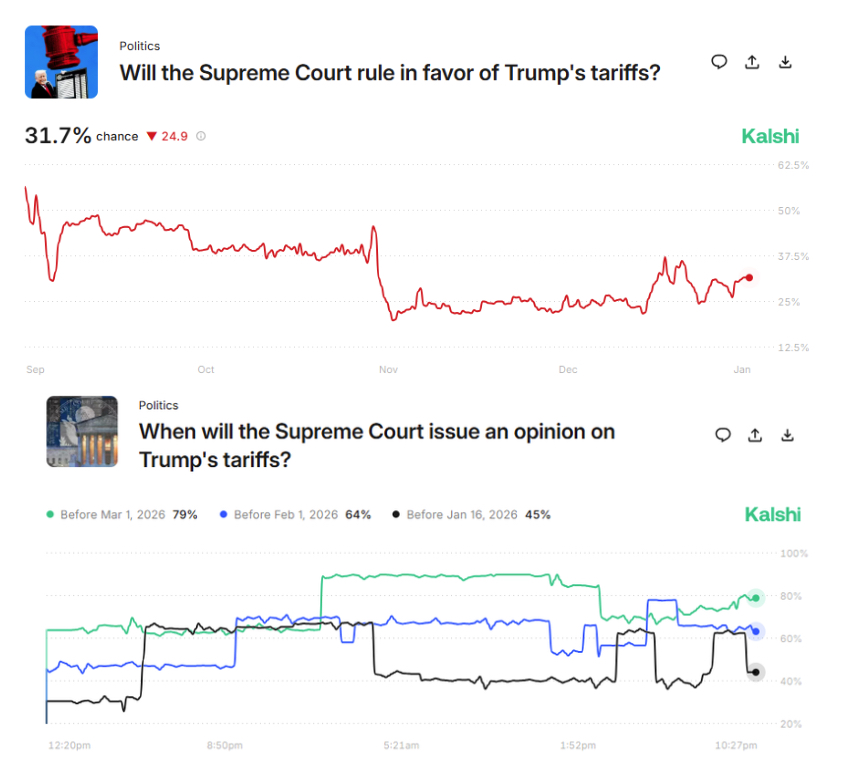

…with a Supreme Court decision on the legality of Trump’s tariffs expected soon…

Source: Kalshi

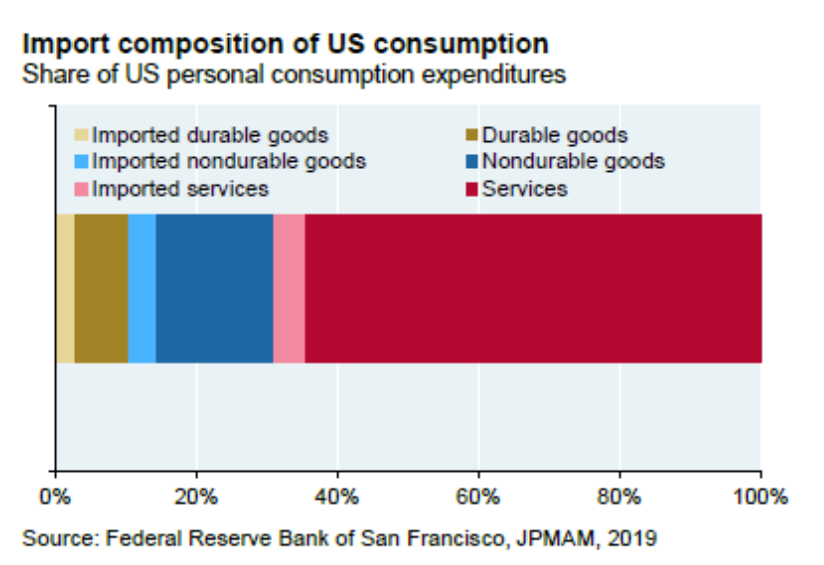

…and the import share of US consumption is fairly low

Source: JP Morgan

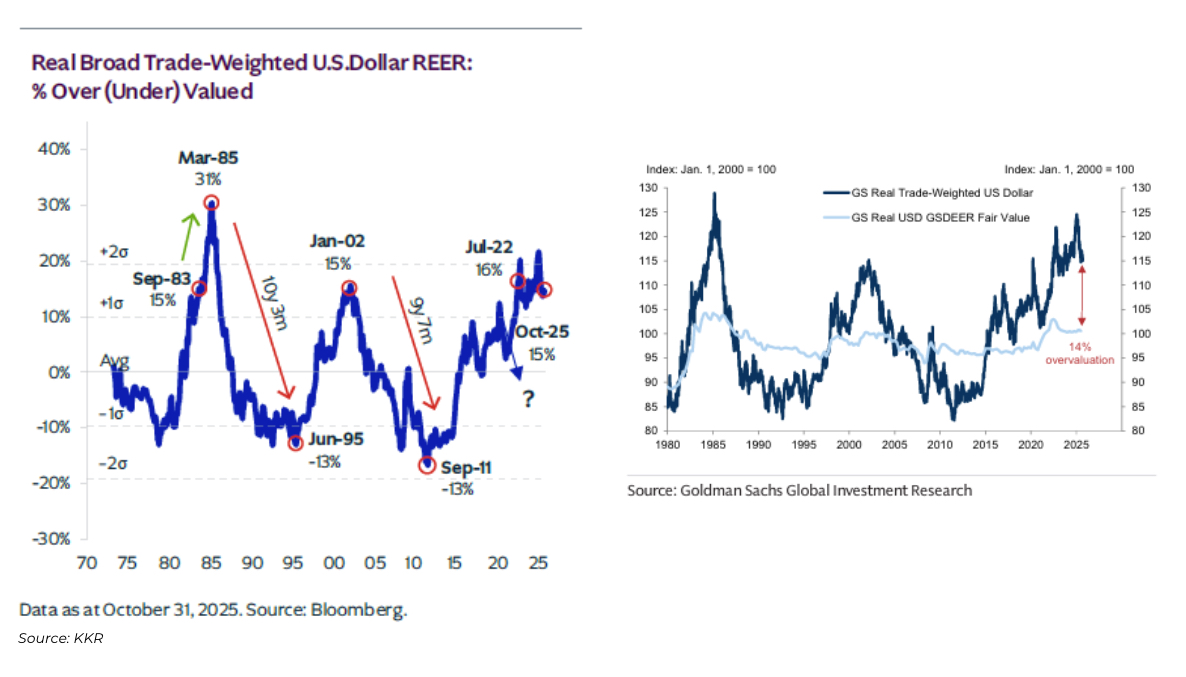

The US dollar remains overvalued, but it moves over long cycles…

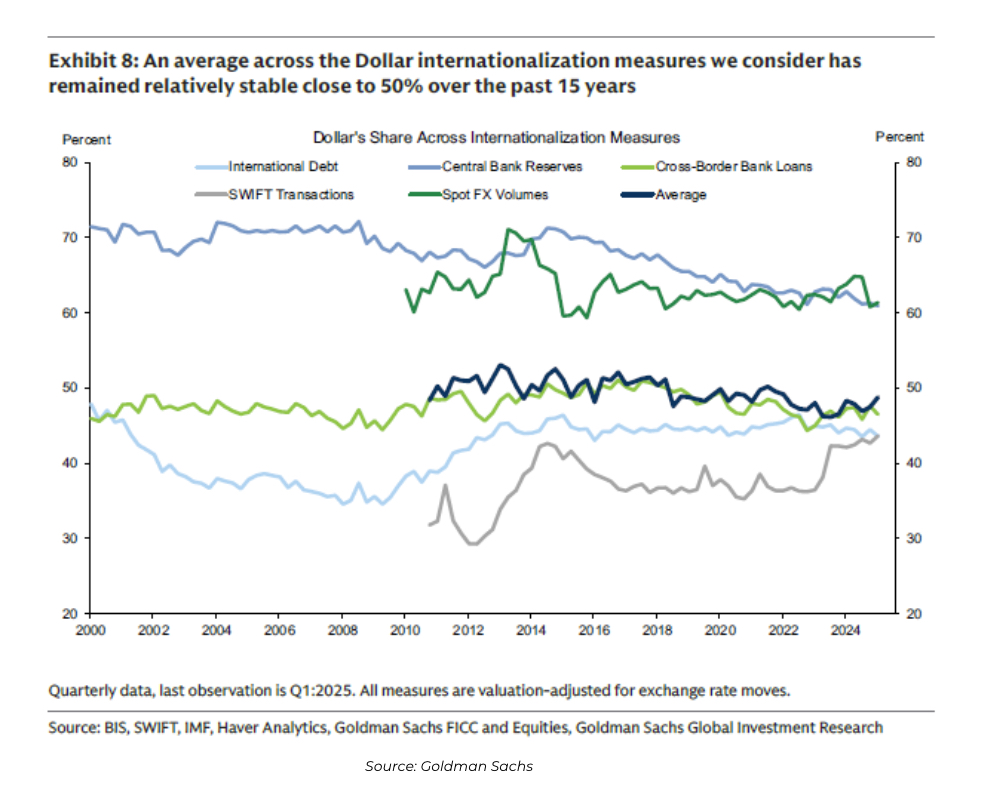

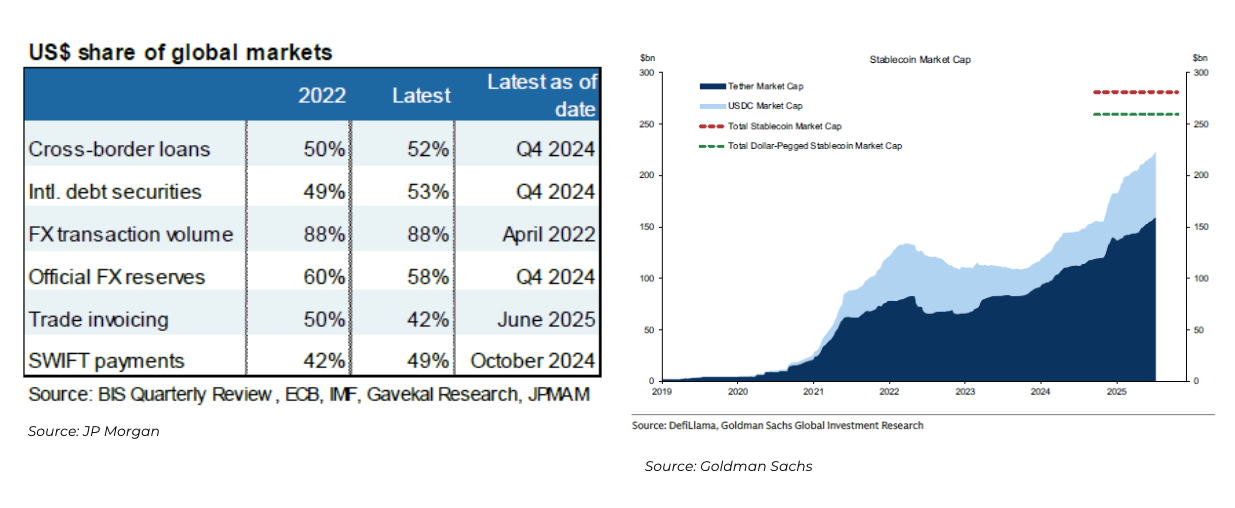

…and it is still the dominant global currency (part 1/2)…

…and it is still the dominant global currency (part 2/2)…

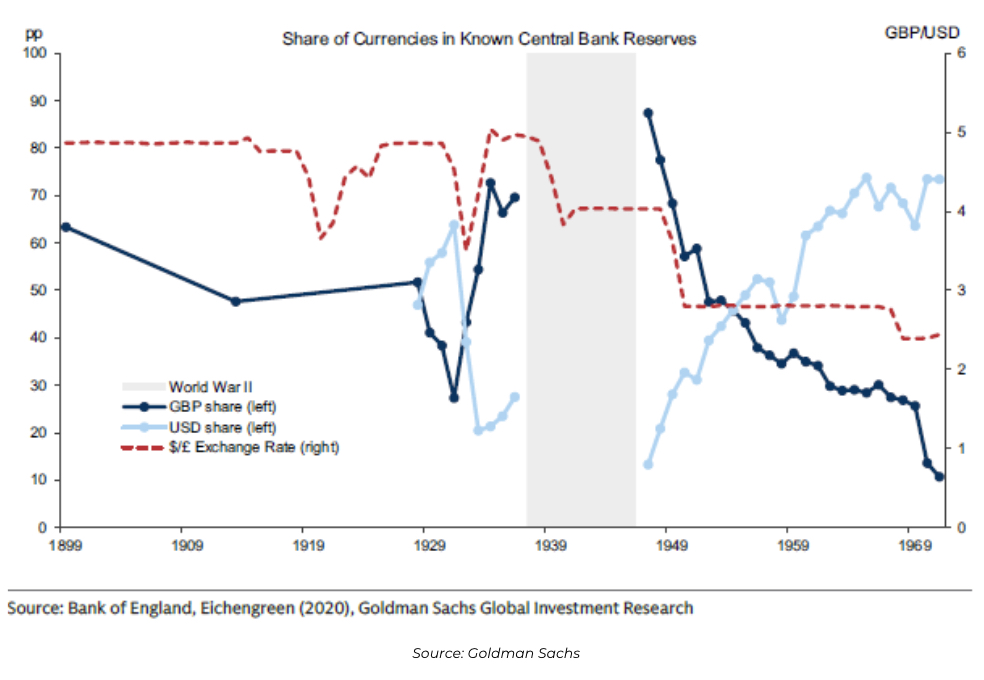

…as it has been since the decade after World War II

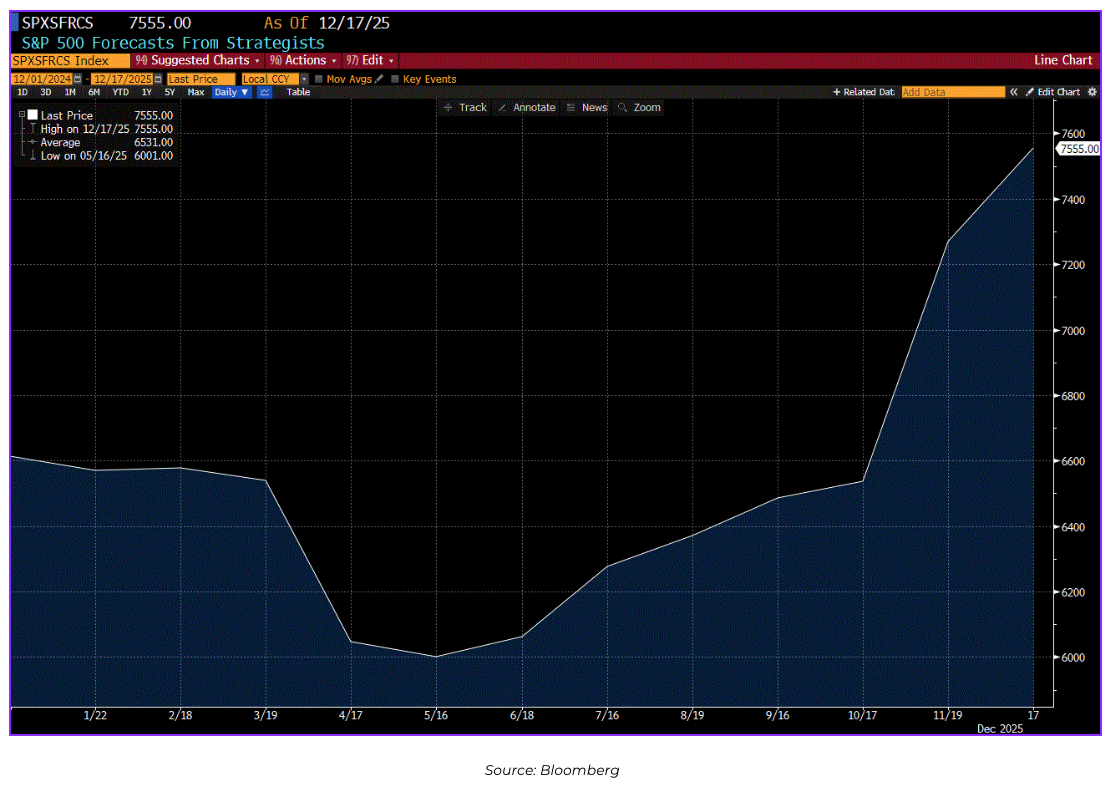

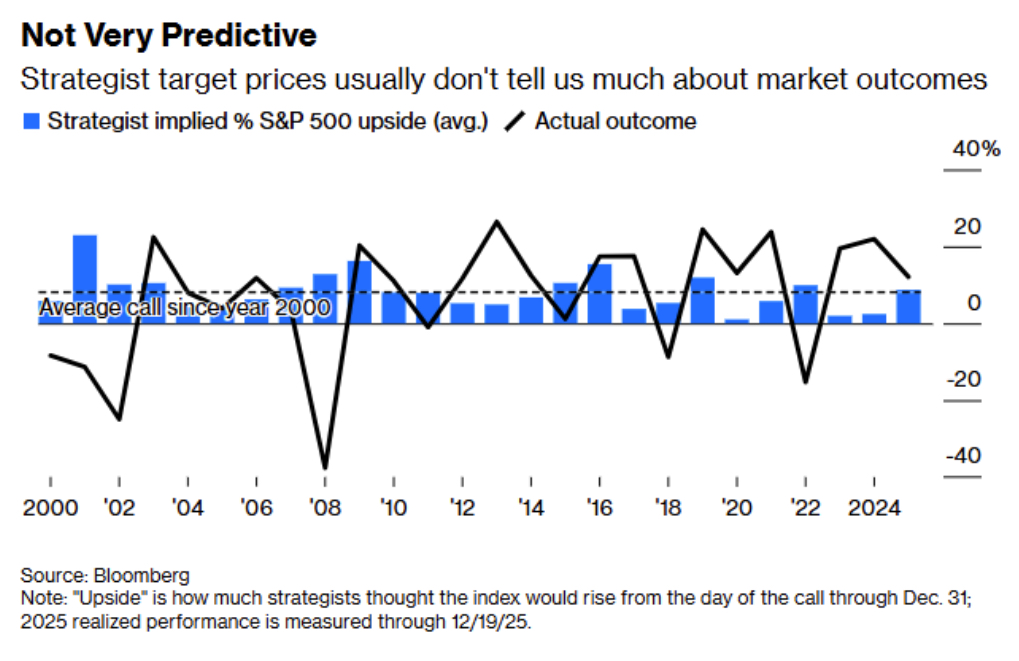

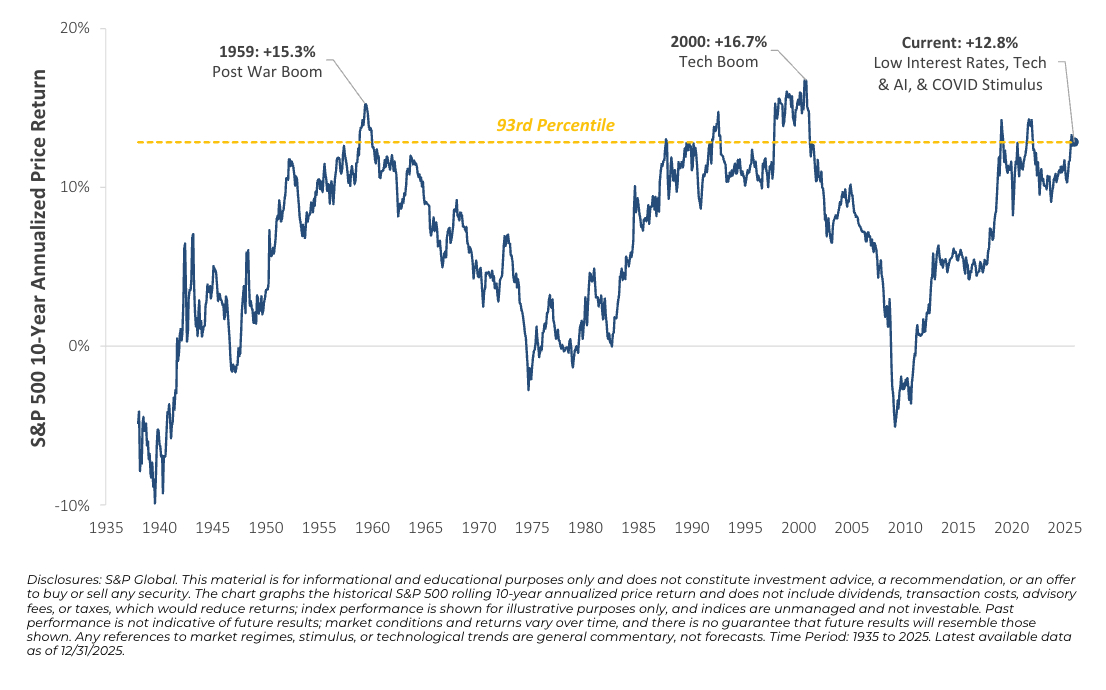

Strategists forecast about a 10% return for the S&P 500 in 2026…

…but it’s very difficult to predict returns over one year…

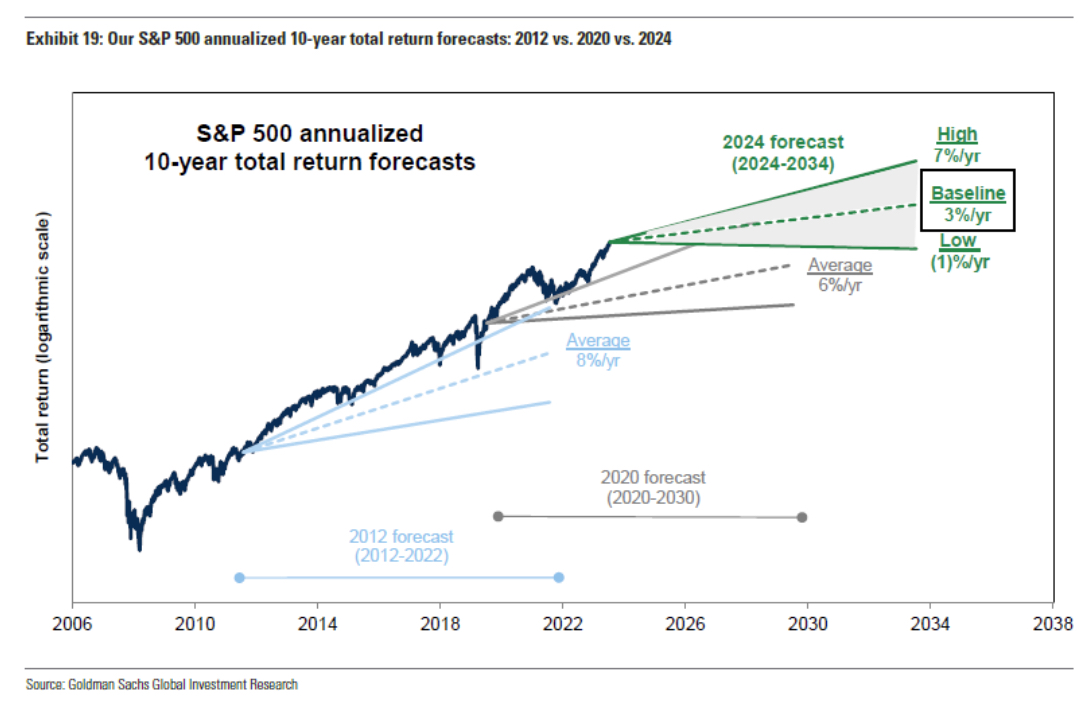

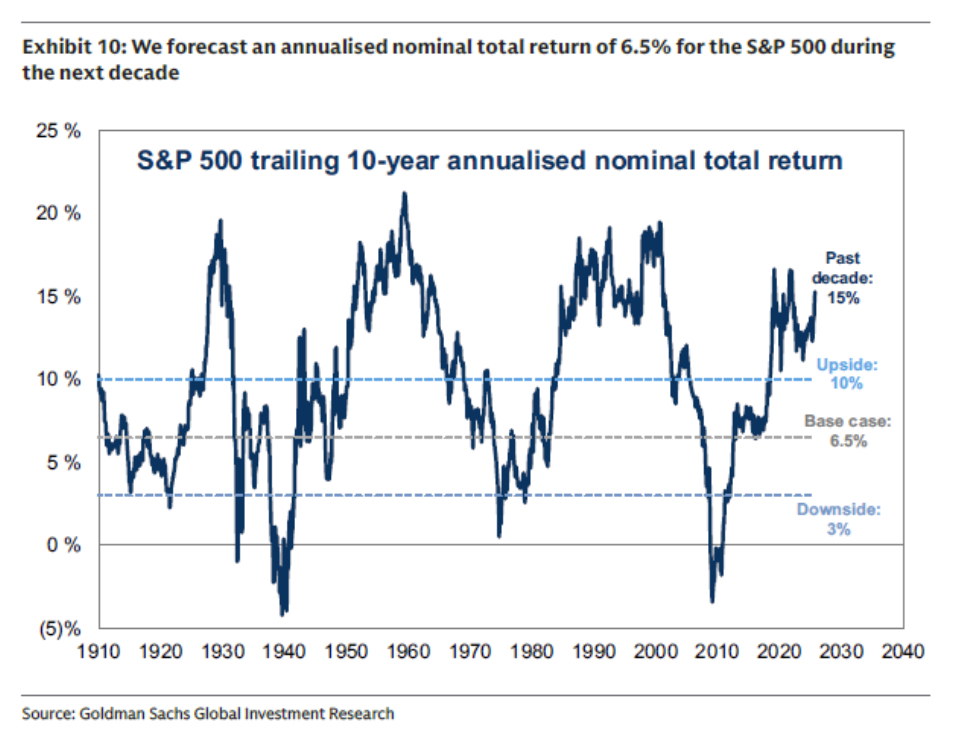

…or ten (part 1/2)

…or ten (part 2/2)

US equity valuations are reasonable in context…

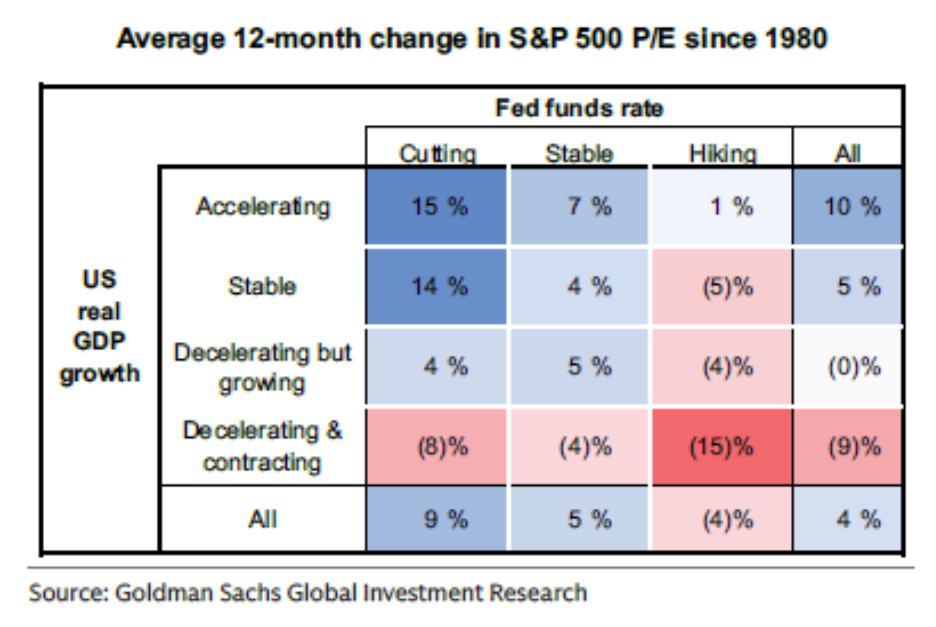

…and tend to rise when the economy is growing and the Fed is cutting rates

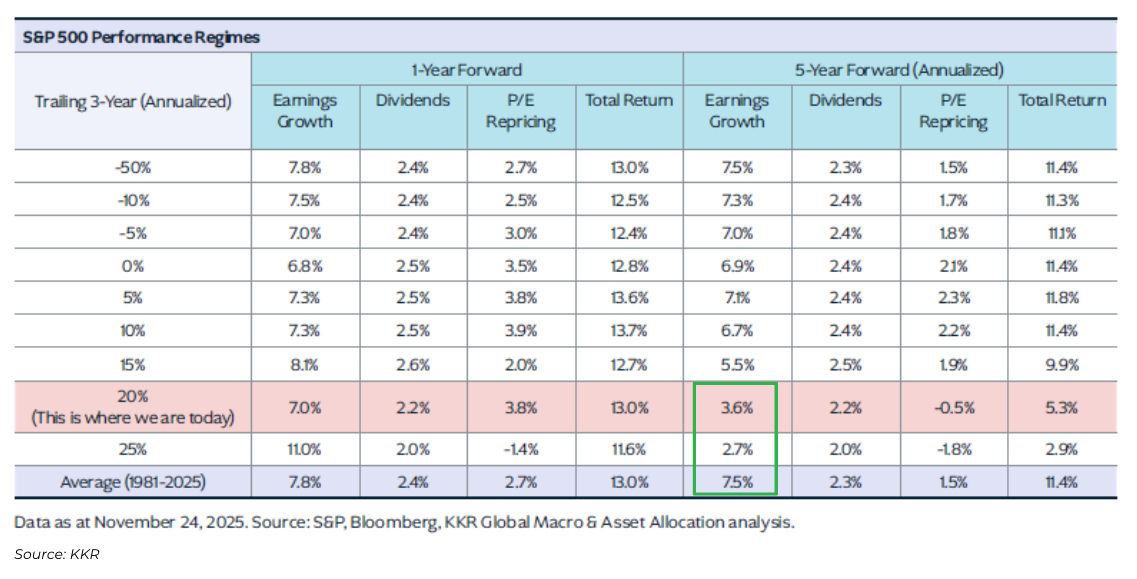

History says that in periods following outsized returns, forward returns tend to be lower, but that is driven by below-average earnings growth

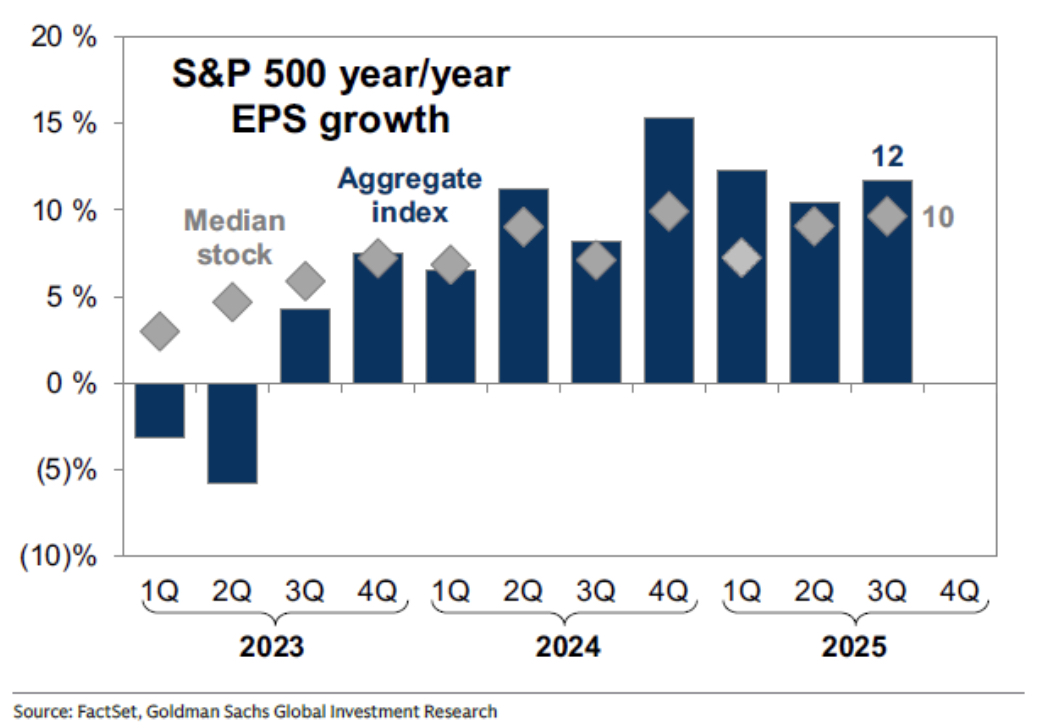

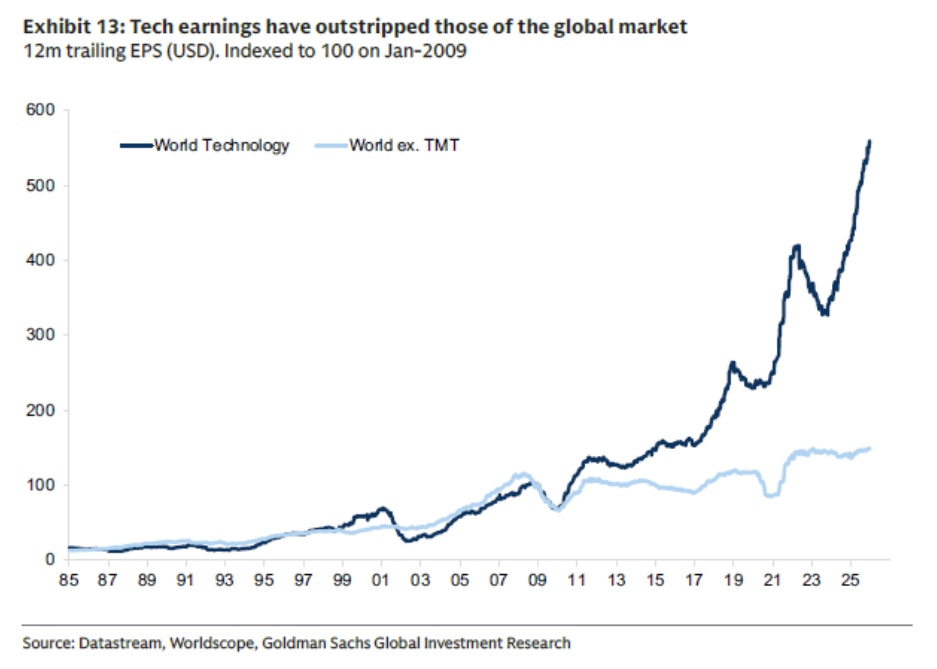

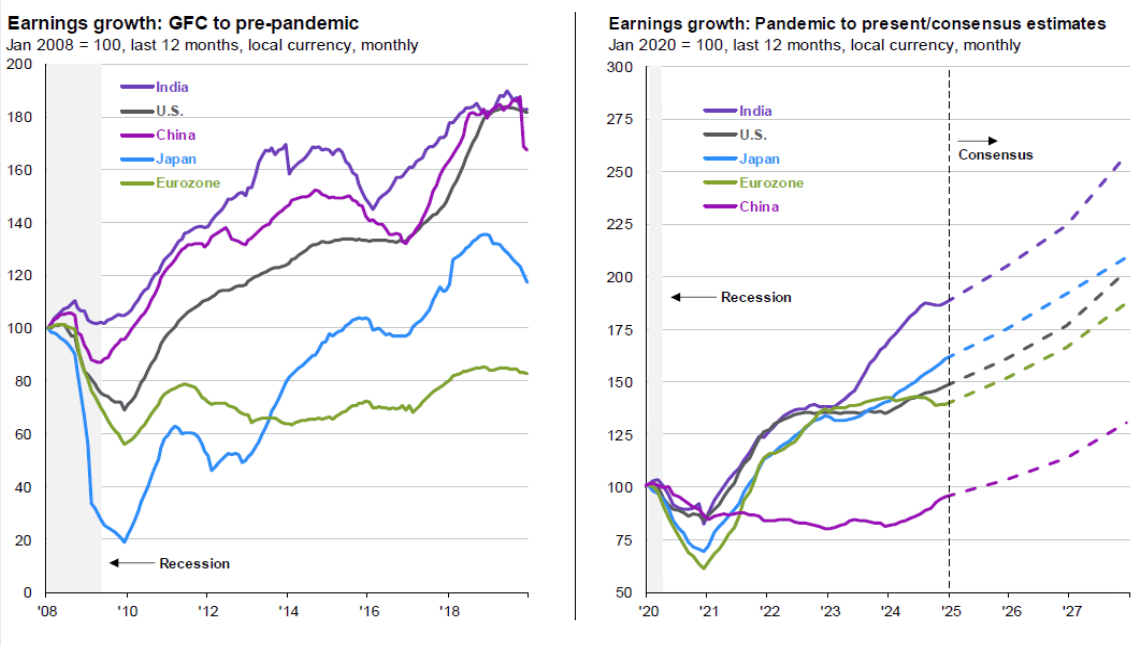

Earnings growth has been strong…

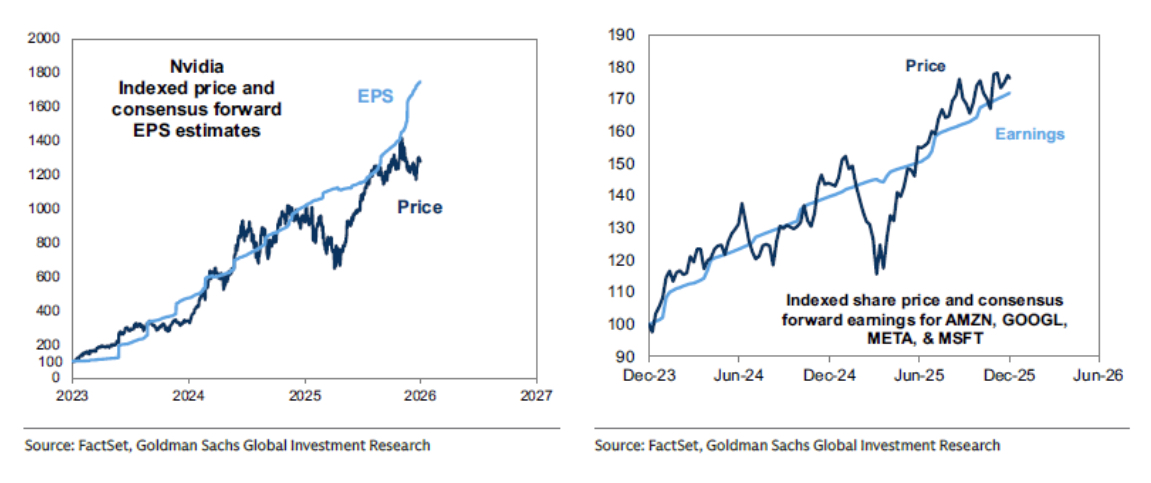

…with the largest tech stocks rising in line with earnings…

…justifying their share of market cap…

…and earnings growth is expected to continue, with the gap closing between the largest stocks and the rest of the market

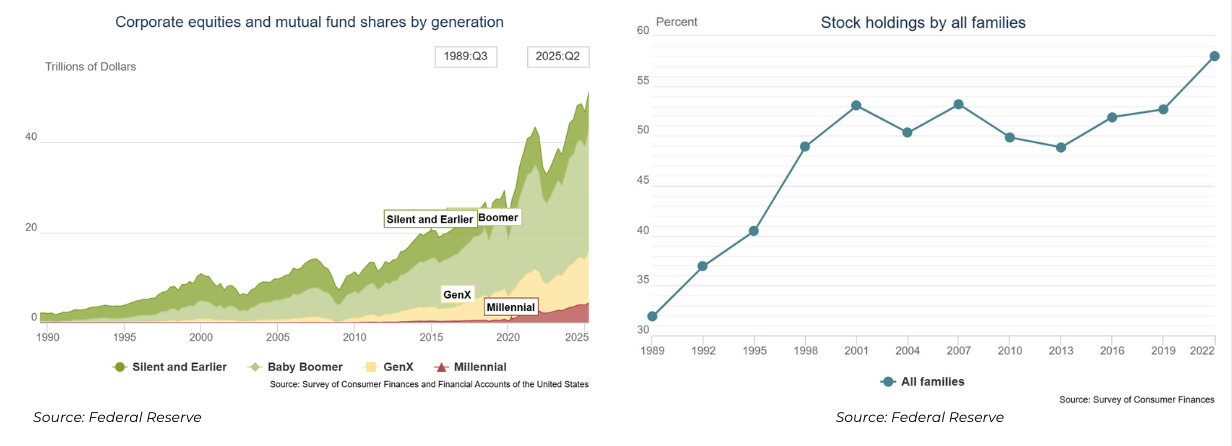

Ownership of equities has increased over the past 30+ years

US equities aren’t exhibiting behavior typical of the late stages of a bubble based on trailing 1-year return…

…Nasdaq 100 performance since the launch of ChatGPT vs. after the Netscape IPO…

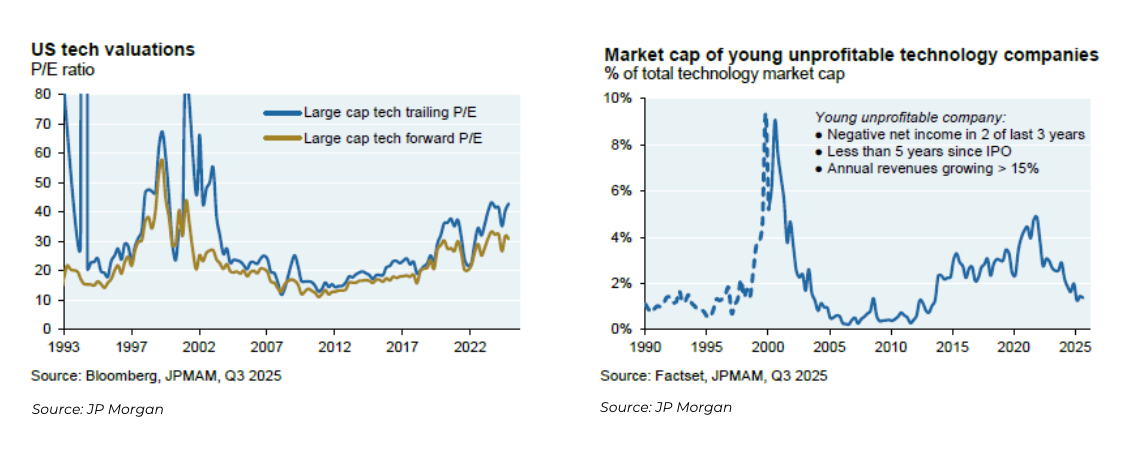

…tech valuations and the share of young unprofitable companies vs. the tech bubble…

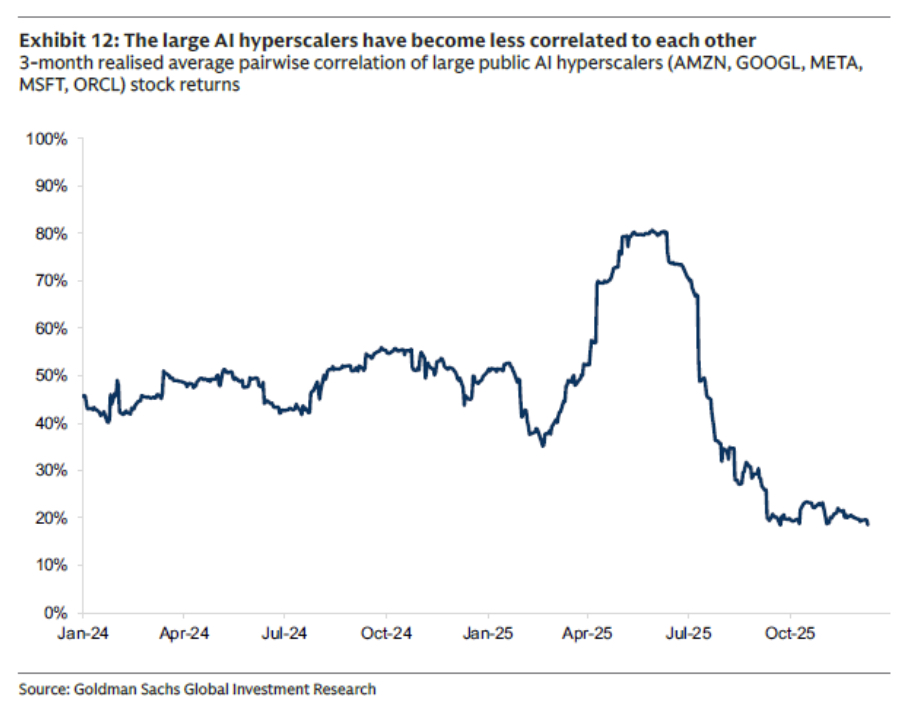

…and the AI hyperscaler stocks have become less correlated…

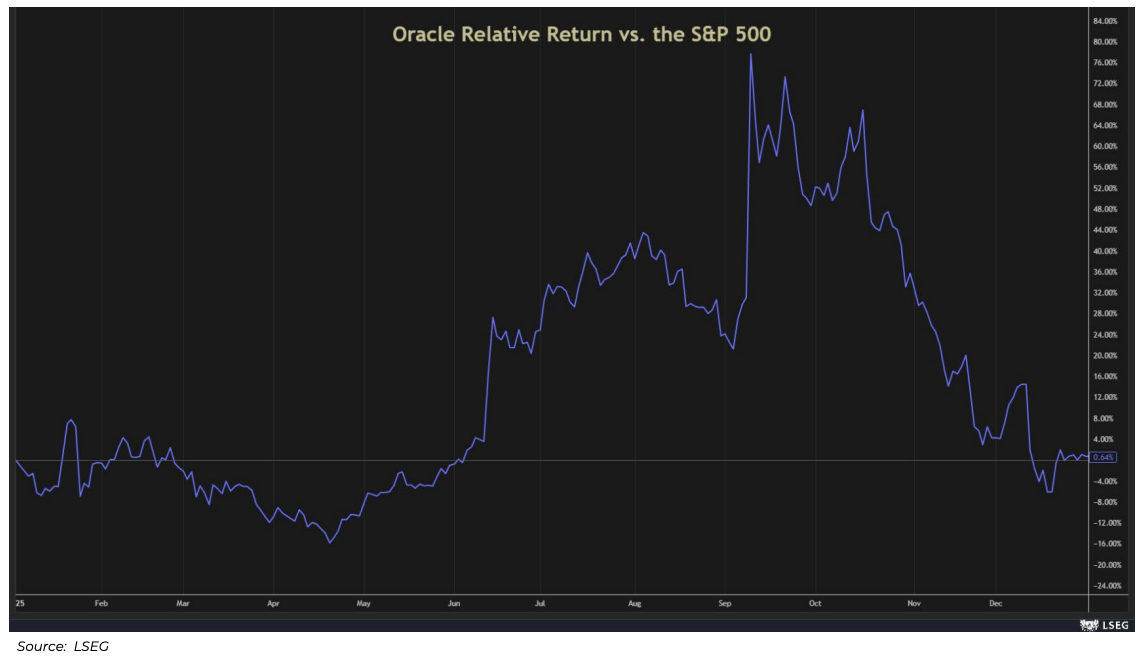

…with Oracle stock dropping significantly after a big run-up last year

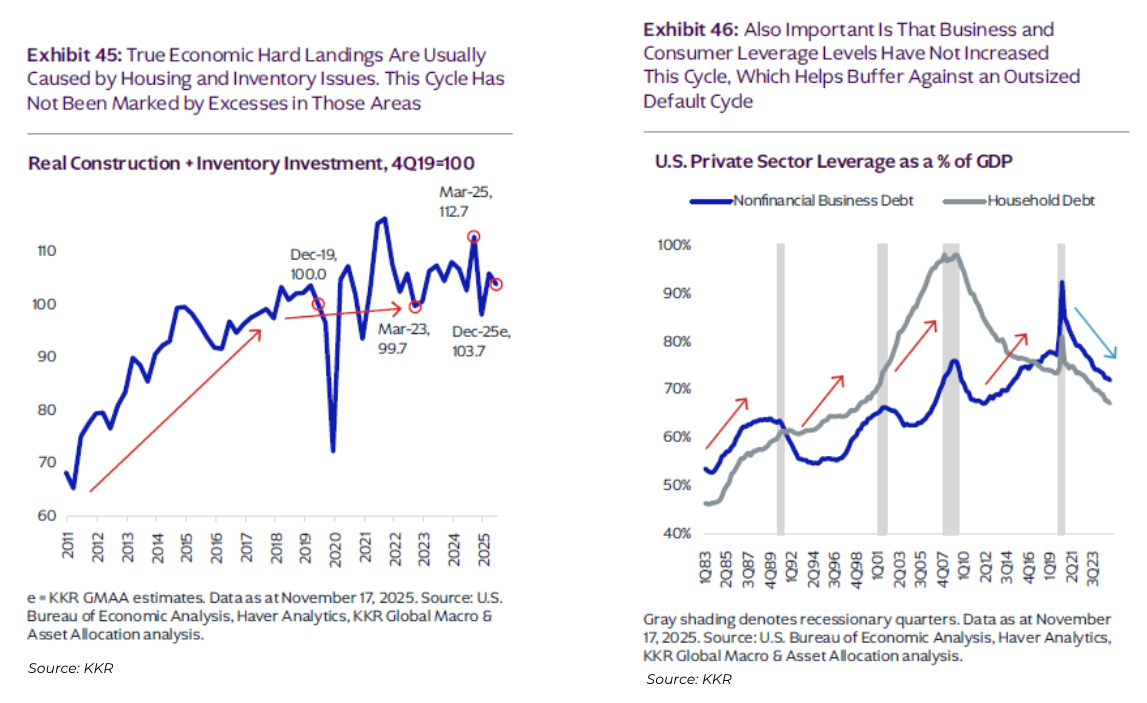

There aren’t obvious excesses in construction, inventories, or private sector debt…

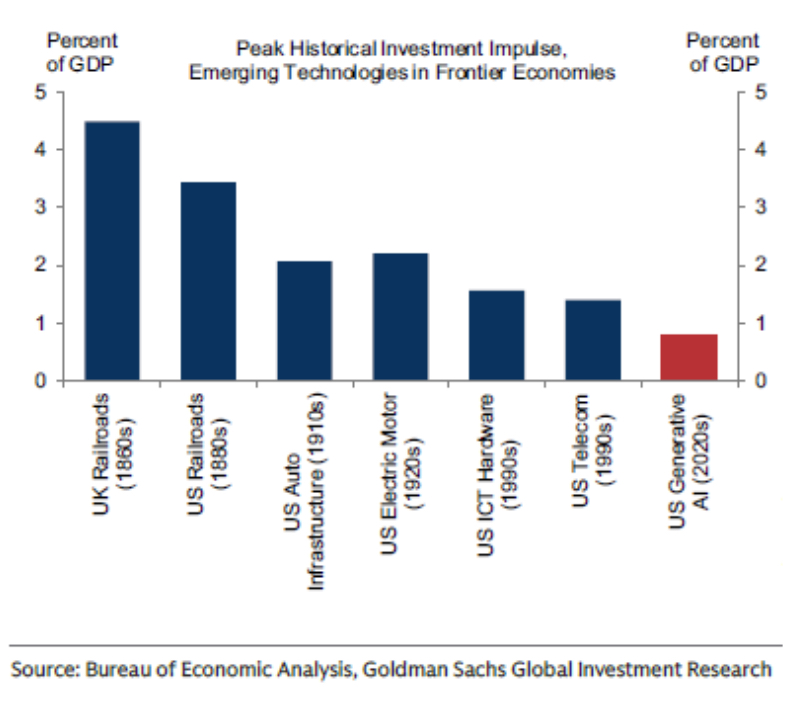

…and US investment in generative AI isn’t an outlier in context…

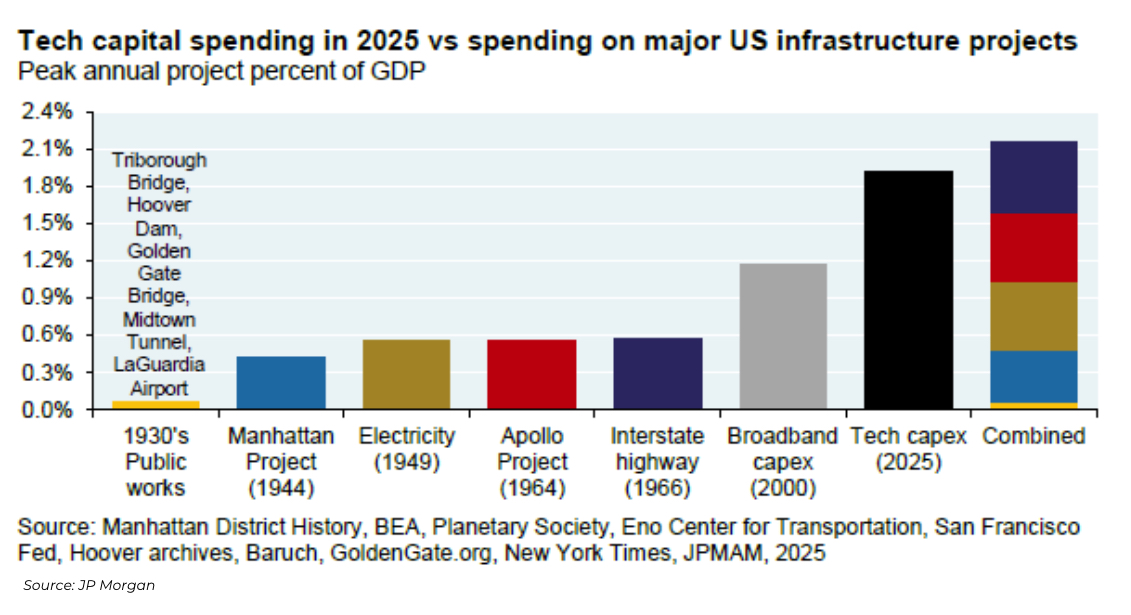

…although it is very large compared to many other infrastructure projects…

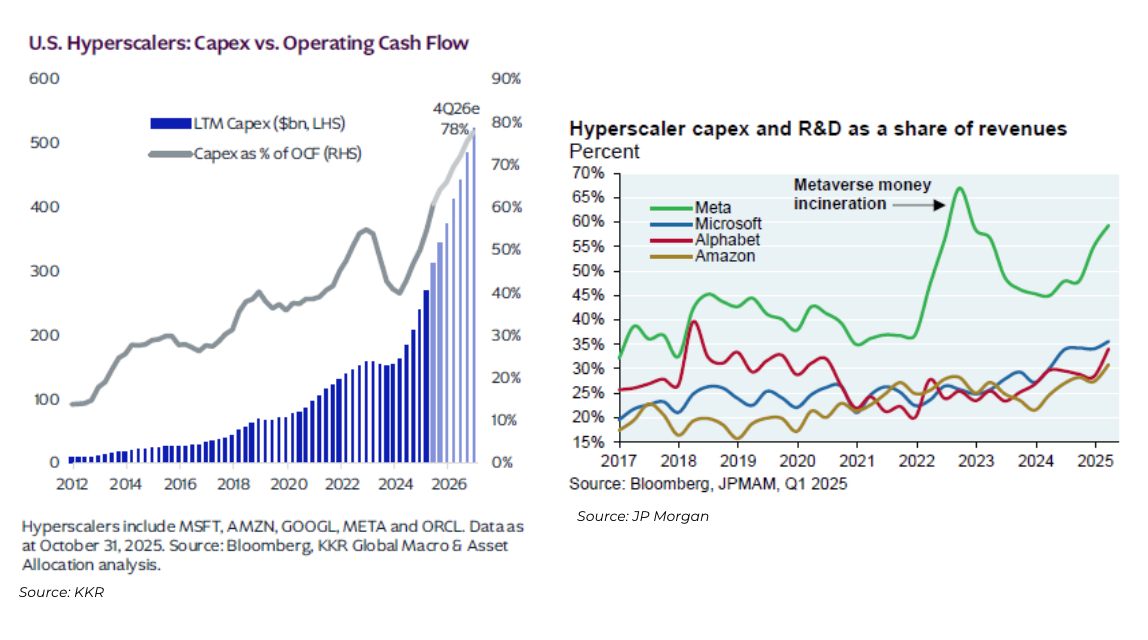

…and while the AI hyperscalers are spending a lot on CapEx…

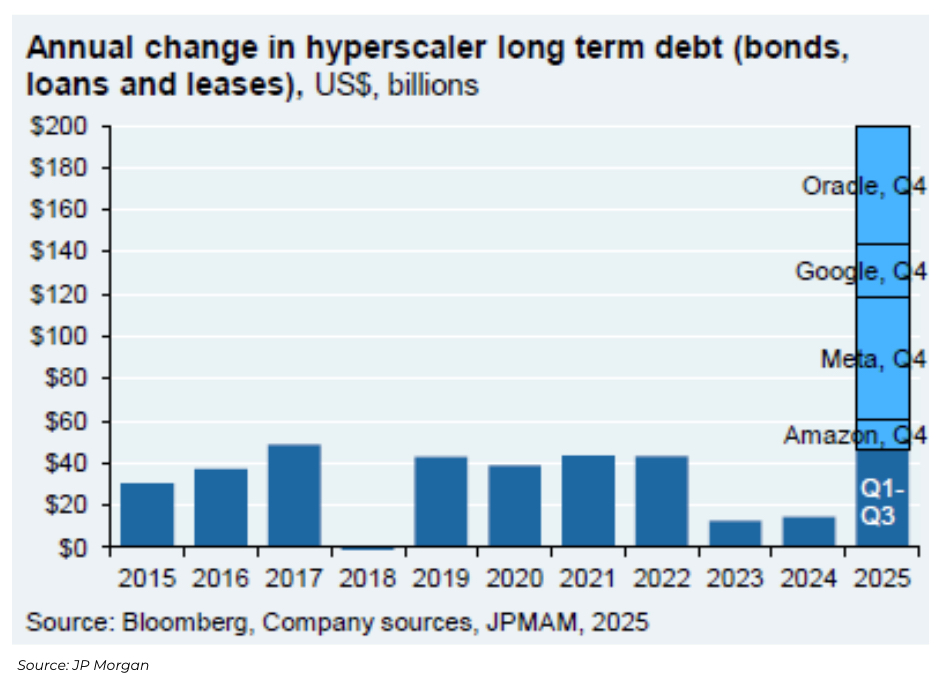

…and they have started to take on more debt…

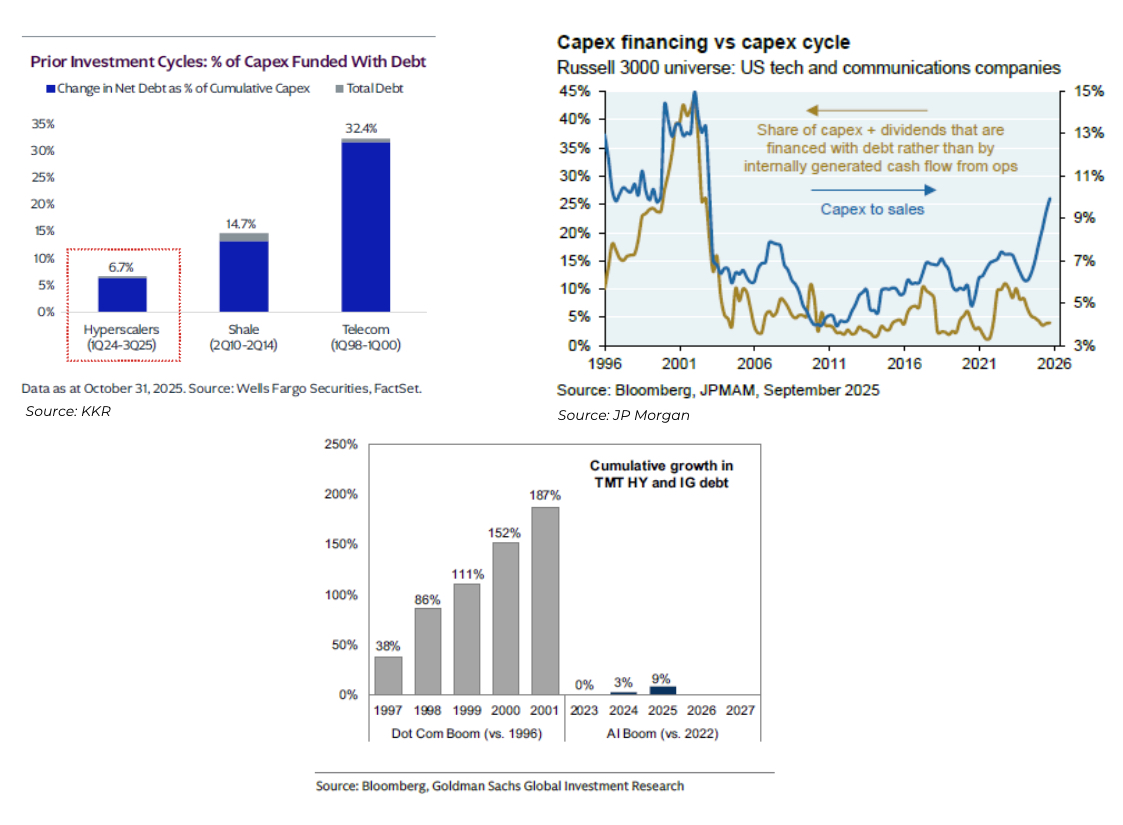

…the debt is modest compared to prior cycles

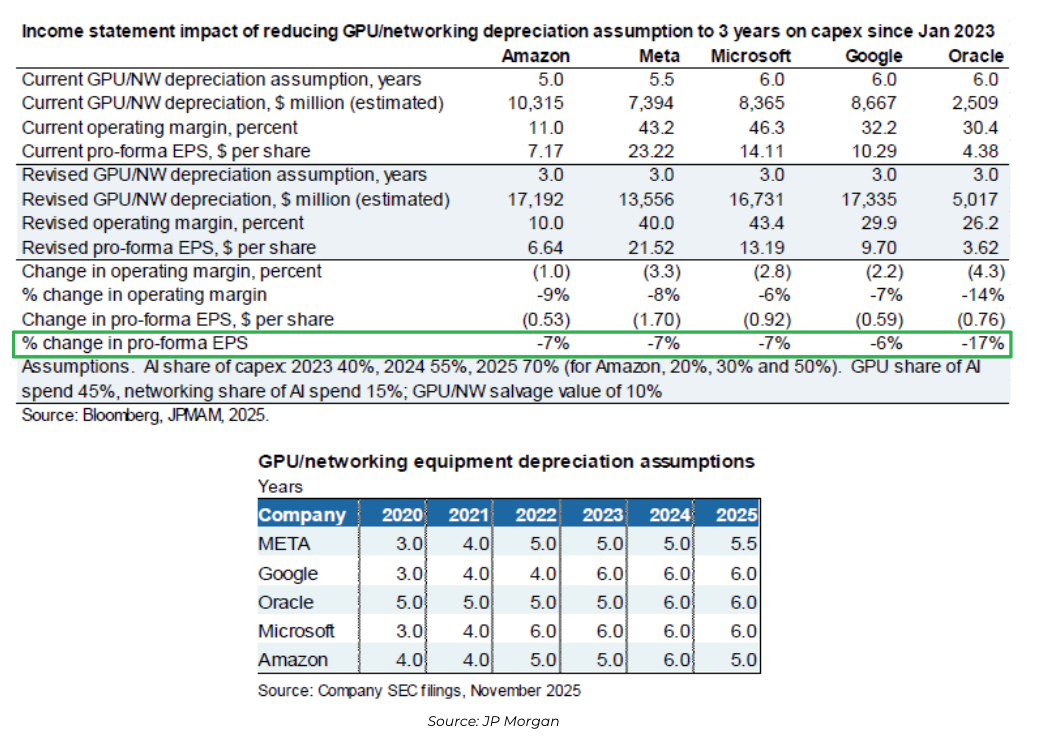

AI risks: GPU depreciation assumptions

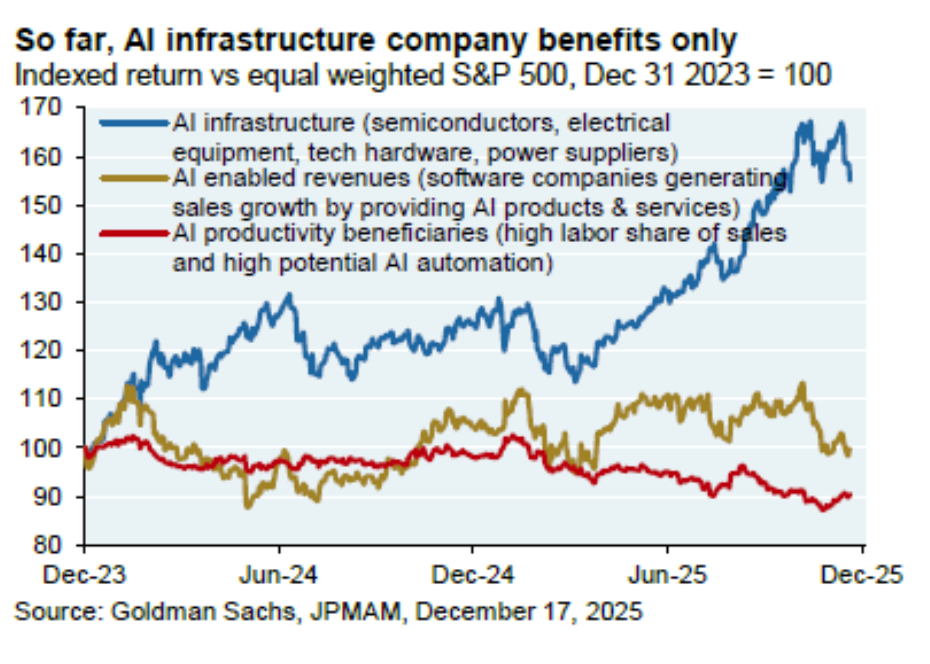

AI risks: modest benefits outside of AI infrastructure companies so far

AI risks: access to power

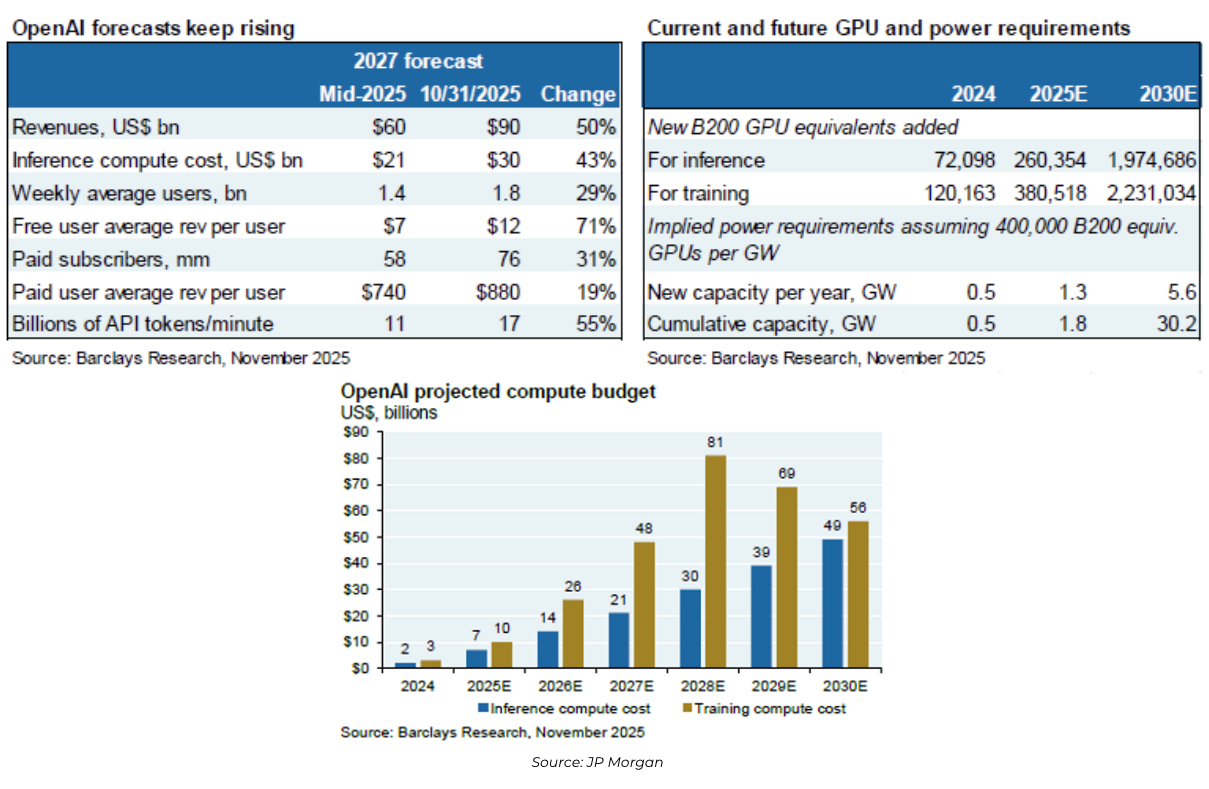

AI risks: OpenAI

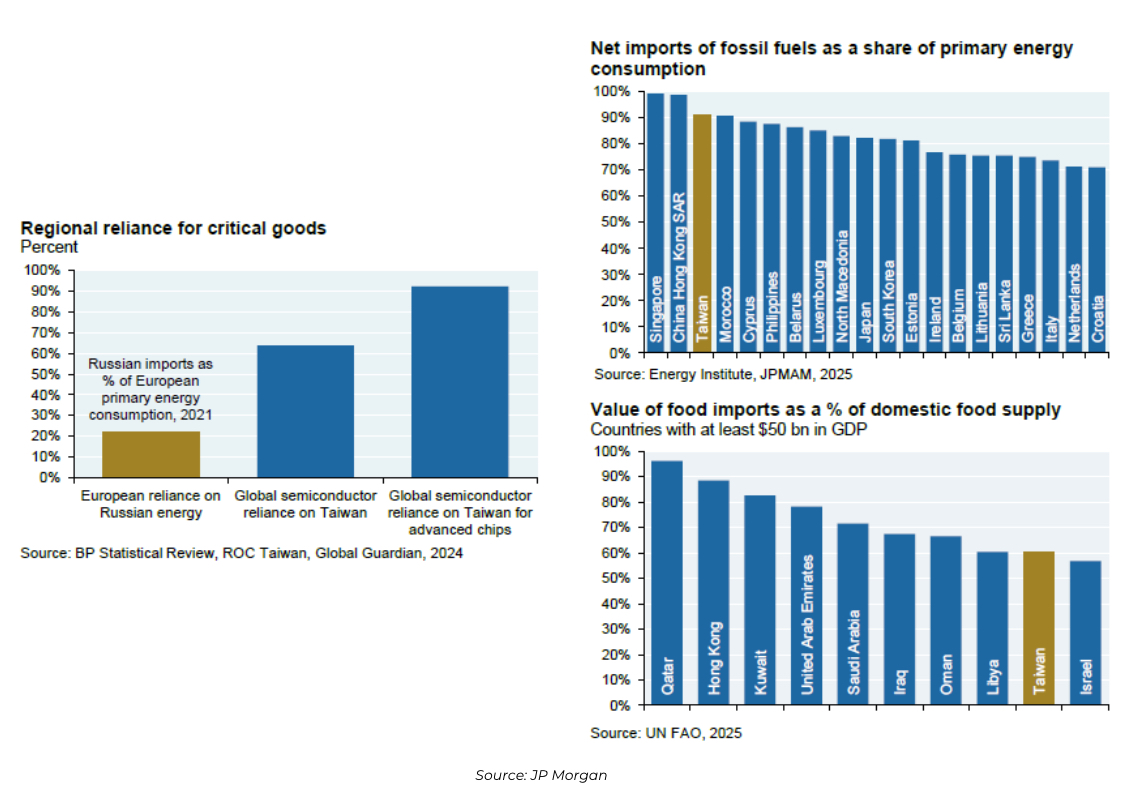

AI risks: Taiwan

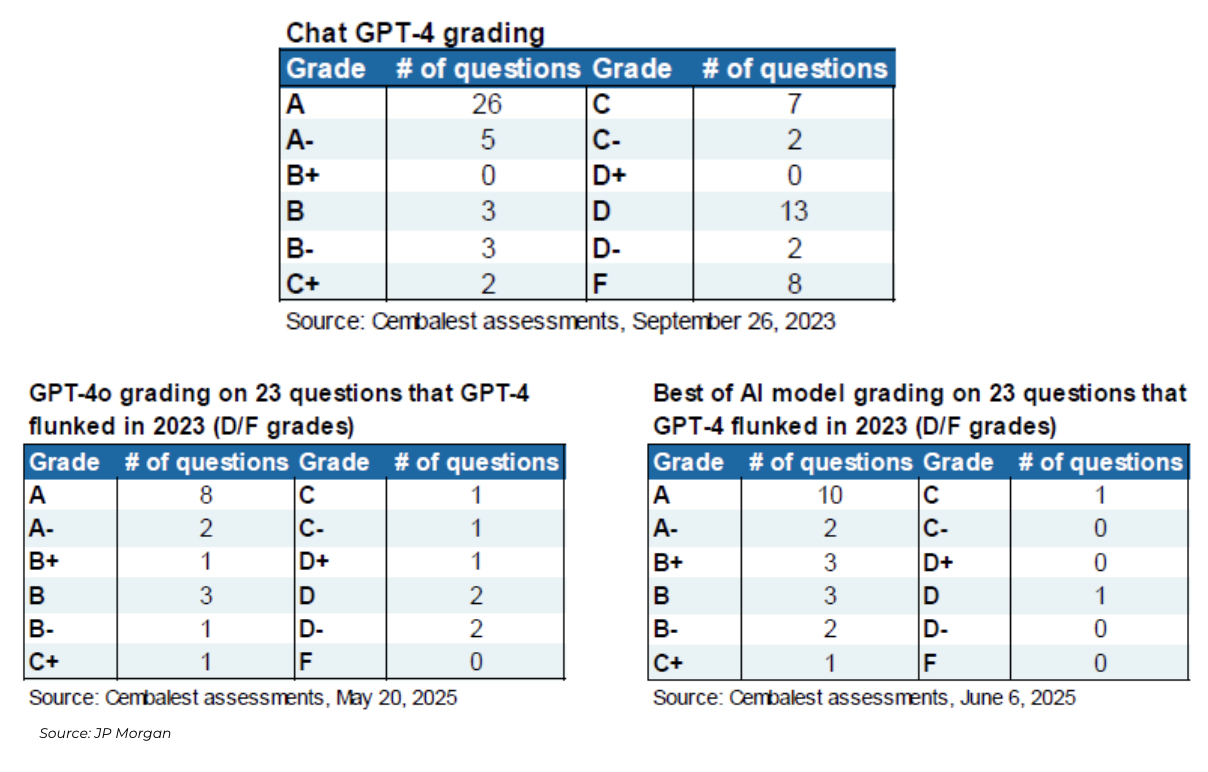

AI potential: LLMs are improving

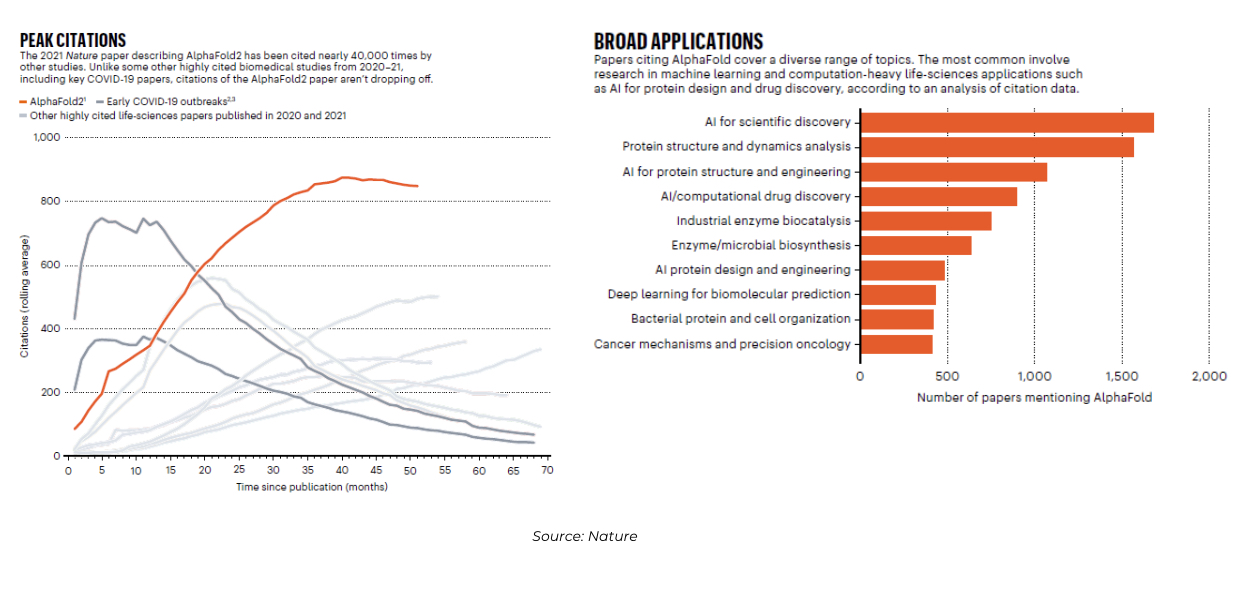

AI potential: AlphaFold

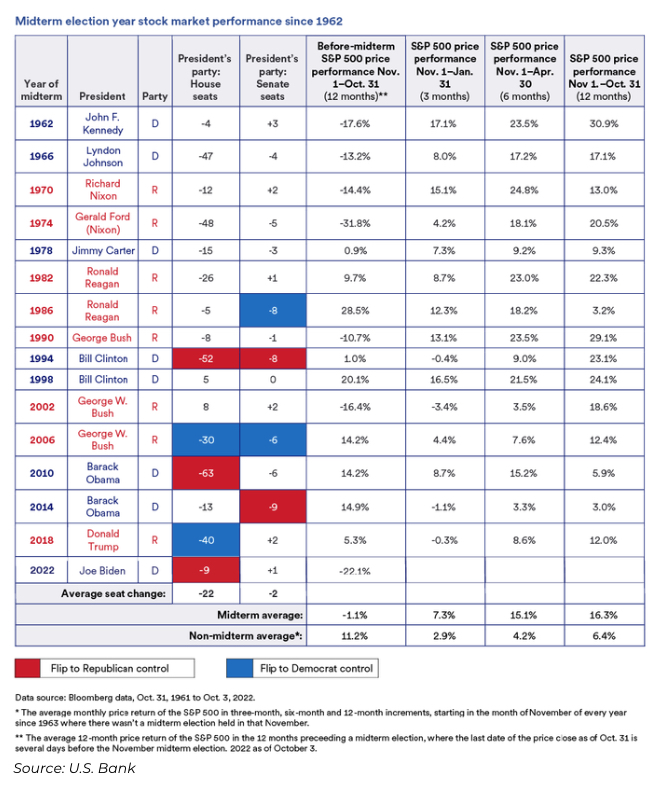

Equities tend to underperform in the 12 months leading up to midterm elections, and outperform in the 3, 6, and 12 months after

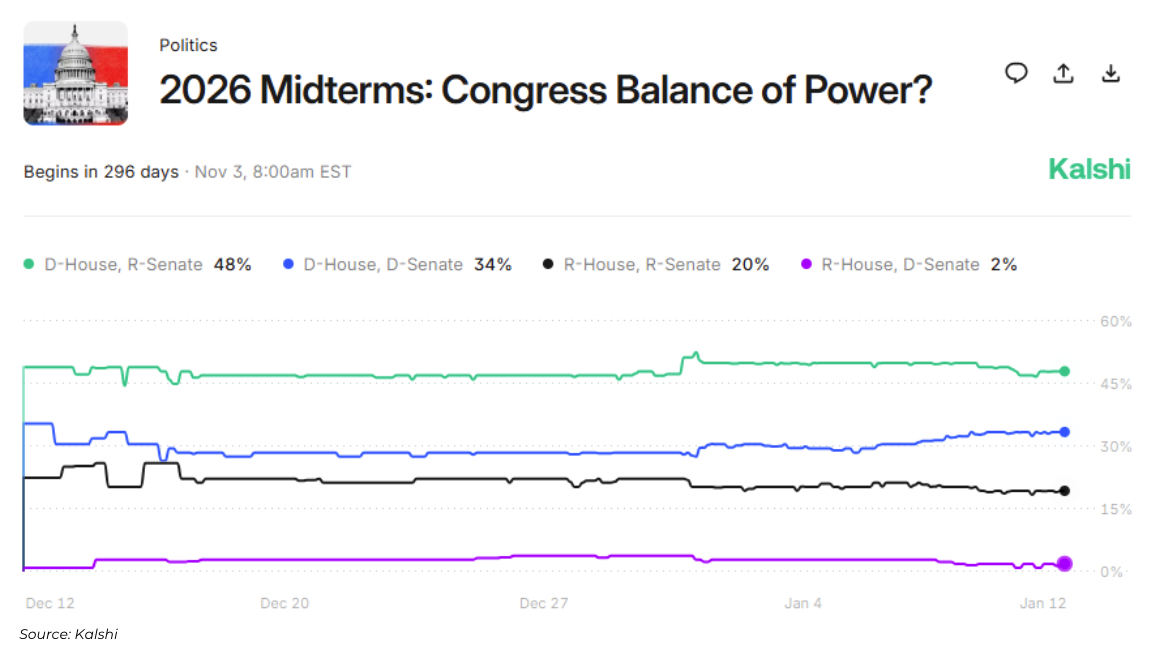

Bettors expect divided control of Congress…

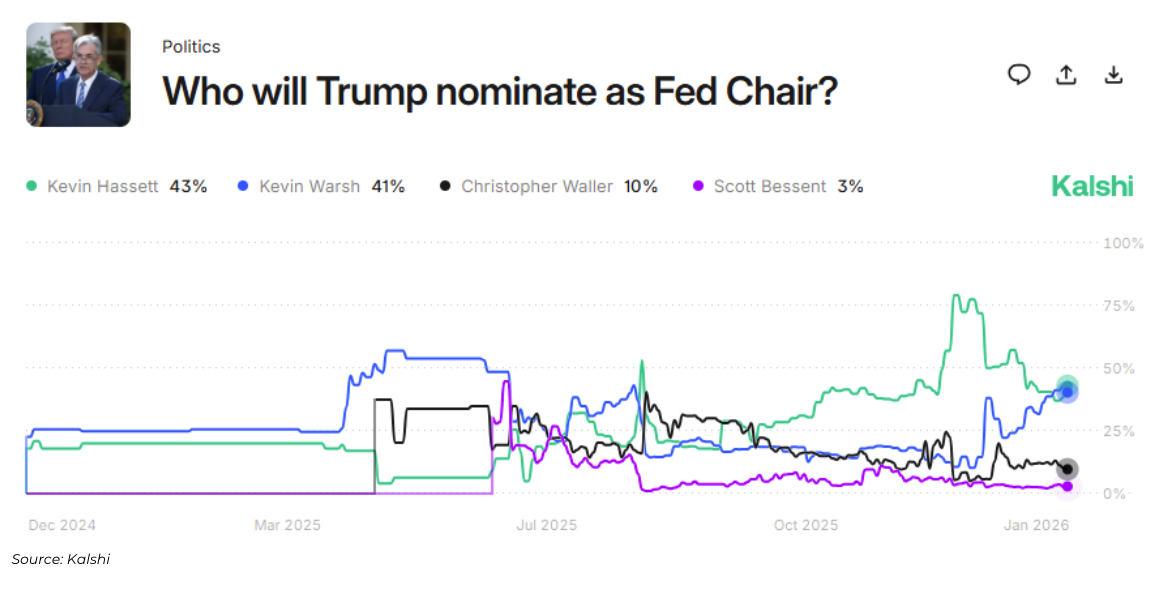

…and a Fed Chair named Kevin

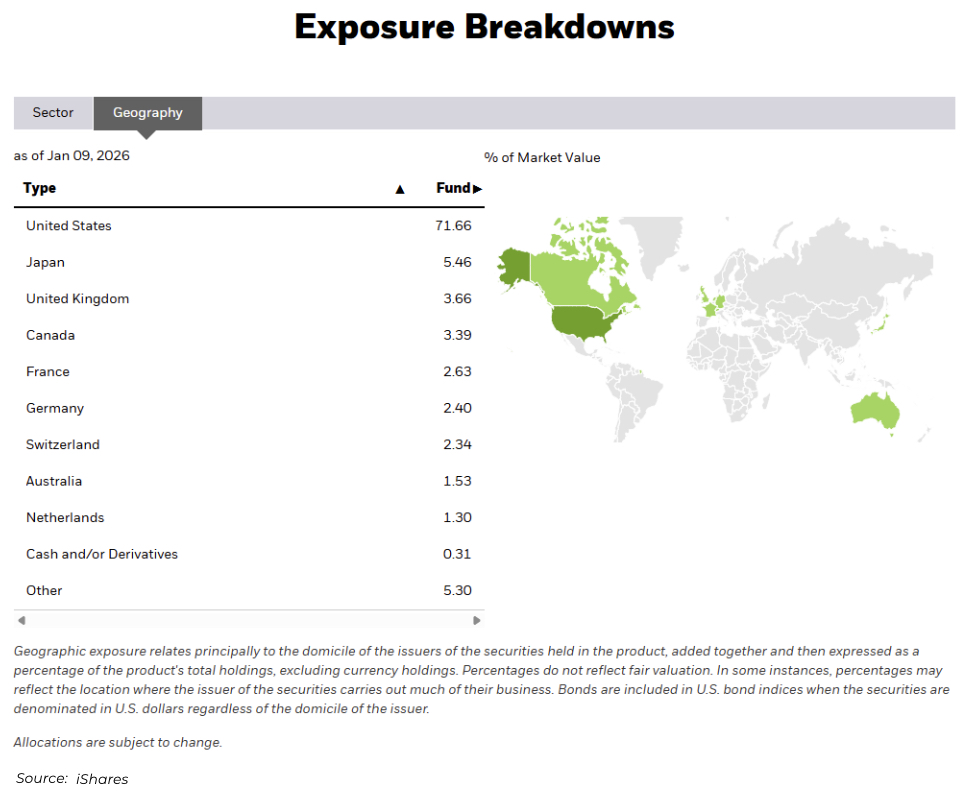

The US represents over 70% of the MSCI World Index

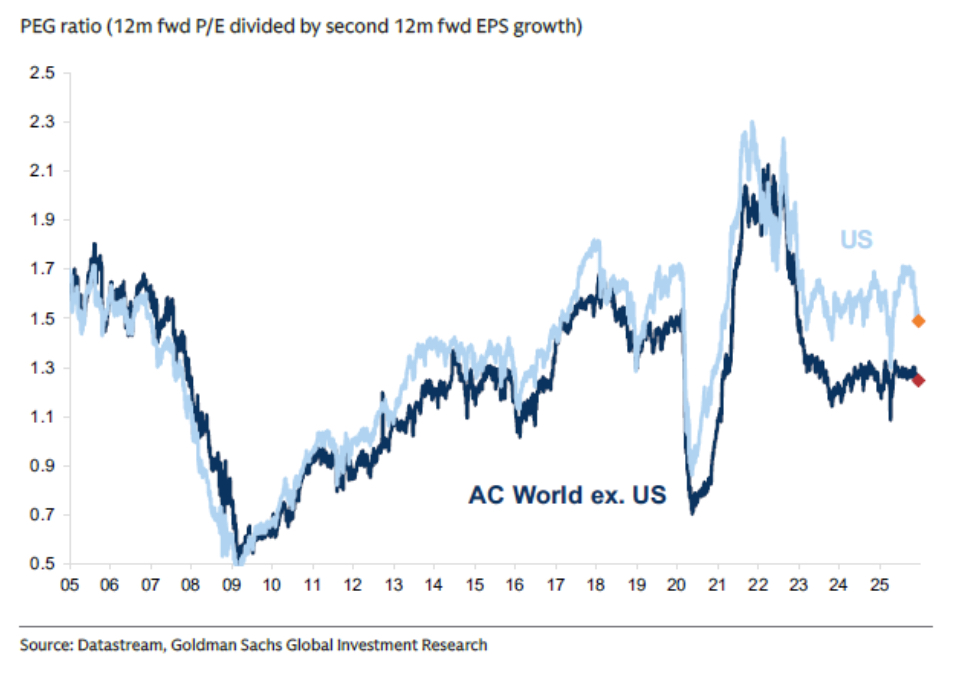

US equities are more expensive than the rest of the world, but the gap in growth-adjusted valuations has narrowed

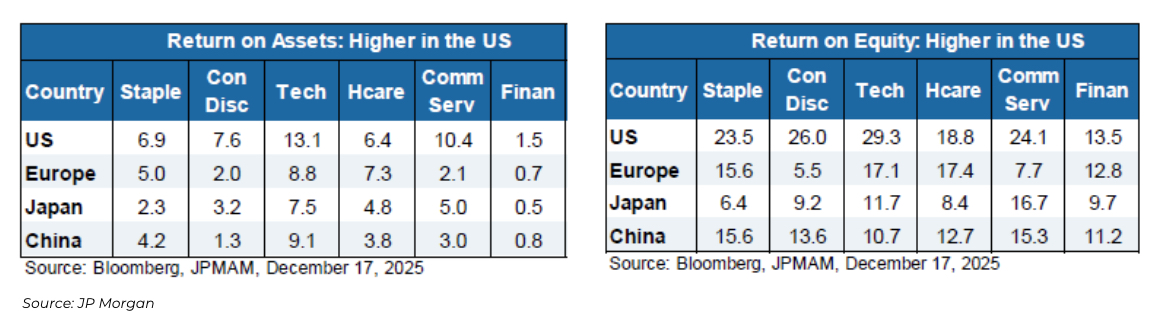

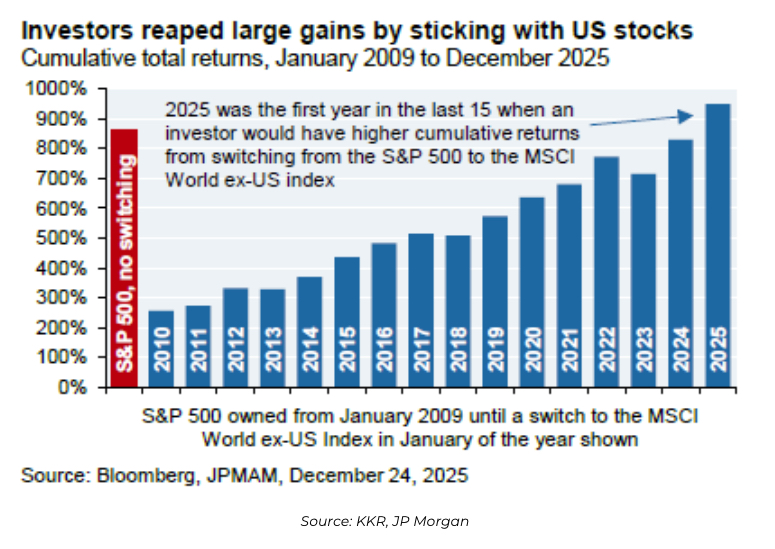

US companies still outperformed their global peers In 2025…

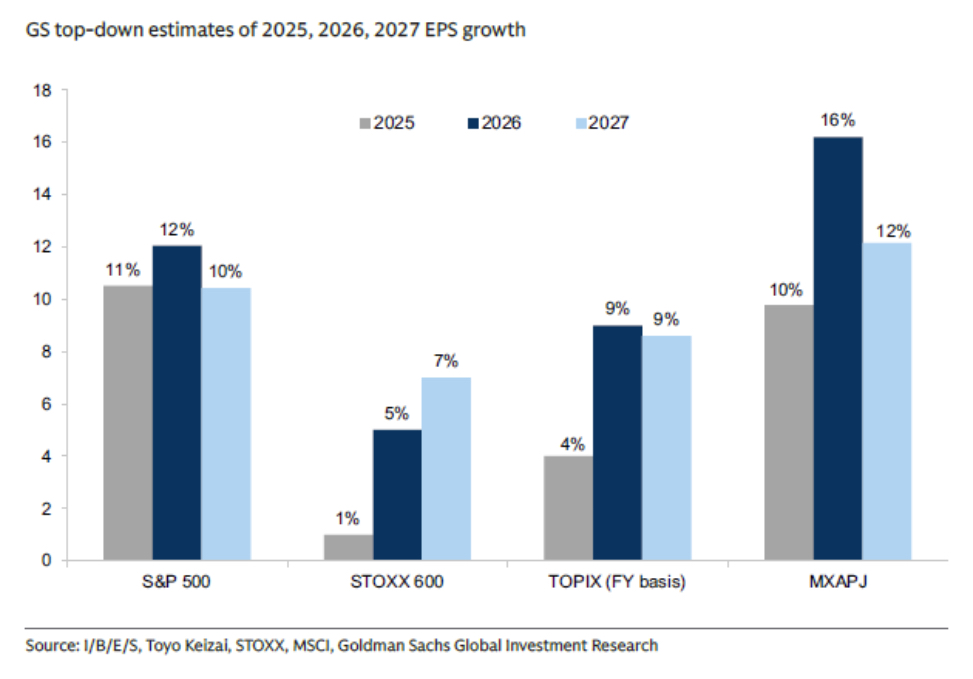

…but earnings growth is forecast to pick up outside the US in 2026 and 2027…

and we believe international equities provide valuable diversification benefits, despite many years of underperformance

Potential tailwinds for international equities include a tight labor market, accelerating CapEx cycle, and corporate reforms in Japan. In Europe, earnings growth is expected to accelerate while stocks remain cheap relative to the US. A weaker US dollar could boost returns further for US dollar-denominated investors.

In addition, international diversification may provide a hedge if we experience an AI-led investment boom-and-bust cycle in the US.

A few words on tax loss harvesting strategies

- We have been utilizing a long/short tax loss harvesting strategy since late 2023 with leverage capped at 130% long / 30% short

- While we believe these strategies can play a valuable role in a portfolio, it is critical that investors understand the risks which vary across strategies and increase with additional leverage

- Tracking error: results may differ meaningfully from benchmarks or client expectations for extended periods. High leverage approaches create much more deviation from the benchmark index.

- Model risk: quantitative signals can underperform for long stretches due to regime shifts, crowding, or flawed assumptions.

- Leverage risk: use of shorts, margin, futures, or swaps can amplify losses even when overall market exposure is low.

- Implementation and execution risk: real-world trading, financing costs, short availability, and counterparty behavior can detract from modeled results.

- Capacity and crowding risk: popular quantitative signals can become overcrowded, reducing returns or causing sharp drawdowns.

Tax loss harvesting strategies: approaches and risks

- Approach 1 is a benchmark-anchored equity separately managed account that seeks to deliver market-like beta plus systematic alpha through quantitative stock The strategy aims to realize capital losses through active long/short extensions. Clients can choose the level of leverage in this strategy, with higher amounts potentially producing more alpha and tax losses, but also higher tracking error against the benchmark.

- Risks of approach 1: Benchmark underperformance risk – the strategy can lag the index, sometimes for years, especially at higher tracking-error At 250% leverage, tracking error could be 6% or more annually, and could meaningfully underperform the benchmark over multi-year periods.

- Approach 2 is a pooled, multi-strategy vehicle combining defensive long-short equity with managed-futures trend following, designed to deliver diversifying returns with moderate equity beta (about 0.5) for taxable investors. Because this is a fund structure, losses are deferred if the cost basis hits zero.

- Risks of approach 2: Returns come from two very different engines (long/short stocks and trend-following futures). Either can underperform for long Some tax benefits come from deferring gains rather than generating losses, once the cost basis has reached zero.

- Approach 3 is a market-neutral, statistically driven arbitrage strategy implemented via equity swaps, designed to systematically generate frequent, mostly short-term capital losses with minimal market

- Risks of approach 3: The strategy relies on heavy trading and derivatives. When markets become stressed, these risks can surface Losses may be high in the early years of the investment, but once the tax benefit is used up, additional losses may no longer provide a tax benefit until future gains occur.

Asset Class Recap & Recommendations

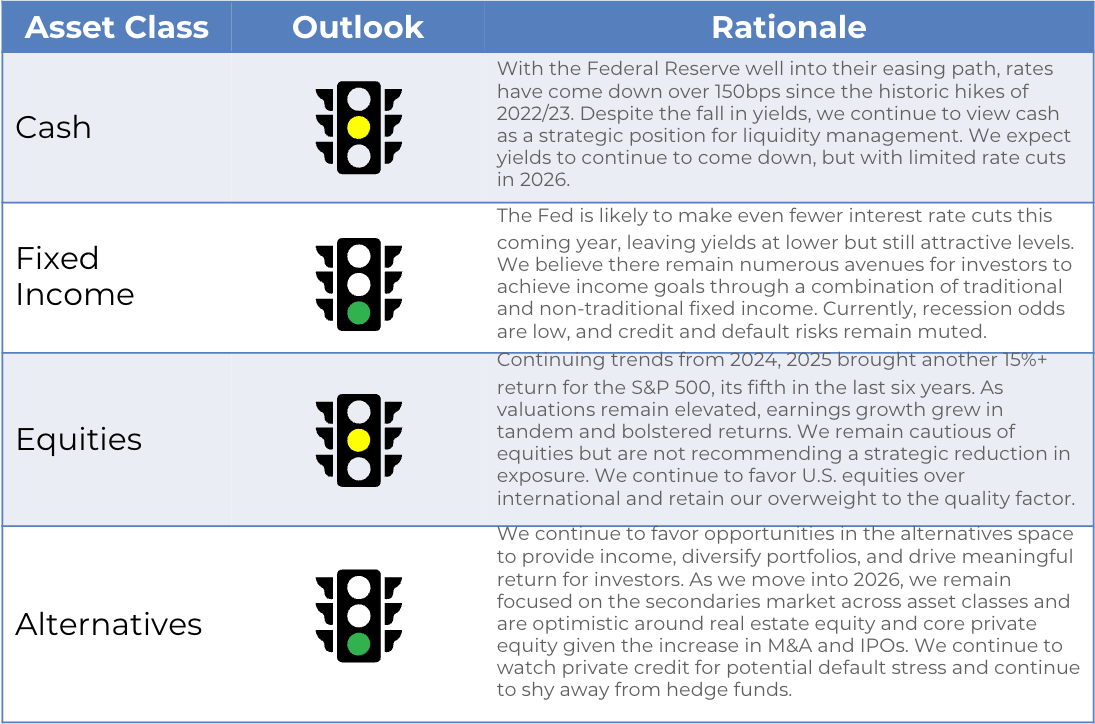

Outlook remains mostly positive

Bonds post broad gains, recovering from 2022

U.S. Bond markets posted three consecutive positive year returns, recovering from an inflation driven 2022 fiasco. The Federal Reserve continued its monetary policy push through 2025 but with some hesitation following President Trump’s sweeping tariff policy in early April. Despite headwinds and global uncertainty, the Federal Reserve ultimately cut the Federal Funds Rate three separate times for 25bps in the latter half of the year, although it was less than forecasted coming into the year.

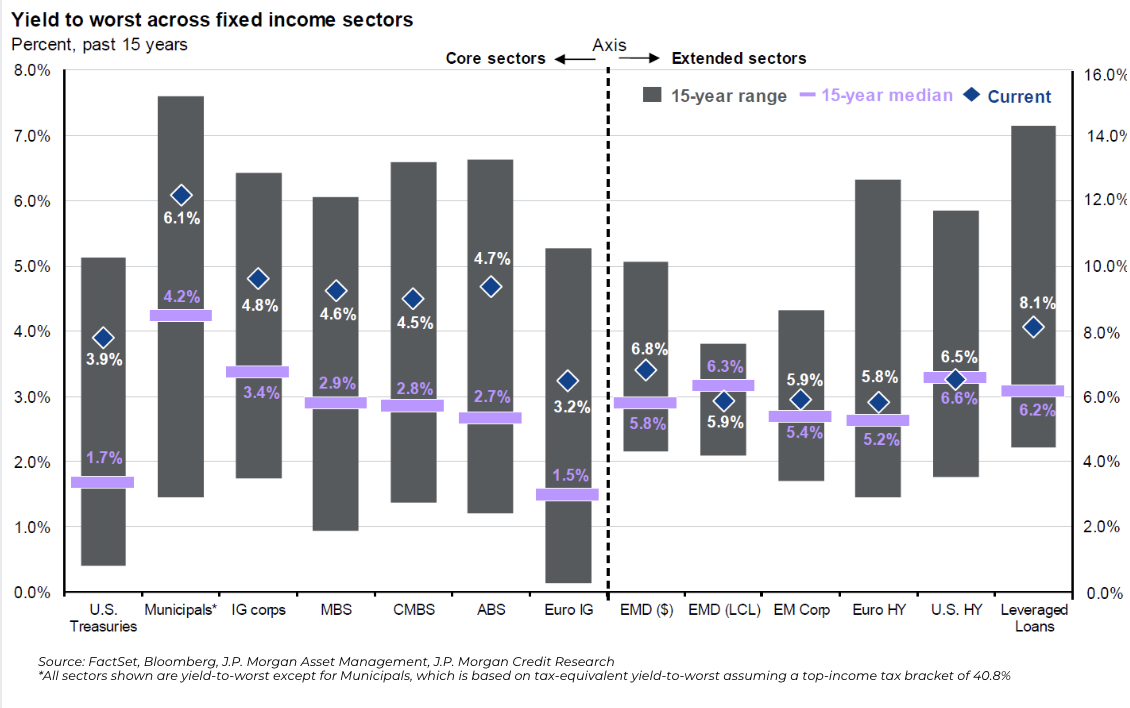

Yields remain high above 15-year norms

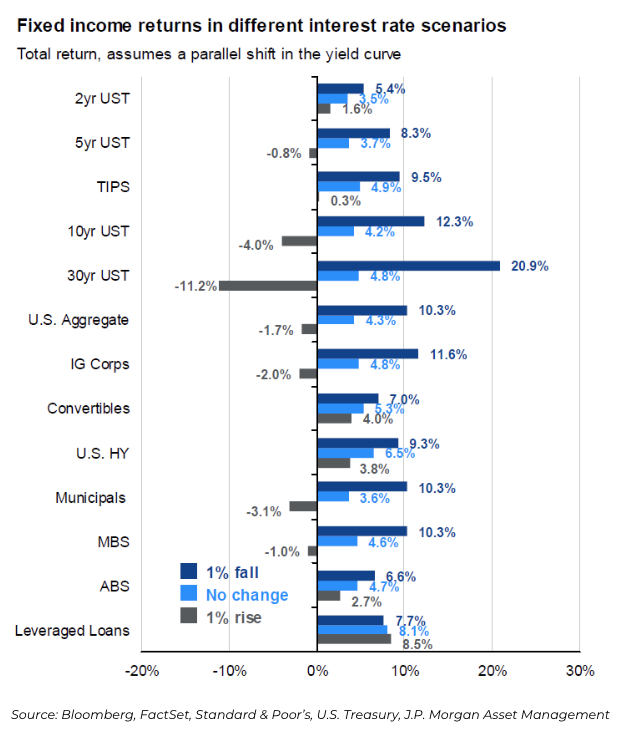

Duration target hasn’t changed, with no immediate plans to

After a historic rise in interest rates, following the rapid inflation in 2022, we recommended extending duration from short to intermediate in the 4th quarter of 2023. Interest rates saw a shift from tightening to easing as the Fed lowered rates by one full percentage point.

This duration trade has been positive for our clients as shifting monetary policy combined with lower defaults and less spread expansion than some feared, were positive boosts to performance.

The table to the right shows the risk/reward trade-off continues to favor the short to intermediate part of the curve.

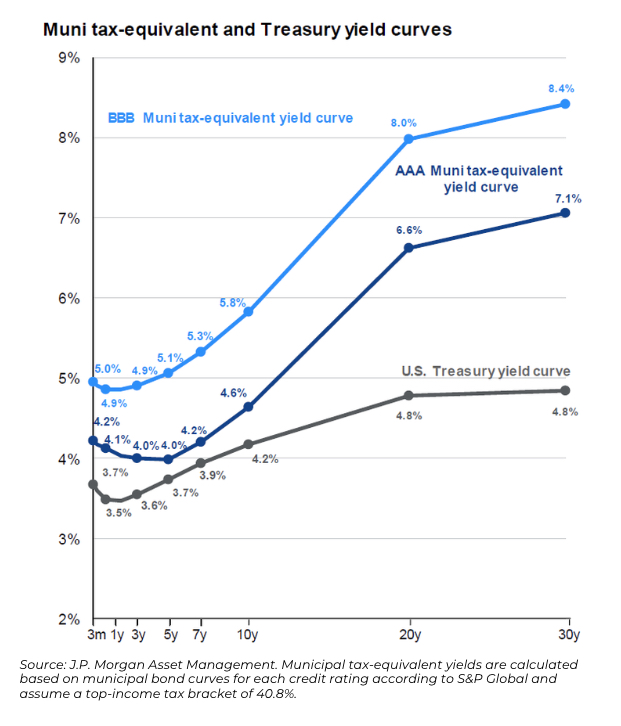

Municipal bonds remain a viable solution

Municipal bonds continue to be a compelling opportunity for high income earners, especially given the significant rise in rates over the last couple years. After a rocky start to 2025 from tariffs and supply issues, municipals were able to enjoy a strong second half of 2025, boosted by fund inflows, normalizing supply, and the Fed resuming its easing cycle.

We continue to recommend clients utilize municipals to capture tax advantaged yields, through separately managed accounts and funds that balance a mix of investment grade and high yield bonds to provide strong income.

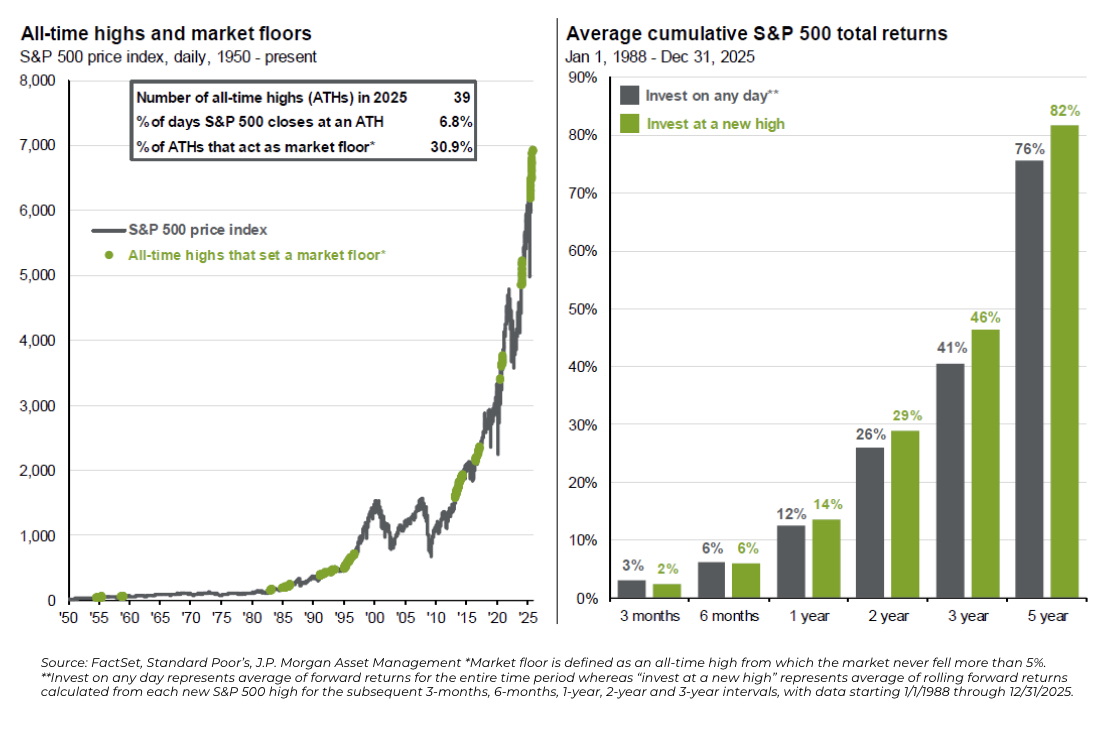

Taking a step back, equity markets performance has been nothing short of historic

And there is a case for it not slowing down

Timing rarely works… even at market “highs”

The dominance of Tech stocks isn’t new, and AI is diversifing the growth

Growth is poised to be more dispersed, easing the burden on Mag 7

The remarkable rise of technology companies, both in market value and influence, has been driven by genuine business growth and strong fundamentals, not unfounded speculation about what might happen down the road. When we look back at previous market bubbles, we saw far more extreme investor behavior and much steeper price increases in the final stages. What we’re experiencing today looks quite different from those historical episodes.

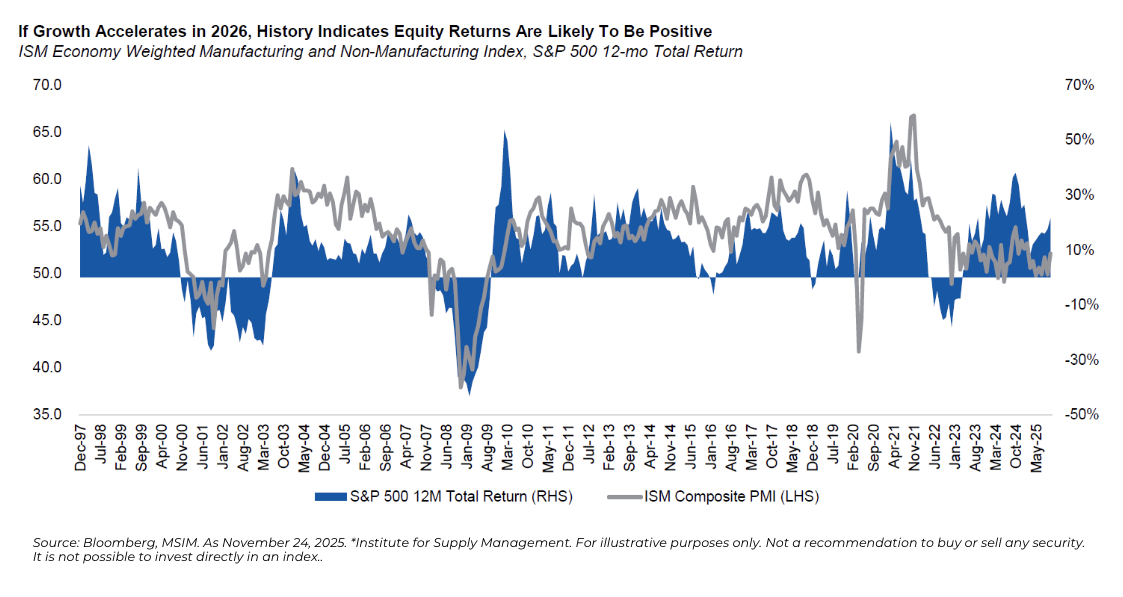

In fact, history shows us that U.S. equity returns are normally positive when economic growth strengthens

Quality lagged in 2025, but still offers long-term benefits

The quality factor in investing refers to the tendency of high-quality stocks with typically more stable earnings, stronger balance sheets and higher margins to outperform low-quality stocks, over a long-time horizon. Research has shown that quality companies, those with higher ROE, lower leverage, and more sustainable cashflows and earnings, outperform lower quality companies over time. Quality stocks are lagged in 2025, mainly due to their lower weights in some of the mega cap names that led the market, but the factor remains steadfast in its ability to deliver alpha over full market cycles.

International sees its biggest outperformance since 2009, but…

…it still lags over last 5-years

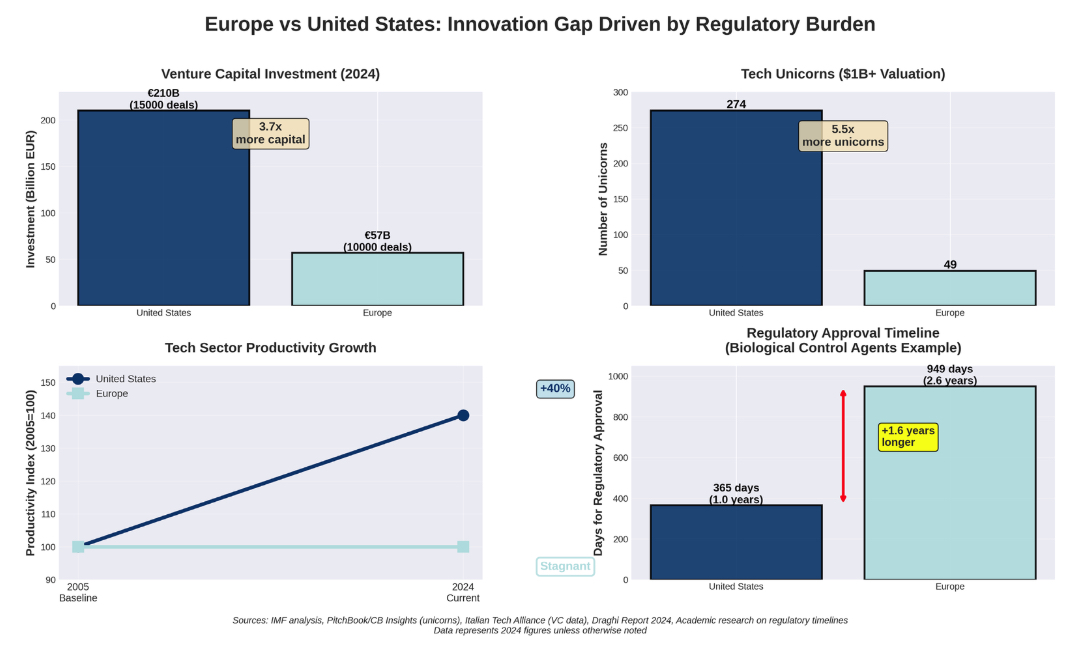

The US is expected to continue growing faster than the Eurozone, but forecasts remain tight…

…partly due to heavy regulatory differences weighing on EU innovation

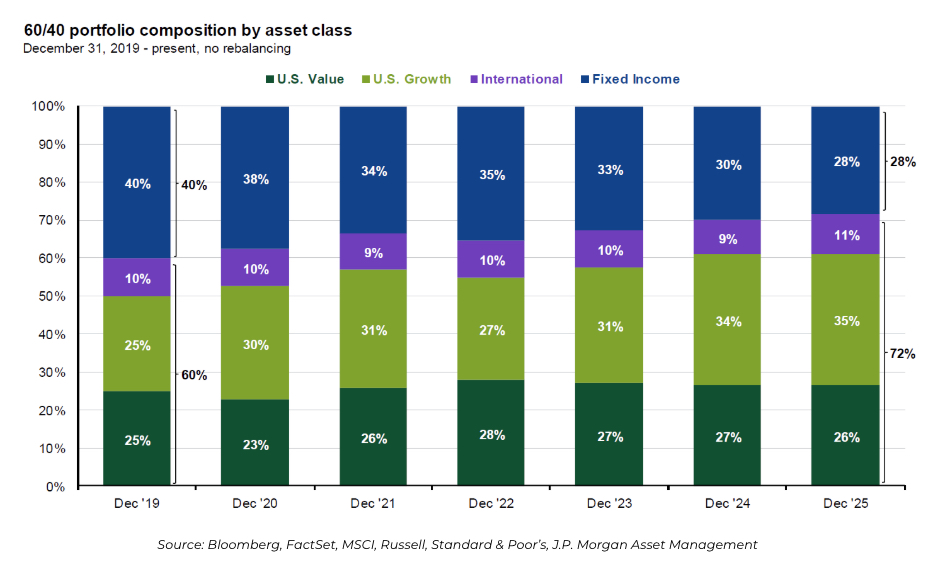

To achieve portfolio goals, rebalancing to targets should be considered

Markets have marched steadily higher since 2022, with US stocks, especially Technology names, driving much of the gains. For investors holding traditional balanced portfolios, this strong performance has likely pushed equity allocations well above their intended targets. As clients evaluate their portfolio and consider realizing gains, it’s worth reviewing whether your current allocation still aligns with your long-term strategy and risk tolerance.

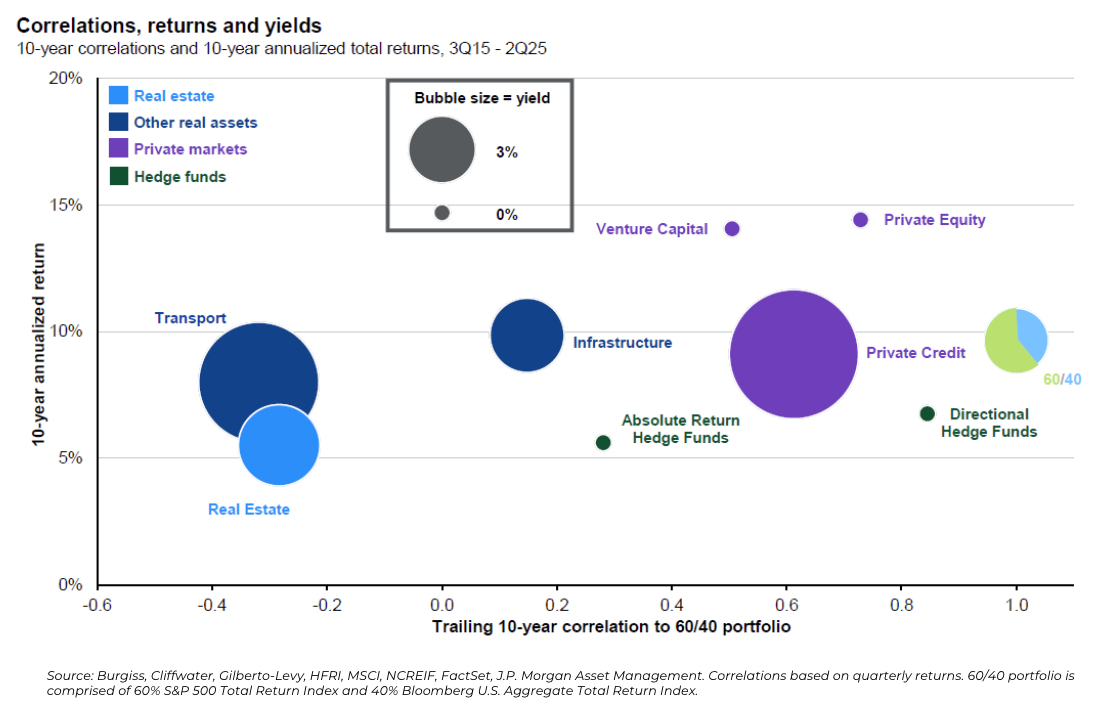

Alternatives remain a key source of return generation…

…but that’s not all they do

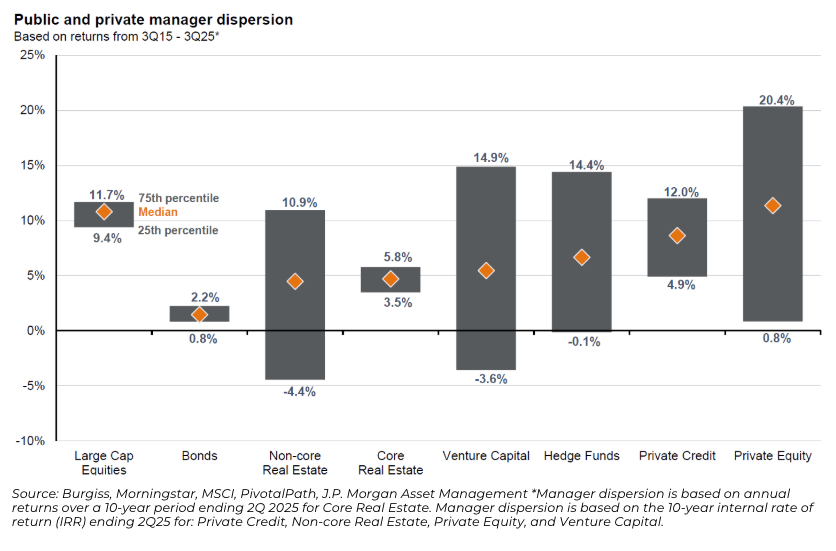

Due diligence and manager selection remain paramount in private markets

The last three years have shown that active management in public markets isn’t sustainable, and it is increasingly hard to outperform indexes, while private markets exhibit the importance of finding best in class managers.

The return dispersion, as illustrated below, between the top and bottom quartile private fund managers over the last 10-years is vastly larger versus public markets. Given the illiquid nature, lack of public information, and longer time horizon, private markets require strict and comprehensive due diligence to select best in class managers for investments.

Looking ahead in alternatives

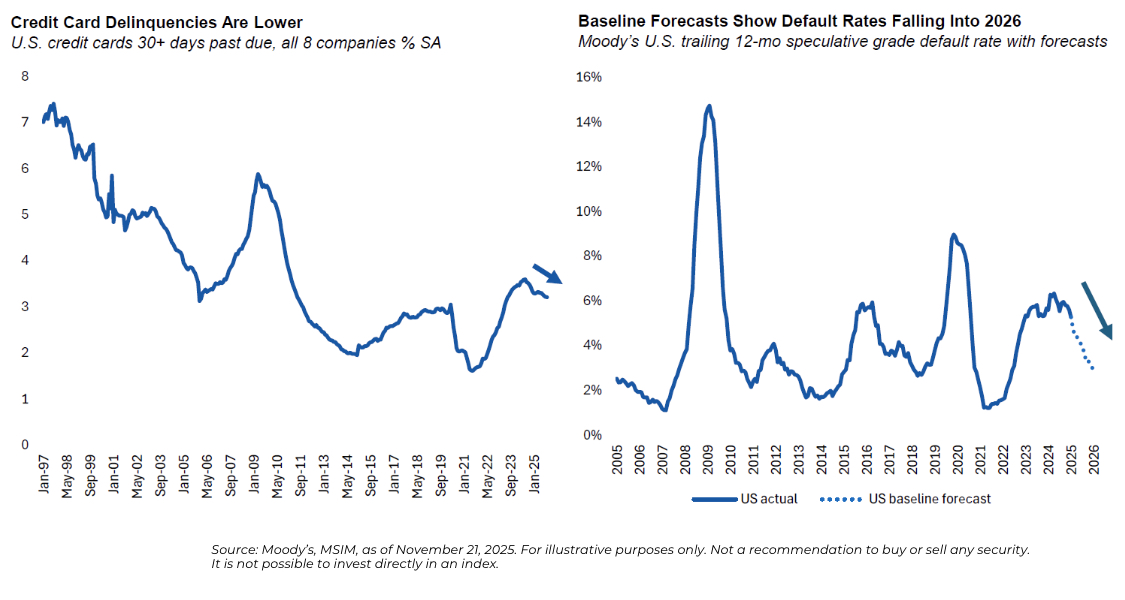

US Credit Health/Default Rates

While credit spreads remain tight by historical standards, the fundamentals underpinning credit markets continue to trend positively. Credit card delinquencies have drifted lower, and Moody’s forecasts show default rates falling through 2026.

Private Credit

Summary Outlook: As we enter 2026, the “Golden Age” of easy returns in private credit is evolving into a more complex phase. Private Credit has grown hugely, and may be settling into a maturation phase. While the asset class remains a source of steady income, the tailwinds of 2022–2025 (rapidly rising base rates and banks on the sidelines) are shifting. We are moving toward a borrower-friendly market defined by tighter spreads, a revival in M&A deal flow, and competition from a rebounding syndicated loan market.

Key Themes for 2026

Yield Compression: Spreads have tightened significantly as capital is abundant and banks re-enter the lending arena. While yields remain attractive relative to public fixed income, the “illiquidity premium” has shrunk. In the meantime, the Fed is lowering the front end of the curve, reducing SOFR.

The M&A Catalyst: A robust recovery in private equity dealmaking (M&A) is expected to spur demand for new financing. This volume is critical to replacing older vintage loans that are being refinanced or repaid.

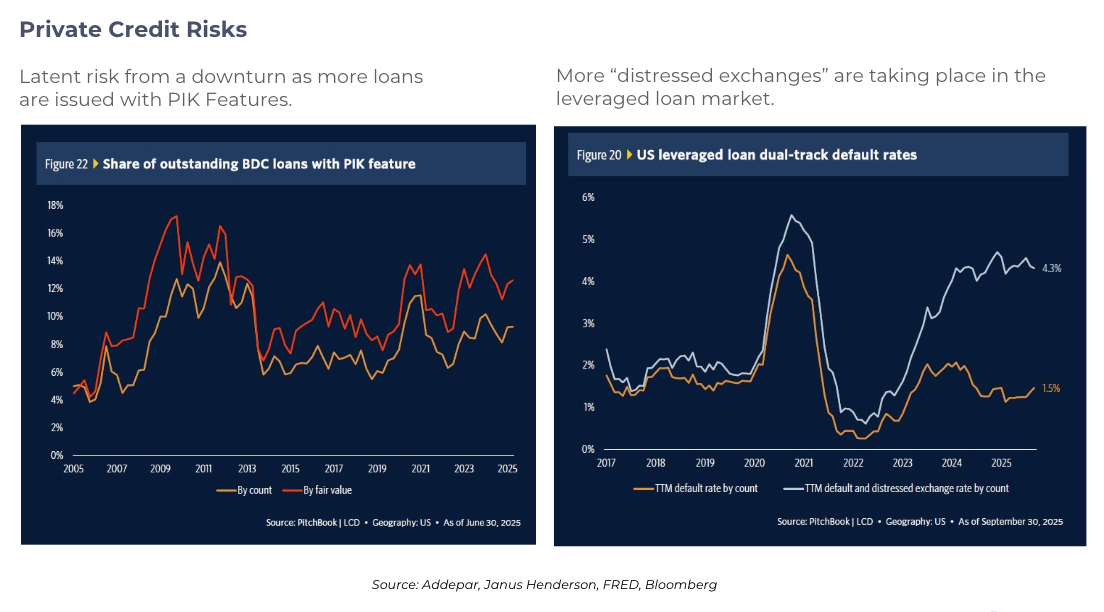

Bifurcation of Quality: The gap between strong and weak managers is widening. We are seeing a divergence where established borrowers remain healthy, but stress is building in the “tail” of portfolios, visible in rising Payment-in-Kind (PIK) interest usage.

Market Data: According to Cliffwater’s Direct Lending Index (CDLI), historical realized losses remain low (1.01% for the last 10 years, and 0.69% in 2025 for middle market direct loans), suggesting the asset class has structural resilience despite fears of a downturn. Still, the asset class has not been tested with a grinding, long economic slowdown during this era of high AUM. Quarterly income continues to drive total returns, cushioning volatility even as price appreciation slows.

Private Credit – Bull and Bear

The Bull Case:

Dealmaking Revival: A pickup in M&A provides a fresh pipeline of high-quality loans. As Private Equity dry powder is deployed, lenders can be more selective, financing stronger companies rather than refinancing troubled ones.

Income Cushion: Even with modest rate cuts, base rates remain elevated compared to the last decade. Private credit yields (often nearly double-digit) continue to offer a significant buffer against inflation and moderate default rates.

Structural Protections: Unlike public high-yield bonds, senior private loans retain strong covenants and seniority. Historical data shows that even in stress periods, realized losses have been contained, although with significant volatility.

New Frontiers: The asset class is expanding beyond corporate buyouts into asset-based finance (ABF) and infrastructure (e.g., AI data centers), offering diversification backed by hard assets rather than just corporate cash flow. This is a focus for Sage in 2026.

The Bear Case:

Spread Compression: Competition is fierce. Spreads are trading near historical tight levels, meaning investors are getting paid less for taking the same amount of illiquidity risk. The “excess return” over public markets has eroded.

Hidden Stress (The “PIK” Problem): A growing number of borrowers are opting to pay interest in kind (PIK), adding interest to the principal rather than paying cash. This is a classic late-cycle stress indicator, masking potential cash flow issues at portfolio companies.

Untested in Prolonged Stagnation: While resilient so far, private credit has not been fully tested in a “higher-for-longer” rate environment combined with a generic economic slump. If GDP growth stalls while rates stay near 4-5%, interest coverage ratios could deteriorate rapidly.

BDCs

- Market Sentiment & Dividends: BDCs have traded down due to recession fears, falling rates, and tight spreads. Consequently, some major players (e.g., Goldman, Blackrock) have cut or modified distributions to manage weaker payout coverage.

- Credit Fundamentals: The sell-off is driven by fear rather than data; actual credit trends remain While competition is high and rates are easing, non-accruals remain historically low (~1.3% of loans).

- Idiosyncratic Shocks: Specific events, such as two auto-related defaults and isolated bank real estate fraud, have spooked investors. The market is treating these as potential systemic risks (“cockroach theory”), causing a broader sell-off.

- PIK Levels: Payment-in-Kind (PIK) interest is rising, but it depends on the Golub and Kayne Anderson have far lower levels, for example.

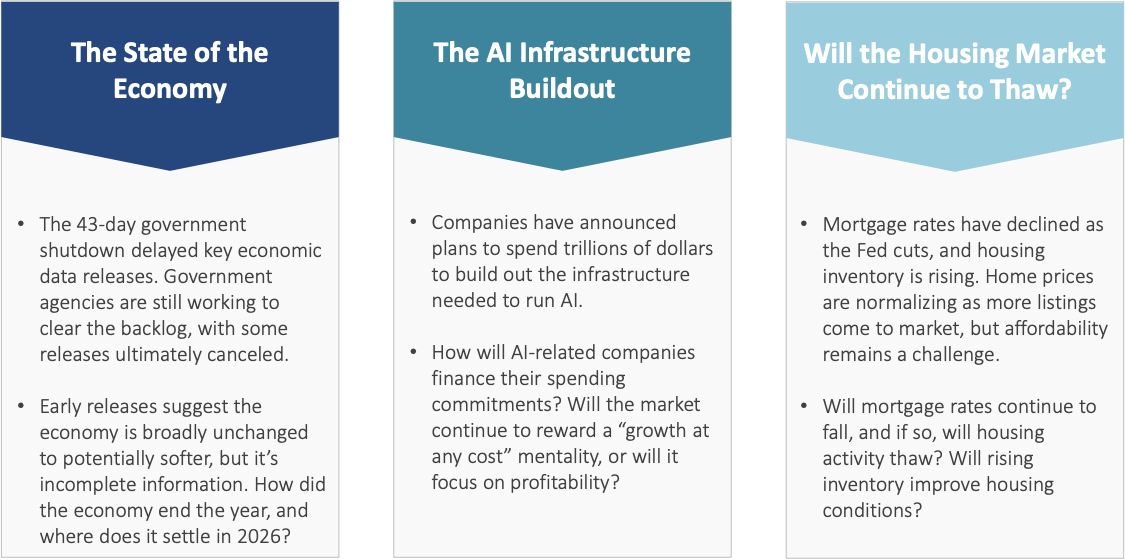

Macro Overview

Looking Ahead – Key Themes to Watch the Next Six

Months

Disclosures: Forward-looking statements are based on current expectations, estimates, projections, and assumptions. These statements involve risks and uncertainties, and actual outcomes may differ materially from what is expressed or implied. Forward-looking statements are not guarantees of future performance and should not be relied upon as such. Economic and market conditions are subject to change, and any opinions or forecasts contained herein are subject to change without notice.

Economic Commentary

- The global economy appears set for moderate growth; despite tariffs, policy uncertainty, and geopolitical tension it will likely avoid Our outlook is for positive but slowing growth as AI capex and heavy fiscal spending continue, but moderate from last year.

- GDP: Analyst expectations for S. GDP growth cluster around 2%, which we think is a slightly high but reasonable expectation. For example, JP Morgan expects US real GDP growth of +1.8% in 2026, while Goldman Sachs forecasts +2.6% growth. Supports to the economy include AI capex, a resilient US consumer, and gradually easing financial conditions due to rate cuts and moderating inflationary pressure from rents.

- Labor Market: We expect the labor market to continue to slow In 2025, job creation in the U.S. slowed from 150k a month to 30k a month, with more weakness at year end. Yet, to keep unemployment steady, payroll gains only need to average 60k per month as labor supply growth slows due to demographics and immigration enforcement. Vanguard projects unemployment at 4.2% by end-2026, comparable to 2025.

- Inflation: We expect inflation to run closer to 3% than 2%, remaining somewhat “sticky.” JPMorgan expects core PCE inflation of 2.7% in 2026, with tariff pass-through continuing well into next year. They emphasize sticky inflation’s “roots” are rising wages plus continued services inflation.

- Europe: Analysts expect Euro area GDP growth of +1.2% in 2026 (near potential). They quantify tariff drag as –0.3pp on GDP in 2026, partially offset by fiscal tailwinds such as increased defense Unemployment is expected at about 6%. Inflationary pressures should be lower compared to the US.

- China: Economists expect growth about 5%; domestic demand remains weak but China has successfully pushed export growth. Disinflation/deflation risk remains central as the real estate bubble has deflated, taking consumer sentiment with it.

- Japan: We expect slow growth of one percent or less. We also expect more normalization of interest rate policy, i.e. higher rates than in the past decade.

(Source: Goldman Sachs, Vanguard, JP Morgan Outlooks)

Political / Policy Commentary

- Upon resuming power, the Trump administration moved quickly on three fronts: tariffs, the budget/taxes and deregulation. On taxes, the “OBBBA” resulted in net tax cuts, but skewed largely to higher income households with lower propensity to Tariffs caused significant disruption, but ultimately have resulted in significantly lower rates than feared. On the whole, significant deregulatory measures have largely been taken in financial (banks, crypto) and environmental issues, but the market still hopes for broader federal deregulation efforts to impact the economy. For example, measures to speed permitting and construction.

- The 2026 midterm elections loom as a major inflection point. With narrow Republican margins in the House, control of Congress will determine how much of the administration’s agenda can continue. Loss of the House would likely result in legislative gridlock rather than policy

- The administration’s general policy direction is pro-growth, with emphasis on spending and industrial policy. Although industrial policy (semiconductors, rare earths, oil) may introduce inefficiencies, the government’s efforts to push investment into the economy may support growth in the near term. The fiscal deficit remains wide and is likely to accelerate even further until after the midterms.

- The Fed: President Trump has pushed hard to promote his preference for lower rates, and seems likely to appoint a docile Fed Chair that will echo his We think it is an underappreciated risk that investors will be unnerved by a Fed that has visibly lost independence, potentially keeping longer term interest rates higher than they otherwise would be.

(Source: Sage Mountain Advisors analysis)

Geopolitical Commentary

- We expect intermittent geopolitical turmoil as the administartion has turned more interventionist, but significant disruption / large-scale conflict is not our base

- On January 3rd, the S. conducted a military operation in Venezuela to capture President Maduro. The operation depended on special operations, intelligence, naval flexibility, and stealth capabilities. For investors, this reinforces a multi-year outlook of structurally higher defense spending, not only in the U.S. but across Europe and the Indo-Pacific (including Japan). Defense procurement is increasingly skewed toward high-tech, asymmetric, and cyber-enabled capabilities.

- There is a long history of U.S. intervention in Latin America, and Maduro’s epic mismanagement tested the patience of both the Venezuelan people and neighboring countries (refugee crisis). Accordingly, other countries’ objections to this event will take the form of words, not deeds.

- The long-term implication of the S. intervention is a downside risk to oil prices, but Venezuela’s oil infrastructure will take years, and a stable government, to rebuild.

- In response to the S. taking a “might makes right” stance, it is possible that China may push harder on Taiwan and the South China Sea, or that Russia may intensify pressure in Ukraine and Central Asia. However, the U.S. action doesn’t really change the underlying risk-reward calculus that these countries face.

- U.S.–China relations are currently in a tactical détente following high-level engagement, with tariff escalation paused into mid-2026. Strategic rivalry will remain high around technology, supply chains, and strategic materials. China remains the primary long-term geopolitical variable, despite short-term stabilization.

- Expect intermittent volatility, but not a collapse in the macro or market

(Source: Sage Mountain Advisors analysis)

Comments on Gold

- Although it has been “money” since antiquity, we don’t view gold as a productive asset (it has no cash flow). We do view it as a portfolio diversifier and a hedge against Gold’s usefulness rises when investors start caring more about real purchasing power, debasement risk, and threats to the dollar’s position as a world reserve currency.

- Gold had an extraordinary year in 2025, returning 64%, the highest rise since 1979. While gold was notoriously poor in the 1980s, 1990s, and parts of the 2000s, its performance has been so strong in recent years that gold has almost matched the S&P 500 over the past

- Our Outlook: We have not recommended a dedicated gold exposure, preferring to address inflation risks through investments in real estate, higher yielding instruments and However, we believe that (1) deficit-driven spending pressure persists, (2) dollar debasement risk remains

non-trivial, and (3) structural diversification away from the dollar continues. Accordingly, we are exploring taking a position in gold, but are reluctant to initiate a position when consensus is extremely bullish. In other words, we are monitoring but haven’t changed our guidance.

- When does gold tend to perform well? Historically, gold tends to work best when:

- Real rates are falling or negative (currently, rates are positive).

- The dollar is weakening (gold is typically priced in USD, so USD weakness often shows up as higher USD gold prices). The dollar has recently fallen against many currencies but is not particularly weak overall.

- Inflation uncertainty is rising (not CPI data per se, but rather the market repricing policy credibility and future inflation risk). Despite Fed rate cuts, the intermediate to long end of the curve have not fallen, reflecting uncertainty.

- Tail risks rise (geopolitical stress, financial stability episodes, recession/panic correlations). We don’t believe we are currently in a crisis nor that risks are particularly high.

- On top of this, we believe sentiment is currently elevated for gold and silver, possibly making this a poor time to start a position.

- How has gold performed after very strong performance years? The data is Using Stern

professor Damodaran’s data, after very strong years (≥ +50%), the record is mixed (with wide ranges)

- From the 1970–2025 period in that dataset, the years with ≥ +50% gold returns were:

- 1973: +72.96%, then 1974: +66.15%

- 1974: +66.15%, then 1975: -80%

- 1979: +126.55%, then 1980: +15.19%

Comments on US Dollar (Broad US Dollar Index)

- We are arguably still in a “strong dollar” environment, just less extreme than last year. Note 120 is still historically high compared to the 2016–2020 average.

- The 2020 Crisis: You can see the gray shaded vertical bar representing the COVID-19 There was a massive spike (flight to safety) followed by a drop as the Fed printed money (liquidity injection).

- 2021–2024 Climb: Following the 2020 volatility, the index entered a relentless This was likely driven by the “American Exceptionalism” economic theme: US interest rates staying higher than the rest of the world and the US economy outperforming peers.

- The 2025 Peak: The chart shows the dollar hitting a massive peak in 2025, reaching near 130. This suggests that for most of last year, the US dollar was historically expensive, putting immense pressure on emerging markets and US exporters.

- Sharp Correction: After hitting a peak of 130 in 2025, the dollar has declined

- Narrative Shift: The Federal Reserve finally cutting interest rates aggressively, better economic news overseas, and fear of currency debasement / inflation

- “Least Dirty Shirt” The U.S. Dollar is extremely unlikely to be replaced as the global reserve currency anytime soon.

- Gold / Gold Token: A gold-backed currency essentially ties a country’s hands. If your economy grows but your gold reserves don’t, you suffer massive deflation (money becomes too scarce). Modern economies need the flexibility to expand the money supply during crises (like the 2020 crash).

- The “Trust” Paradox: For a Chinese or Russian gold-backed currency to work, the world has to trust that the gold is actually there and that they will deliver it upon Given that China maintains strict capital controls and Russia is heavily sanctioned, major global institutions are unlikely to trust them.

- China (Yuan): You cannot be the global reserve currency if you have capital Money goes into China (for trade), but the CCP makes it very hard to get money out.

- Europe (The Euro): The Eurozone has a monetary union (one currency) but not a fiscal union (separate debts). Every time there is a crisis in a specific member state (like Italy or Greece), it threatens the stability of the whole Euro project. Investors prefer the singular political authority of the US Treasury.

- The US Treasury Market: This is the deepest, most liquid pool of assets on Earth. If you are a sovereign wealth fund with $100 Billion to park, you literally cannot put it all in Swiss Francs, Gold, or Bitcoin, the markets are too small. You would move the price too much. You have to buy US

- Bitcoin has been a fantastic speculative asset (and a “store of value” for some), but it fails the two primary tests of a currency: Volatility: a currency needs to be a boring unit of No “Lender of Last Resort”: When the 2020 crisis hit, the Fed printed trillions to stop the global plumbing from seizing up. There is no “Central Bank of Bitcoin” to step in and provide liquidity when the system crashes.

Financial Planning

Financial Planning Opportunities for 2026

- The 2026 Lifetime Exclusion has increased to $15mm per individual. If you have previously maxed out your exemption, now is a good time to “top off” outside of estate trusts up to the new amount. The Annual Exclusion remains $19k per year.

- The SALT deduction increased to $40k for the 2025 tax year and will continue at that rate ($40,400 adjusted for inflation in 2026) through 2029. There is an income phase-out range of $505k-$606,333 (2026), after which a taxpayer will be limited to the lower $10k Importantly, the Pass-Through Entity Tax (PTET) Election or SALT workaround is still available in addition to the increased new cap.

- IRA contributions increase from $7k ($8k catch-up) in 2025 to $7,500 ($8,600) in 401k contributions increase from $23,500 ($31k catch-up) in 2025 to $24,500 ($32,500).

- Take advantage of super catch-up contributions to qualified plans like 401k’s for those 60-63 years The amount is $11,250 instead of the regular $8k for those 50+. You must choose Roth (not pre-tax) if your previous year’s income was $150k or more. If no Roth option exists, then you are not eligible for the super catch-up.

- The Qualified Charitable Distribution (QCD) limit increases to $111k per individual in 2026. For taxpayers who need little or none of their RMD’s to live on, the best strategy is to make QCD’s first since you cannot recharacterize an RMD into a QCD later in the A QCD is an above-the-line deduction, which is usually more valuable than a normal charitable deduction on Schedule A.

- Invest in Opportunity Zones (OZ) no earlier than 1/1/27 when the new OZ rules go into Gains realized in 2026 are eligible as long as they comply with the 180-day rule. For personally owned assets or shares, wait until no earlier than 7/5/26 to realize gains that will be rolled into OZ investments in 2027 (ideally later to provide a time buffer for OZ investments made in early 2027). For assets owned by an S Corporation or partnership, the 180-day period begins as late as the tax filing date of the corporation or partnership, which is generally 3/15. The original OZ legislation provided a static date of 12/31/26 when the deferral of all gains ends, meaning the deferred capital gains tax will be due in April 2027. Under the new rules, the gains are deferred until the 5th anniversary of the OZ investment, and investors also receive a 10% basis step-up after 5 years. A 30% basis step-up is available for investing in a “qualified rural opportunity fund.”

- AMT phase-outs will start at $500k for singles and $1mm for joint filers on 1/1/26. The previous phase-outs started at $626,350 for singles and $1,252,700 for joint filers. The phase-out percentage will rise from 25% to 50%. This can create a “bump zone” where the effective rate is 42%! The IRS estimates that 7.6mm people will pay AMT in 2026 compared to 200k in 2025. AMT preference items include high capital gains/qualified dividends, high Schedule A deductions (especially SALT), Intangible Drilling Costs (IDC) deductions, QSBS stock sale, ISO’s, accelerated depreciation, and Passive Activity Bond (PAB) interest. The normal AMT rate is 28%.

Please see attached disclosures. Clients are advised that no portion of the services provided by SMA should be interpreted as legal, tax or accounting advice. For legal and tax-related matters, we recommend that you seek the advice of a qualified attorney, accountant or tax professional.

Disclosures

Past performance is not indicative of future results. Sage Mountain Advisors, LLC (“SMA”) is an independent SEC registered investment advisor. Any reference to or use of the terms “registered investment adviser” or “registered,” does not imply that SMA or any person associated with SMA has achieved a certain level of skill or training. This material is provided for informational and educational purposes only.

Any subsequent, direct communication by SMA with a prospective client shall be conducted by a representative that is either registered or qualifies for an exemption or exclusion from registration in the state where the prospective client resides. For more information pertaining to the registration status of SMA, please contact SMA or refer to the Investment Adviser Public Disclosure website (www.adviserinfo.sec.gov). The information contained herein should not be construed as personalized investment, tax, or legal advice. Certain information contained in this presentation has been derived from third party sources. While we believe these sources to be reliable, we make no representations as to the accuracy, timeliness, and completeness of any such information prepared by any unaffiliated third party incorporated herein, and take no responsibility therefore. As such, there is no guarantee that the views and opinions expressed in this presentation will come to pass.

All investments carry a certain degree of risk of loss, and there is no assurance that an investment will provide positive performance over any period of time. The statements contained herein reflect opinions, estimates and projections of SMA as of the date hereof, and are subject to change without notice. SMA reserves the right to modify its current investment strategies and techniques based on changing market dynamics or individual portfolio needs. The opinions expressed herein are those of SMA and are subject to change without notice. Information presented should not be considered as a solicitation or recommendation to buy or sell any security, financial product, or instrument discussed herein. Additionally, this material contains certain forward-looking statements which point to future possibilities. Due to known and unknown risks, other uncertainties and factors, actual results may differ materially from the results portrayed or implied in such forward-looking statements. Furthermore, the illustrative results presented in this presentation in no way reflect the performance of any SMA product or any account of any SMA client, which may vary materially from the results portrayed for various reasons, including but not limited to, investment objectives, financial situations and financial needs of SMA clients; differences in products and investment strategies offered by SMA; and other factors relevant to the management of SMA client accounts.

This presentation and its contents are provided “as is” without warranty of any kind, express or implied, including, but not limited to, implied warranties of merchantability, fitness for a particular purpose, title, non-infringement, security, or accuracy. SMA reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs. It should not be assumed that any of the security transactions, holdings or sectors discussed were or will prove to be profitable, or that the investment recommendations or decisions we make in the future will be profitable or will equal the investment performance of the securities discussed herein.

Actual investment advisory fees incurred by clients may vary. A complete description of SMA’s fee schedule can be found in Part 2 of its FORM-ADV which is available at www.sagemountainadvisors.com or by calling (404) 795-8361. Clients are advised that no portion of the services provided by SMA should be interpreted as legal, tax or accounting advice. For legal and tax-related matters, we recommend that you seek the advice of a qualified attorney, accountant or tax professional. SMA-25-0388